There's a low cost way to invest in indexes or baskets of both equities and bonds in Sri Lanka. Fees on Unit Investment Trusts [UITs] for equities range from 1% to 2%, and equity funds usually have a front load between 1.5% and 5%. Fees on Unit Investment Trusts for bond and income funds range from 0.5% to 1%, and I have not encountered front-end or exit fees for these. Exit fees do apply for some funds, though none currently on the list below.

These funds are open-ended. They can be entered into and left at any time. Those listed are not publicly traded on the stock exchange but do price daily (NAMAL Acuity Value Fund is publicly traded and I will try again to meet with NAMAL on my next trip to Sri Lanka). According to Ceybank, there are about US$170 million invested in UITs in Sri Lanka.

Notes On Bond Investing

Rates of return on bonds and fixed deposits (aka Certificates of Deposit) in Sri Lanka are quite good, 10% and higher as of October 2012. Foreigners interested in buying bonds directly are collectively limited to 12.5% of the total bond issue. However, there are no limits on foreigners investing via UITs. Thus, UITs not only can provide good income, but provide a means around limitations on foreigners.

Institutional investors would typically be subjected to 28% tax on income, but this rate falls to 10% for investments via Unit Investment Trusts as a government concession to encourage these investments.

Additionally, one needs a SFIDA (Special Foreign Investment Deposit Account) in Sri Lanka to invest in fixed deposits directly while to invest in UITs, Sri Lanka's treasury bonds and equities, one needs a SIA (Securities Investment Account). Importantly, one cannot transfer money between SIAs and SFIDAs (i.e. if you had funds in an SIA you wanted to place in a SFIDA, you would have to wire the money out of the country to your home account from the SIA and then send a separate wire back to your SFIDA).

Notes On Investing In Stocks

There are a number of different baskets and funds to invest in. I met with three fund families whose funds I will discuss in more detail below, but there are certainly other good options at the other UIT firms. I will be writing related articles on why I think Sri Lanka, and the Colombo Stock Exchange [CSE], will be a good investment over time elsewhere.

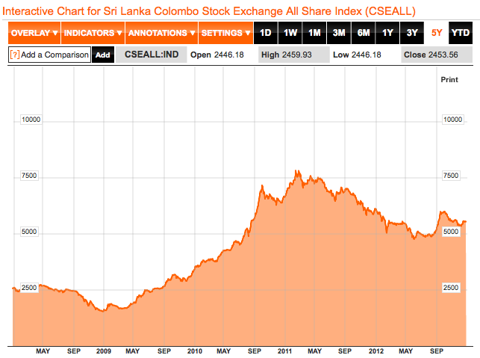

CSE investments went up about 100% in 2009 and 2010 on the heels of the end of Sri Lanka's Civil War. However, one should keep in mind the market was down about 50% in the year before, so the first year of this growth got the market back to where it had been two years earlier.

At the end of the two year run, Dulindra Fernando of Ceylon Asset Management thinks P/E ratios were in the mid 20s. Now the CSE's P/E ratio is about 12.

Source: Bloomberg, CSE All Shares Index 5 year chart as of December 25, 2012.

Notes On Currency Risk

Any investment in the local currency of a country comes with currency risk (that the value of the local currency you are investing in will go down against your home currency). Dulindra Fernando of Ceylon Asset Management feels that the Sri Lankan Rupee is bottoming out after a 20% depreciation in about a year's time. If correct, this would be the other side of currency risk, that one can make compounded gains through an appreciating currency (assuming one also makes gains on one's investment).

Dilshan Wirasekara from SoftLogic Capital said of the Sri Lanka Rupee in October 2012:

- he thought the rupee had more room to appreciate as of October 2012

- he noted the government had tried to stabilize the rupee at 109 rupees to the U.S. dollar

- the government used reserves to try to stop the rupee's depreciation, then reversed policy and let the rupee float

- the rupee dropped to 136 rupees to the U.S. dollar

- there is a belief among many people that the unofficial government targets is 125 rupees to the U.S. dollar

- for the last 30 years, the average annual depreciation of the Sri Lankan Rupee is 3%, and 2011's depreciation was an anomaly

- he also noted that for the safety conscious, Sri Lanka has U.S. dollar denominated bonds that pay about 5.8% to 6%.

Source: Yahoo Finance, U.S. Dollar Sri Lanka Rupee exchange 1 year chart, as of 25 December 2012.

Source: Yahoo Finance, U.S. Dollar Sri Lanka Rupee exchange 5 year chart, as of 25 December 2012.

Notes On Opening An Account To Invest In UITs

You will need to fill out some paperwork and open some accounts to start investing in UITs. The company you choose to open your account with should help guide you through this process and provide you with paper work. You will need:

- A Securities Investment Account [SIA] with a bank in Sri Lanka. This is a specific type of account for foreigners that allows your investment dollars to flow freely in and out of Sri Lanka.

- Central Depository System [CDS] paper work that will link your SIA account to your CDS account with your UIT company.

- A copy of your passport.

- A copy of a bill that shows you are domiciled at your home address.

- To send funds to your SIA at the bank; maintain a minimum amount in the bank account (5000 Sri Lankan rupees, or about $40 currently); and transfer funds from your bank account into your UIT account(s).

It is possible that the 2013 budget will enable certain classes of investors to invest in UITs without going through a SIA, but this is pending.

Notes On Banking Risks

For a list of banks rated by Sri Lanka's local Fitch Ratings, please consult this list. On it, you will find all banks rated from AAA to B, so that you may feel comfortable with the bank you choose to use for your SIA.

Special UIT Tax Note

Sri Lanka has taxes on dividends, interest and capital gains. UITs are tax exempt from taxes on dividends, interest and capital gains on distributions from the UIT. UITs pay a 10% tax on interest that is kept in the UIT, after expenses are deducted.

Those choosing to invest in the Colombo Stock Exchange [CSE] with a brokerage are subject to a withholding tax.

Three Fund Groups I Met With

I met with Ceybank, Ceylon Asset Management, and Heraymila Capital about their unit investment trust options. There are seven other UIT companies. They all can be found via the Unit Trust Association of Sri Lanka [UTAS]. The funds I met with were a function of scheduling and are listed alphabetically.

The top three fund families by assets under management are Ceybank, NAMAL, and NDB Aviva's Eagle Funds. On my next trip to Sri Lanka I hope to meet with more fund families so I can be more inclusive.

The 10 UIT companies. Source: UTAS.

Ceybank Asset Management

Ceybank is 43% owned by the Bank of Ceylon. Ceybank is the largest company in the Unit Investment Trust industry with approximately 40% of the market. Ceybank is over 20 years olds and launched its first fund in March 1992. Ceybank's assets under management were about US$60 million at the time we met in October, or approximately one third of all UIT investments.

Management believes being linked with Bank of Ceylon, Sri Lanka's largest bank, gives it an edge. Through their relationship with Bank of Ceylon, the analysts at Ceybank and staff at Bank of Ceylon exchange data on the macroeconomic situation in Sri Lanka.

Additionally, as the largest UIT investor, Ceybank has good access for meeting with companies either as an investor or potential investor. One of the analysts I met with said our "fund doesn't disturb shareholder votes so it is a good holder for a company to have, a passive investor."

At Ceybank, I met with analysts Ian Ferdinands & Indika Rajakaruna, along with CEO & CIO, Mr. Chitra Sathkumara. Mr. Sathkumara received his MBA at Fordham University in New York, and was trained in fund management at UTI in Singapore. In total, including Mr. Sathkumara, five analysts together manage the below listed funds.

Ceybank Savings Plus (as of October 2012, about a 13% yield on this money market fund)

Fees: 1% per annum

Minimum Investment: US$200

Assets under management: $5 million

This is a vehicle for investing in local money market instruments. This fund is primarily invested in short-term corporate paper. Ceybank uses the contacts it has from its long history investing in equities to find good corporate debt to meet the needs of this fund.

Ceybank Surakum: Gilt Edged Fund (sovereign debt)

Fees: 0.685% per annum

Minimum Investment: US$100

Assets under management: $9 million

This fund invests in sovereign debt of Sri Lanka.

Ceybank Century Growth Fund (equities)

Fees: 1.985% per annum. 3% front-load.

Minimum Investment: US$50

Assets under management: $9 million

This fund invest only in equities on the Colombo Stock Exchange. The largest cash position the fund has had in its history is 22%. For this fund, as well as the Ceybank Unit Trust below, Mr. Sathkumara indicated that for Ceybank's purposes there are a bit less than100 investable companies on the CSE. For both this fund and Ceybank Unit Trust below, management prefers to buy and hold, then trade, as much as possible.

Ceybank Unit Trust (balanced fund)

Fees: 1.985% per annum. 5% front-load.

Minimum Investment: US$10

Assets under management: $39 million

This fund will typically have 60% to 80% of holdings in equities and the remained in fixed income securities and cash equivalents. This is Ceybank's original fund from 1992.

As of October 2012, this fund was close to 90% in equities because fund management was currently bullish on the economy. All UITs must always maintain a 3% cash position to cover redemptions. Beyond that, the Ceybank Unit Trust can be 97% in equities or 97% in bonds. Management analyzes the market and positions the fund accordingly.

Long term, Mr. Sathkumara indicated the fund has return over 20% per year plus dividends, so Ceybank has rarely seen significant redemptions in this fund, even during a downturn in the market.

Contact: ian@ceybank.com, indika@ceybank.com, or sathe@ceybank.com

Ceylon Asset Management

Ceylon Asset Management funds include well-known investor Michael Preiss on its board of directors. It was an introductory conversation with him via e-mail that led me to go to Sri Lanka. I met with Mr. Dulindra Fernando and Mrs. Janethri de Silva at Ceylon Asset Management. We have met via Skype and in person, going back to May 2012. Ceylon Asset Management has two income funds and three equity funds we discussed. Of particular interest to investors will be: the performance of their income fund, the diversification of their top 10 fund, and that they have two sector focused funds available to investors in two of Sri Lanka's most dynamic sectors.

Ceylon Income Fund (Corporate Debt)

Fees: 0.5% annual management fee, no front end or back end fee.

Rate of return as of October 2012 meeting with management: 12% to 15% after fees.

Assets under management: Approximately U.S. $3.5 million.

First UIT income fund to receive a rating from Fitch. 50% of assets are asset-backed securities. The company website states proudly:

The best performing Unit Trust in Sri Lanka. Annualized year to date (14th November [2012]) return of Ceylon Income Fund is 10.88%.

After tax return of 12.39% in financial year 2010/11. The top performing fixed income fund in 2010/11 at the lowest cost in Sri Lanka.

Invests in Sri Lanka corporate debt instruments rated "Investment Grade" (BBB - or better). Maximum single exposure limit is 15% per company.

Ceylon Gilt Edged Fund (Sovereign Debt)

Fees: 0.5% annual management fee, no front end or back end fee.

Rate of return as of October 2012 meeting with management: 11% to 12% after fees.

Assets under management: Approximately U.S. $1 million.

This fund is relatively new.

The one year Treasury bill rate which declined below 10% in 2012 has now once again risen to 12.66% as at 06th June 2012. The Governments' commitments towards accelerated infrastructure development as well as rising oil prices have contributed the rise in interest rates.

Fees: 1% annual management fee, 2% front-end fee, and

Performance Fee: 20% of any excess % in 'net return'* over the growth of the All Share Price Index (ASPI) during each quarter.

Minimum investment: US$100

Assets under management: Approximately U.S. $1 million

The Index Fund holds 10 companies that are typically about 40% of the CSE's market cap. The index fund is limited to holding a maximum of 2 companies in any one sector. This weighting process allows investors to invest in a diversified grouping of the biggest companies in Sri Lanka.

Fees: 1% annual management fee, 2% front-end fee, and

Performance Fee: 0.5% in the event of the net return* of the Unit NAV exceeds 10% during any quarter.

Minimum investment: US$100

Assets under management: Approximately U.S. $1 million

The banking sector in Sri Lanka is old and mature, dating back to the beginnings of English colonialism in Sri Lanka. Mr. Dulindra Fernando explained that the sector is over 150 years old, well regulated by the Central Bank, and a sector that is always making money. Banks dominate the stock exchange and are typically 5 of the top 10 stocks by market cap on the exchange.

Fees: 1% annual management fee, 2% front-end fee, and

Performance Fee: 0.5% in the event of the net return* of the Unit NAV exceeds 10% during any quarter.

Minimum investment: US$100

Assets under management: Approximately U.S. $1 million

Sri Lanka's tourism is relatively small after 26 years of civil war. It is now viewed as a growth industry. Dulindra Fernando believes ports and tourism are Sri Lanka's two drivers of economic growth.

The Tourism Fund's index cover 65% of the existing sector's market cap. The sector is still tiny and just starting out, so it entails greater risk than investing in the banking sector with the Financial Fund.

Contacts: dulindra@ceylonam.com and janethri@ceylonam.com

Heraymila Capital

Heraymila Capital's funds were both launched this year in January and November respectively. "Heraymila Investments Limited is the holding company for the Al Mashal family's offshore investments. One of the larger family offices in Saudi Arabia," the parent company has investments in 33 countries. I met with director Ravi Abeysuriya at Heraymila. Mr. Abeysuriya previously founded Fitch Ratings Sri Lanka, the first Sri Lanka based office of an international ratings agency.

Sri Lanka Heraymila Capital Growth Fund

Fees: 1.9% annual fees, 1.5% front-end fee

Cash: 3% kept in cash to cover redemptions

Minimum investment: US$100

Assets under management: Approximately U.S $8.4 million

Normally an equity heavy fund targeting 90% equity holdings and 10% income holdings. However, based on market conditions, the equity portion can drop as low as 40% (60% income cap) to protect capital in market declines. This fund is actively managed.

Amana Heraymila Shariah Fund

Fees: 1.9% annual fees, 1.5% front-end fee

Cash: 3% kept in cash to cover redemptions

Minimum investment: US$100

Assets under management: Approximately U.S. $781,000

Normally an equity heavy fund targeting 90% equity holdings and 10% income holdings. However, based on market conditions, the equity portion can drop as low as 40% (60% income cap) to protect capital in market declines. This fund is actively managed.

Normally a balanced fund investing in Shariah compliant equities and Shariah compliant income with equities targeted at 60% and income targeted at 40%. However, based on market conditions, the equity portion can drop as low as 20% (80% income cap) to protect capital in market declines and the equity portion can rise as high as 70% (30% income base) to take advantage of a rising stock market.

Contact: info.hcl@heraymila.com or ravi.abeysuriya@heraymila.com

A Note On Risks

Readers investing in Sri Lanka's UITs should carefully consider currency risks before investing. Markets anywhere in the world can be volatile, and readers are advised to independently study this market and assess the risks for themselves before investing.

Disclosure: I do not have a UIT account or intent to open one at this time.

© Jon Springer. Please contact for the right to copy or reproduce this article.

Last updated 11 January 2013.