Amid months of turmoil in the bond market, and a lot of scary talk about bonds from investment advisers, yields on Treasury Inflation-Protected Securities have actually declined slightly over the last three months.

Hard to believe, isn't it? Take a look at the chart for the TIP ETF, in blue, versus Vanguard's BND ETF (total bond market) since July 1:

After a lot of volatility in the bond market, the price of the TIP ETF has actually increased almost 0.5% since July 1, outperforming the overall bond market. This means TIPS yields have declined over that time.

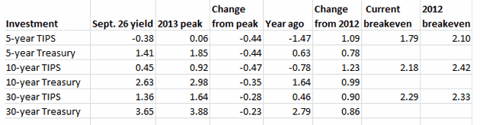

Here is a summary of how TIPS and Treasurys stand now, versus a year ago:

- 5-year TIPS: Today's yield is about -0.38%, 44 basis points down from the early-September peak but a whopping 109 basis points higher than a year ago. Today's inflation breakeven rate of 1.79% is much more attractive than 2.10% a year ago. It's obvious the bond market is not anticipating near-term inflation.

- 10-year TIPS: Today's yield is 0.45%, down 47 basis points from the peak but up 99 basis points from a year ago. The inflation breakeven point is 2.18%, down substantially from last year's 2.42%

- 30-year TIPS: Today's yield is 1.36%, down 28 basis points from the peak and up 90 basis points from a year ago. The breakeven point is down slightly from a year ago at 2.29%.

What these numbers mean. TIPS yields have declined sharply since the Sept. 18 Federal Reserve decision to back off from tapering its $1 trillion a year bond-buying stimulus program. The early-September peak in yields appeared to be pricing in tapering, and then the bond market was also hit by a weak jobs report (Sept. 13) and a very mild inflation report (Sept. 17).

Nevertheless, TIPS are a much more attractive investment today than they were a year ago, with yields across all maturities up about 100 basis points. At the same time, TIPS have gotten less expensive versus traditional Treasurys, shown by the lower inflation breakeven rates.

Are TIPS a screaming buy today? No. Are they a horrible investment today? No.

I personally believe Fed tapering is inevitable, and TIPS yields will again rise to more normal levels, in the range of 1% to 2% above inflation. We got very close to 1% above inflation in early September on the 10-year, before the Fed blinked.

A serious government shutdown, while unlikely, would change this equation. Read my April 25 blog: The TIPS earthquake: When did it happen, and why? It documents how the threat of a government shutdown in July 2011 set off a massive reaction in the TIPS markets, with TIPS yields plummeting into negative territory for the first time in history.

A government shutdown would be 'good' for TIPS prices. Let's hope that doesn't happen.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Additional disclosure: I own TIPS and hold them to maturity.