Bank of America (NYSE: BAC) currently presents a great opportunity to invest. The stock has decreased significantly since the financial crisis but I believe the market is discounting the stock at a conservative set of assumptions. I will explain below why I believe Bank of America's stock is undervalued.

Valuation

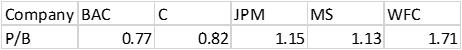

Most people try to value financial companies using the multiples approach, but the problem is that multiples change all the time. For example, before the crisis, banks usually trade around a P/B multiple of 2; after the crisis, that multiple dropped to around 1. This inconsistency will create problems and that's why I believe DCF is still the correct way to value financial companies.

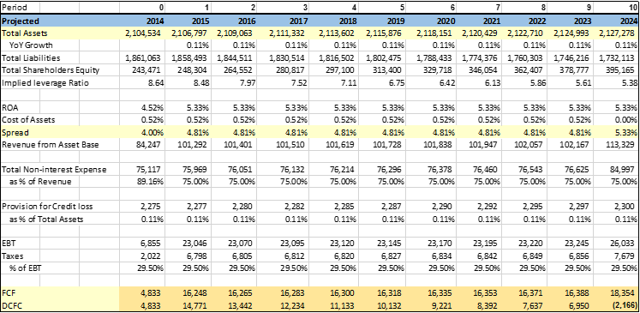

The methodology I used to model Bank of America is to first lay out its balance sheet, and present its revenues and costs as return on assets and cost of assets, respectively. The net of ROA and cost of assets is the spread, which is the amount of revenue Bank of America's assets can generate, net of costs. The interest rate is currently at historical lows but it is very unlikely to stay this low. Though we do not know when rates will rise, we alsmot know for certain that it will go up. When that happens, Bank of America's spread will increase.

The biggest factor that influences BAC's cash flows is its noninterest expense. Noninterest expense as a percentage of total revenue have increased from 49.44% in 2005 to 89.16% in 2015, with a ten-year average of 68%. Although the increase was partly due to the acquisition of Merrill Lynch, 89.16% of total revenue is still way over the roof. As a comparable to Merrill Lynch's wealth management business, which is its main segment, Wells Fargo's noninterest expense is around 60% of revenue. So BAC definitely has room to improve in this aspect, especially with the current high level of litigation cost.

Bank of America's litigation cost for 2014 was $16.4 billion, or 19.5% of revenue. As Bank of America continues to resolve its litigation charges, its noninterest expense will drop significantly, even without any cost cutting. Moreover, Bank of America rolled out a cost cutting plan "Project New BAC", which aims to save $8 billion in certain noninterest expense categories on an annualized basis by mid-2015, and it has successfully completed the goal by the third quarter of 2014.

Executive Compensation

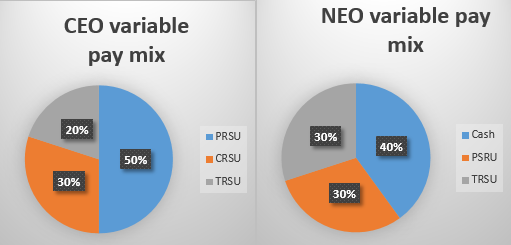

On top of that, the management team's compensation at Bank of America is focused on shareholder return, which means the company will do its best to increase stock value.

PRSU: Performance Restricted Stock Units, Vesting requires achieving specific return on assets and growth in adjusted tangible book value goals over 3-year performance period.)

CRSU: Cash-settled restricted stock units: Granted only to the CEO, CRSUs track stock price performance over 1-year vesting period.

TRSU: Time-based Restricted Stock Units, Track stock price performance over 3-year vesting period

From the pie graph, the CEO's compensation package is exclusively composed of restricted units, which is really good as it puts management shoulder to shoulder with shareholders, which is more likely to drive up return on invested capital.

Summary

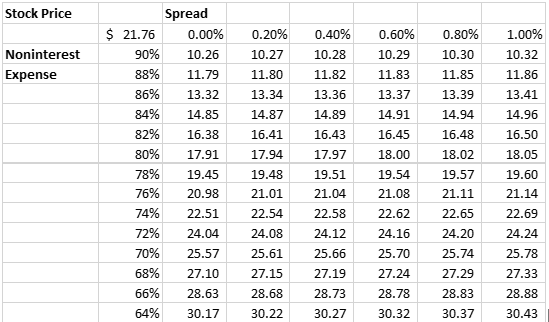

The potential upside for Bank of America exists for three reasons: 1.Increase in Interest rate (Spread); 2.Decrease in Noninterest expense 3.Management is focused on shareholder return

From the sensitivity analysis table, we can see that the stock price is very sensitive to noninterest expense. So even without any spread increase, as long as noninterest expense drops down to the 10-year average of 68%, Bank of America's stock price will soar.

Finally, BAC's P/B is among the lowest compared with other large banks. Using the historical average noninterest expense of 68%, the stock price $27 will give us a P/B of 1.1, which is still reasonable.