April 28, 2016

Resetting The US Dollar Primary View -- One Last Decline (In Progress), Then A Rally Through May-Early June

Important notes

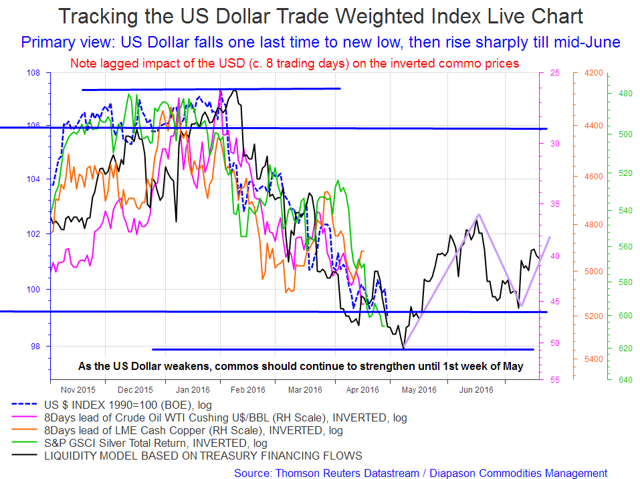

Here is a US Dollar TWI chart you can track, with the expected price path over the next few weeks. The actual TWI price is highly unlikely to perform exactly as I think (especially as to the exact timing of the turns provided by the models), but hopefully it will be close.

I believe the US Dollar will be the critical factor for risk assets over the next few months -- hence we should track its progress closely.

The inverted WTI oil, copper, gold, silver prices are juxtaposed to make it easier to track the impact of the USD TWI on these assets.

Note the leads and lags in the USD vs commo relationships

Primary View:

- The USD TWI may bottom early in the second week of May and then rally through May to mid-June (at least)

- A new USD very short-term weakness begins from there

This is a live chart. Click on the link below to get an update chart: