Since the beginning of August 2012 GBP/JPY has been in an uptrend but this uptrend became stronger since November 2012. It is very rare that for past 10 weeks GBP/JPY did not have a single weekly candle on candlestick chart which is red.

The strength of the British pound depends a lot on the sentiments about the economy of Euro zone. Even though U.K. is not part of Euro zone but the geography also matters. European Monetary Union is the biggest trade partner of the U.K. and Germany tops the list as the recipient of 11.6% exports of U.K while 13.2% of U.K. imports are from Germany.

The recent price action clearly suggests a general weakness of Japanese yen than any absolute strength of British Pound.

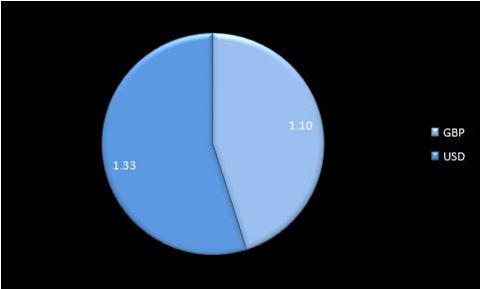

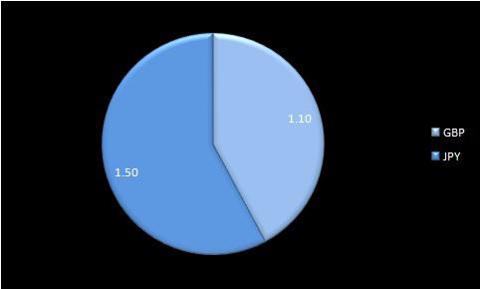

Let's have a look on British pounds moves against the dollar and Japanese Yen.

The recent economic releases reflect a neutral outlook for the both the currency pairs. The recent economic data from the last week has been as follows:

Economic Releases from the U.K.:

U.K. (GBP): Goods Trade Balance: GBP -9.164B and though less than the consensus of GBP -9.050B but better than the previous -9.487B British Pound.

U.K. (GBP): Interest rate was kept same at 0.5%.

U.K. (GBP): BoE Asset purchase facility was kept same at GBP 375B.

U.K. (GBP): Industrial Production: Year on year change -2.4% and though less than the expected -1.9% but better than the previous -3.0%. Same with the month on month change of 0.3% against the consensus of 0.8% and previous release of -0.9%.

U.K. (GBP): Manufacturing Production: Year on year change -2.1%, negative as compared to the forecasts (-1.3%) as well as the previous -2.0%. Month on month change was -0.3% and though less than the forecasts of 0.5% but was better than the previous release of -1.3%.

U.K. (GBP): NIESR GDP Estimate (3 months): -0.3% against the previous 0.1%.

Economic Releases from the U.S.:

U.S. (USD): Consumer Credit Change: USD 16.05B, positive as compared to the forecasts (US$ 12.75B) as well as the previous 14.08B US Dollar.

U.S. : Import Price Index (YoY): Remained same as the previous release of -1.5%.

U.S. : Trade Balance: US$ -48.73B, quite negative as compared to the forecasts (USD -41.30B) as well as the previous -42.06B US Dollar.

U.S. : Monthly Budget Statement: USD-0.30B, quite positive as compared to the forecasts (US$ -22.50B) as well as the previous -172.11B U.S. Dollar.

Economic Releases from Japan:

Japan (JPY): Indications from Finance Minister Taro Aso about Japan's plans to use it's foreign exchange reserves to buy bonds issued by the European Stability Mechanism (ESM) to weaken the currency.

Japan (JPY): Trade Balance BoP Basis: JPY 847.5B against the previous -450.3B Japanese Yen.

Japan (JPY): Eco Watchers Surveys: Outlook 51.0 against the previous 41.9. Current situation 45.8 and again positive as compared to the forecasts (41.1) as well as the previous 40.0.

Graphical representation of the relative strength of economic releases

1) GBP/USD: Relative strength of the economic releases

2) GBP/JPY: Relative strength of the economic releases

(economic Strength meter copyright ForexAbode.com)

What to expect during the coming days:

GBP/JPY:

The outlook for GBP/JPY remains bullish and though 145.00 is a strong psychological resistance but the recent strong momentum suggests that the currency pair should be able to test it. We expect the next target to be 145.00 and probably 145.39 i.e. 61.8% retracement of the downward move during the beginning of August 2009 (163.08) to the low of 116.84 on September 22nd, 2011. Any decisive break above that should target the 145.98 which had proved to be a strong resistance during end of April 2010 and is just below the 150.00 psychological level.

Please note that since November 15th the supports are coming over 22-day EMA. The recent support at 139.40 was also above that level. On the downside any break of this pattern would come as an indication of possible downward consolidation. Any break below 139.40 will indicate the failure of this support as well as the break of 22-day EMA support. In case such a move takes place then we would expect further downward consolidation towards 136.20/136.70 and the immediate bullish outlook for GBP/JPY will neutralize.136.20/136.70 support is derived from 55-day EMA as well as the approaching 135.00 level push

GBP/USD:

A break over 1.6180 and then 1.6206 are critical for further upward gains of GBP/USD. The previous week's resistance came just 1 pip below the mentioned 1.6180. Overall the recent price action indicated that the 1.6000 support is holding and that supports the mildly bullish outlook.

On the upside if break over 1.6180/1.6206 resistance zone takes place then we would expect further gains for a retest of 1.6381. Please note that before that some extended volatile sideway action may take place but as long as 1.5992/1.6000 support holds, the near-term outlook will stay for upward gains.

On the downside any break below the recent 1.5992 will neutralize the near-term bullish sentiments. Such a move will not only represent the failure of 1.6000 support but also a break of the mid-term trend line support. Such a move should bring further downward consolidation towards a minor support near 1.5962 (the low of November 28th). Any break below 1.5962 should target 1.5920 support and then possibly 1.5882 i.e. support of November 21, 2012.

Overall the Foreign Exchange markets have seen some unexpected trends since the end of December 2012, however while GBP/JPY has shown a clear trend, the price action of GBP/USD has been lacking any such directional moves and this pattern is expected to continue for some time as the recent price action is more driven by the weakness of Japanese yen than the strength of the pound.

By: Himanshu Jain.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: These views are the views of the author and should not be taken as an investment advice. The author has put in all possible efforts to validate the correctness of the data provided but Seeking Alpha cannot take any responsibilities of any mistakes.