This article is a summary on the most recent developments in the silver market (SLV, PSLV). I will talk about the silver technicals, silver-gold ratio, silver investment, silver depletion, silver long/short positions and silver warehouse stock.

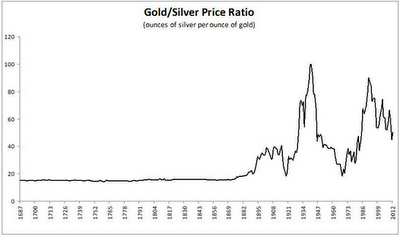

Let's start with the technicals. A pretty concerning picture for silver can be witnessed on the gold-silver ratio chart (Chart 1). You can see that in mid 2010, silver started to outperform gold until mid 2011. During that period, silver went from $US 18/ounce to $US 50/ounce (Chart 2). But more recently, the silver price has underperformed the gold price. The gold-silver ratio went back up to 60.

However, based on historical gold-silver ratios, we could go back to a 16:1 ratio as the trend in the gold-silver ratio is downwards (chart 3). We already had a second peak in 1992 at gold-silver ratio of 94 and we will go back to the low of 16.

So we saw a correction in the gold-silver ratio back to 60. I believe that correction is over and many other investors including Eric Sprott acknowledge silver has bottomed out. We're approaching a key technical point of a wedge pattern. Either we'll get a huge move to the upside or we get a huge move to the downside. I believe we'll see upside and we already see evidence of this. Just recently, the Sprott Physical Silver Trust priced in a follow-on offering of silver trust units in an amount of $US 200 million.

The fundamentals of silver are getting better and better every day. Concerning the depletion of silver, the New Scientist forecasted in 2005 that silver would be depleted in about 15-20 years. This means today we have only 10 years of silver left. Unlike gold, silver is being consumed as it is used in many applications. After consumption, the silver will be thrown together with its applications into land fills and will never be recovered. You could argue that silver can be recycled, but studies have shown that the recycling of silver is not feasible below a price of $US 50/ounce.

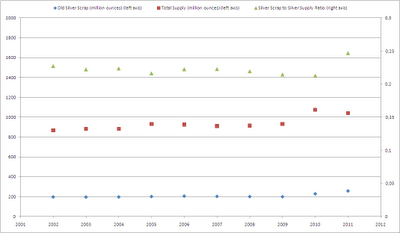

Silver scrap is a very important factor in supplying the silver to the markets because it comprises 22% of total silver supply. Since year 2000, the silver scrap to silver supply ratio has been steadily declining. Only just recently in 2011 we saw a spike in the silver scrap to silver supply ratio to 24.7% (Chart 4). This spike is due to the record high price of silver in 2011 ($US 50/ounce), which spurred investors to recycle jewelry and silverware. I expect this number to come down in 2012 as the silver price has been correcting.

Events like the offering of the Sprott Physical Silver Trust add to the velocity of depletion as investment demand will take silver supply out of the market. Manipulation of bullion banks to decrease the silver price only adds to the demand of investors to buy silver. We see this in the Silver Institute's 2011 report on silver demand/supply. The demand for silver coins went up an astonishing 18%.

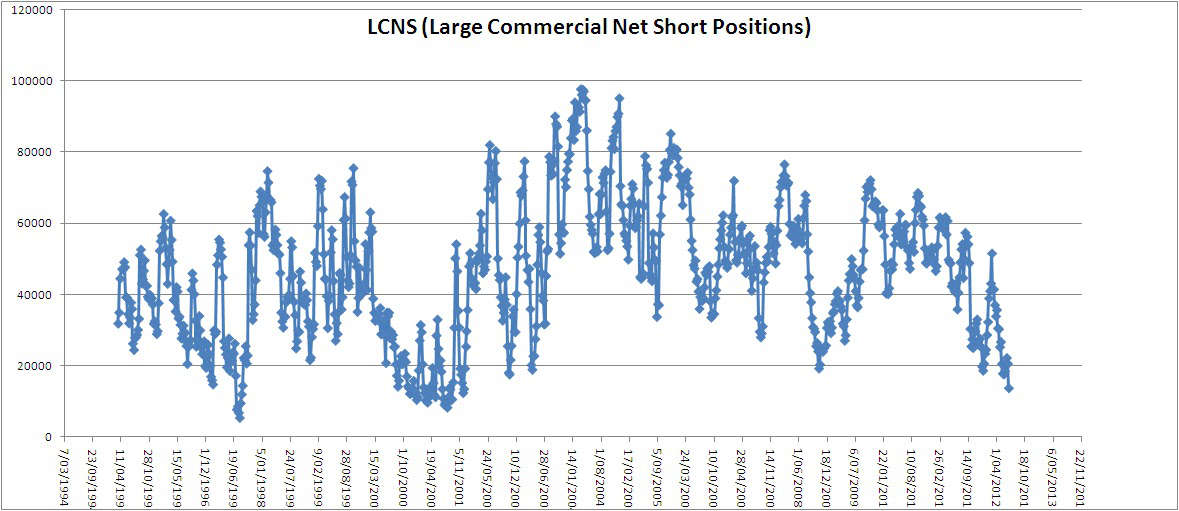

On the net short positions of silver I want to make clear to investors that we are approaching

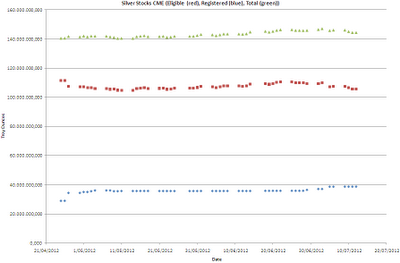

a decade low in the Large Commercial Net Short positions (LCNS). Historically, when LCNS goes up, the price of silver goes with it. Basically this means that a huge spike to the upside is imminent.On the COMEX silver front we note that registered silver went up from 29.0 million troy ounce (25 April 2012) to 38.7 million troy ounce today, indicating that physical silver has been stocked in COMEX warehouses. Total silver inventories rose from 140.6 million troy ounces (25 April 2012) to 144.4 million troy ounces today (Chart 6). Rising stocks typically mean that there is less demand for silver, declining stocks typically mean there is more demand for silver. On chart 6 we see that stocks had been slowly rising in the previous months (less demand), but more recently, the stock has been declining again since the start of July 2012. Demand is picking up again due to seasonal strength in precious metals (month of July).

On the more fundamental side of the economy we noted a very interesting event in the deposit facility of the ECB. Overnight deposits declined by more than half due to the ECB deposit rate cut. This 500 billion euro will basically find its way somewhere, possibly in the precious metals market.

Conclusion: There hasn't been a better time to invest in silver and gold (GLD) than today. If you dare, you can even try to bet double on silver with ProShares Ultra Silver (AGQ).