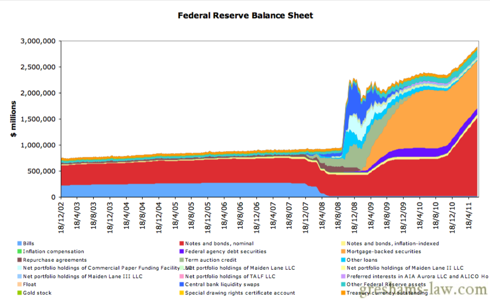

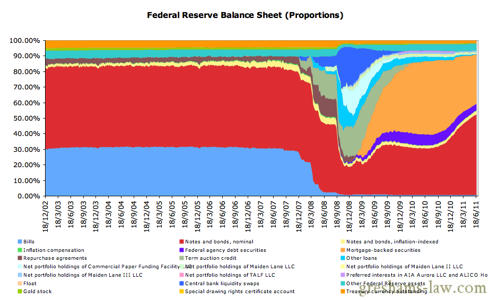

Here, I show an update of the weekly Federal Reserve balance sheet charts for 24/6/11. In addition, given that the dollar index is ever-so-close to making a higher short-term high, I thought I’d detail our thoughts on the dollar for the coming weeks and months. [The first chart shows the Federal Reserve's assets as recorded on the 'factors affecting reserve balances' statistical release. The second chart shows those assets on a proportional basis. That is, the latter chart shows the Fed's various assets as a percentage of its total assets.] With just one week left until the end of the Fed’s latest quantitative easing program, we find that the Fed’s total balance sheet has soared to almost $3 trillion (around $2.88 trillion to more precise). As we have continually noted over the past few months, although the dollar has been diluted by QE2, it has also been changed such that it is now ‘good for’ more ‘traditional’ central banking assets– namely, US Government notes & bonds. Given that – in 2008/2009 – the dollar was debauched in order to reduce the burdens upon certain systemic institutions (housing, banking, yada yada yada), and that economic disequilibrium still prevails, one cannot help but be unsurprised by a resumption of the secular stresses upon these institutions (we have maintained this for some time). Now, of course, the establishment of a new high is no guarantee of a decent sized rally in the dollar – but nevertheless that is out best guess. The important point about this period in financial history is that the mass of IOU claims upon dollars (that was built up by 2008) is tending towards extinguishment. In modern-day fractional-reserve banks, credit can be extended almost at whim (just extend a deposit account, right ‘loan’ in the assets column, and ‘deposit’ in the liability column – let the Fed catch up later). However, it can be destroyed equally as quickly. This process involves people ‘selling stuff to buy back dollars’. Given that the economy has become extremely dependenton the maintenance of this stock of IOU money, such retirement of ‘IOU money’ can lead to cascading trades. Meaning each retirement of credit (that is, extinguishment of ‘IOU dollars’ ), can compel others to do the same. If market participants head for the exit at once, one may find that the amount of stuff that you have to sell to get dollars, rises — aka. The dollar rises. A higher short-term high in the dollar (which is yet to happen!), would signal that the short-term momentum in the dollar is upwards. Given our view on long-term monetary and financial trends, we would embrace that as an opportunity to take part on the long-side.

At the time of writing this, the dollar index is close to making a higher short-term high (see chart below):

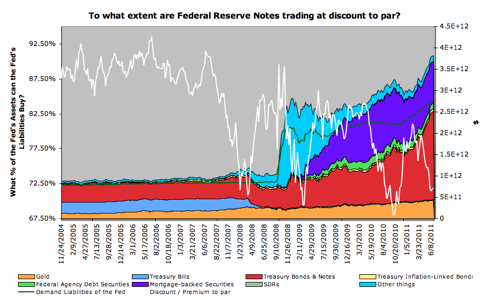

Moreover, considering our understanding of fiat currencies (fiat currencies trade at discounts to par), we find that the ‘dollar discount to par‘ is pointed in favorable direction for long positions in the dollar (although this may well turn down again). The chart below also suggests that gold could do badly for the next few weeks or months (although we still maintain that it’s in a long-term bull market).

Last of all, it doesn’t hurt that Jim Rogers – who has been pretty spot on with currencies over the past few years – is temporarily long the dollar.

http://www.youtube.com/watch?v=Wcndc4JB4BI