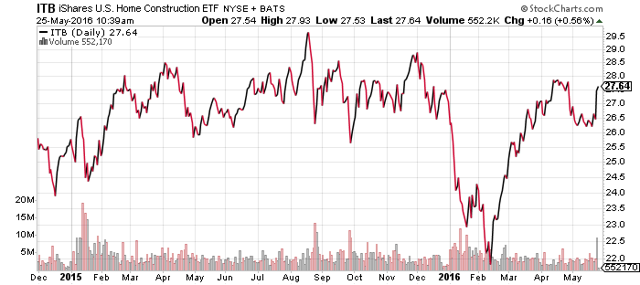

iShares U.S. Home Construction (ITB)

The possibility of a June or July rate hike and robust economic reports have rallied this week's markets. On Tuesday, housing delivered a huge boost in favor of rate hikes when April new home sales soared to 619,000, almost 100,000 units above expectations. New home sales had been stuck in the range of 500,000 units for well over a year and this breakout has some economists expecting the economy will follow. Home prices tend to follow changes in sales volume, so if this uptick in sales holds in the months ahead, it points to higher prices and also higher inflation. ITB gained nearly 4 percent on Tuesday.

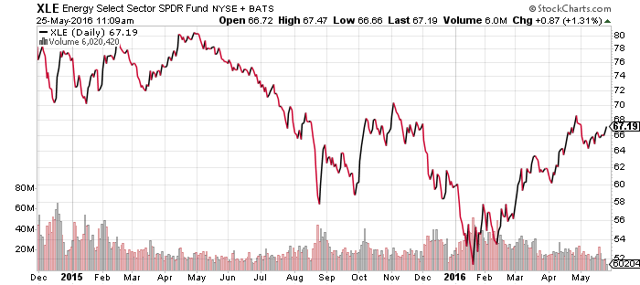

SPDR Energy (XLE)

FirstTrust ISE Revere Natural Gas (FCG)

Global X Copper Miners (COPX)

Market Vectors Coal (KOL)

Market Vectors Steel (SLX)

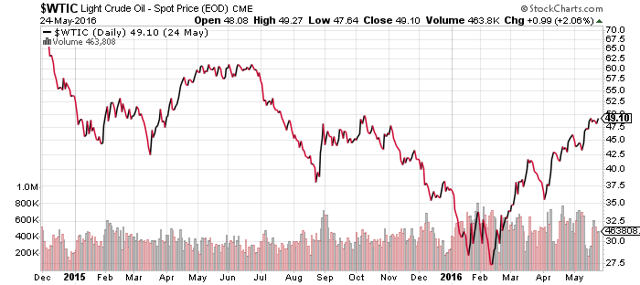

Year-over-year headline inflation was only 1.1 percent in April, below the core inflation rate of 2.1 percent, largely due to oil. Headline inflation, however, advanced 0.4 percent in April alone, a nearly 5 percent annualized rate. The jump was due in part to much higher oil prices. XLE gained nearly 1 percent early in the week and could continue to rally if oil prices break above $50 a barrel.

Steel, coal and copper mining ETFs reversed due to the rising optimism over U.S. economic fortunes. Iron ore and copper markets, however, are dominated by China. Even if the demand for U.S. steel rises, further weakness in China will offset it.

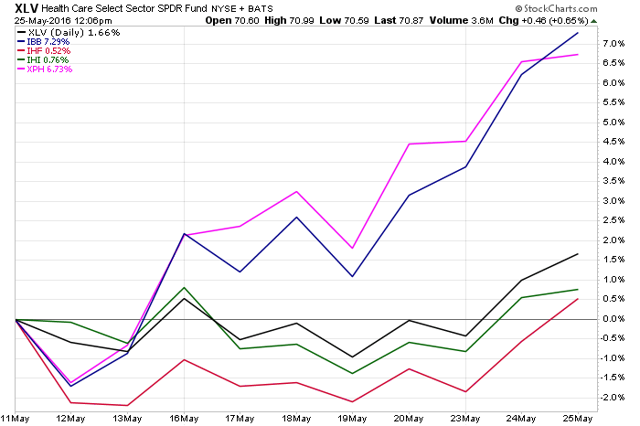

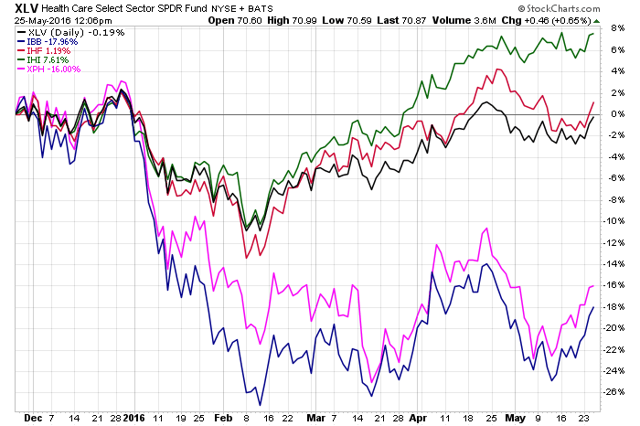

iShares US Medical Devices (IHI)

iShares US Health Providers (IHF)

iShares Nasdaq Biotechnology (IBB)

SPDR Pharmaceuticals (XPH)

Biotech and pharma shares benefited from renewed optimism and advanced strongly in the past week. The big rally in these two sectors helped lift broad healthcare sector funds. Medical devices remains the strongest subsector and another day or two of strength will carry it to a new 52-week high.

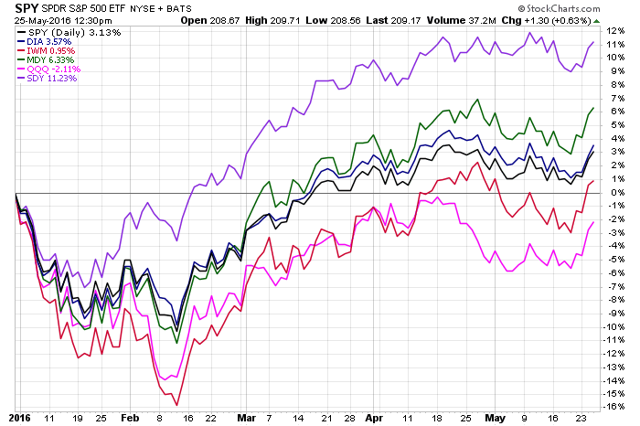

SPDR S&P 500 (SPY)

iShares Russell 2000 (IWM)

S&P Midcap 400 (MDY)

SPDR DJIA (DIA)

PowerShares QQQ (QQQ)

SPDR S&P Dividend (SDY)

The Russell 2000 Index joined S&P 500, Dow Industrials and S&P 400 Mid-cap Index in positive territory this week. The Nasdaq still trails, down 2 percent this year. SDY remains an outperformer and investors have shrugged off any concerns about rising rates. Although utilities have slipped, other dividend paying sectors such as consumer staples, energy and pharmaceuticals have been rallying.

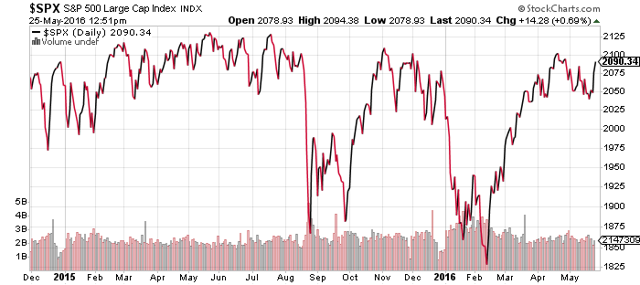

As for the S&P 500 Index, the old highs remain only a few percentage points away. A move back above April's high is the first hurdle.

WisdomTree Bloomberg USD Bullish (USDU)

CurrencyShares Euro Trust (FXE)

CurrencyShares British Pound (FXB)

CurrencyShares Canadian Dollar (FXC)

CurrencyShares Japanese Yen (FXY)

WisdomTree Emerging Market Currency (CEW)

Odds of a rate hike in the futures market are currently at 34 percent for June, and have moved up to 57 percent for July. Historically, the Fed has hiked when odds cross 70 percent. If the Fed wants to hike, it will continue guiding the market higher in the coming weeks.

Emerging market currencies are following commodity prices lower, as are the Canadian and Australian dollars. The British pound is advancing on polling data showing a huge lead for the Remain side.

The euro remains in an uptrend off the December 2015 low, but it is sitting at uptrend support. A drop to $108.50 or lower would be near-term bearish for the euro to support further U.S. dollar strength.

SPDR Utilities (XLU)

SPDR Pharmaceuticals (XPH)

SPDR Materials (XLB)

SPDR Consumer Staples (XLP)

SPDR Consumer Discretionary (XLY)

SPDR Healthcare (XLV)

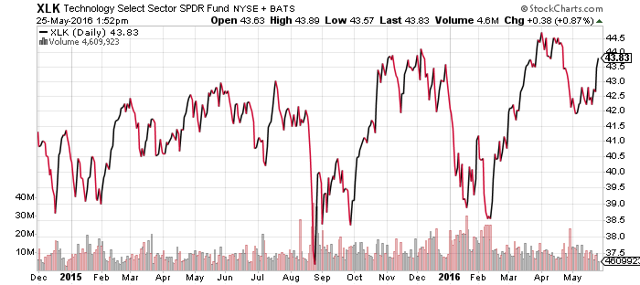

SPDR Technology (XLK)

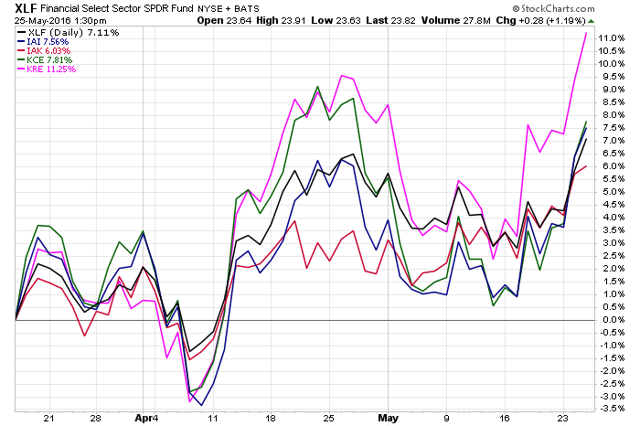

SPDR Financials (XLF)

SPDR Retail (XRT)

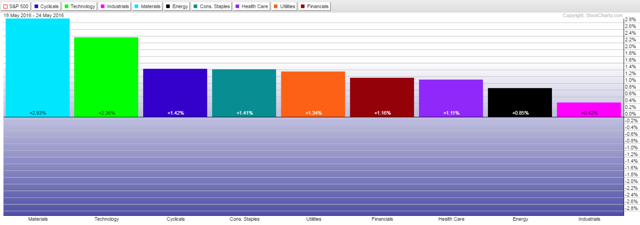

Monsanto, which (MON) comprises 10 percent of XLB, rejected a buyout offer from Bayer, presumably to negotiate a higher price. Materials rose in reaction to the news. Technology saw broader support, with subsectors such as semiconductors rallying. iShares PHLX Semiconductor (SOXX) hit a new high for 2016 yesterday. Technology is also benefiting from the rebound in shares of Apple (AAPL) and Microsoft (MSFT), two stocks that pulled funds such as XLK lower in April. The Internet sector advanced too, with FDN approaching its high in 2016.

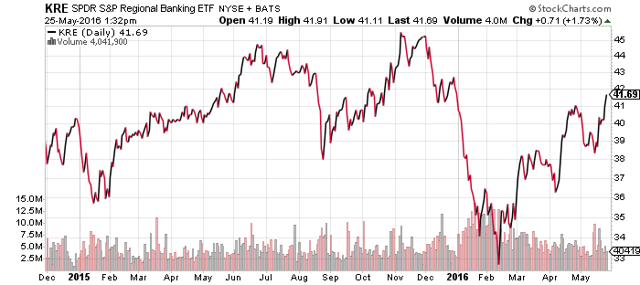

The chart below illustrates SPDR S&P Regional Banking's (KRE) strong advance on the back of interest rate expectations and strong housing data. A stronger housing market and rising interest rates will be a potent bullish combination for smaller banks.

iShares iBoxx High Yield Corporate Bond (HYG)

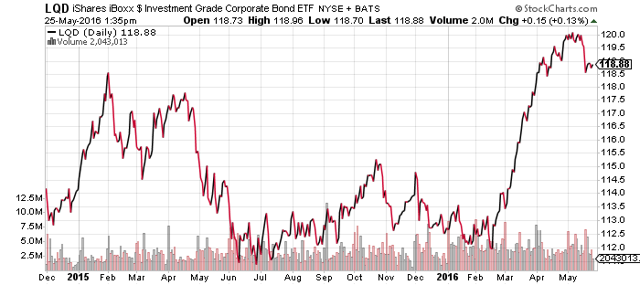

iShares iBoxx Investment Grade Corporate Bond (LQD)

Bonds have firmed over the past week. This led to sideways trading in LQD the 10-year treasury yield. With credit risk taking a back seat to interest rate concerns, this relationship should hold in the near future, with higher yields leading to a lower price for LQD, and vice versa.

SPDR S&P 500 Large Cap Growth (SPYG)

SPDR S&P 500 Large Cap Value (SPYV)

Financials benefit from rising interest rates and they are the dominant sector in many value funds, but technology also performed very well over the past week.

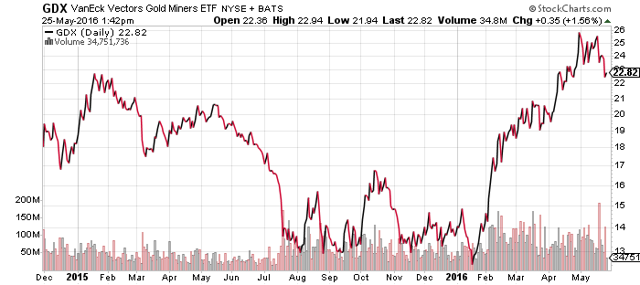

Market Vectors Gold Miners (GDX)

Global X Silver Miners (SIL)

SPDR Gold Shares (GLD)

Gold has fallen considerably throughout the equity rally and a key support level for gold is approaching. A break below $114 for GLD or $1180 on gold is possible and most investors will be steering clear of the metal in the near-term. Even if gold fails to drop much further, the more volatile miners could see significant declines before stabilizing. GDX could easily slide to $19, a 17 percent drop from current levels.