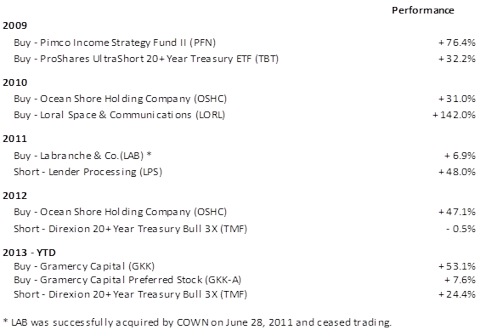

At the beginning of each calendar year, Rangeley Capital publishes two "Best Investment Ideas" for that year. The following chart shows each idea we have published dating back to 2009, and the profit or loss of that investment from January 1 - December 31 for that respective year, assuming a basic buy and hold strategy.

Best Ideas for 2013

Gramercy Property Trust (NYSE: GPT)

Event Categories:

- Turnaround

- Initiate Dividend

- Transition in Shareholder Base

As we observe the investment landscape in 2013, the real return on government debt dips ever deeper into negative territory. High yield bonds could be sued for false advertising based on their very name. Quality, dividend paying equities are fully priced. Master Limited Partnerships (MLPs), among the best values following the Lehman collapse, have fully recovered. Where can a bargain seeker turn for yield? Why should we care about cash yield anyway?

Looking at conventional investor behavior, it is hard to find any type of yield-y security on sale at the moment. However, it appears as if there are any number of foundations, endowments, advisors, and even families who are currently demanding yield at any price who are, in the process driving those yieldy securities to any price. In some cases, these prices are now decoupled from value and decoupled from risk. It is an interesting dilemma for someone who primarily seeks safety that when one overpays for ostensibly safe securities, they become risky securities. Unlike a few years ago, when the marketplace was littered with securities that offered both high yield and low risk, such opportunities appear to be rare today.

But why should the market offer us opportunities where we want those opportunities to be located? In most instances, the market does not even know who we are, let alone care about what we want. To say that we want to make an advantageous bet and to say where that bet is to be found is mighty demanding and probably foolhardy. So, there are not currently safe, yieldy opportunities; too bad for us. Let's not try to see something that is not there.

Well and good to avoid a pitfall, but can we go beyond that to somehow exploit this mania? We suspect so. Securities with low or no yield could be cheap and securities with high yields could be expensive, but this state could last longer than we are able to predict or tolerate. Our solution is to find securities that are on the verge of changing teams so that we can collect the difference between the out-of-favor security that will shortly become the beneficiary of our current era's latest fad. We want to find something that has no yield but is soon to have a high yield and will almost certainly be loved by conventional investors.

Referring back to Warren Buffett, in his 1959 investor letter, the first investment that he cited was the Commonwealth Trust Co., a bank which was trading at about $50 while its intrinsic value was conservatively estimated at around $125. The discount arose because the company paid no cash dividend at all. The value to Buffett came from the mispricing and the opportunity came from the market's arbitrary infatuation with cash dividends.

Our favorite modern example of how to put this idea into practice is Gramercy Capital Corp., a commercial REIT with both common and preferred stock (GKK and GKK.A respectively) that is safe, cheap, and ignored. The common stock currently trades for about $3 per share and the preferreds trade at about $32 per share. In 2008, after significant turmoil in the company's financing business, GKK stopped paying dividends on the preferred and common shares. Five years later, they have yet to reinstate their dividend, despite having enough cash to do so. As a result, the stock has lost its logical shareholder constituency and suffers from a bias against non-dividend paying investments. The good news: we believe the company is positioned to reinstate their dividend within the next year and GKK stock will be the beneficiary of a large re-engaging shareholder base and the market's dividend euphoria.

This past year was a period of transition for Gramercy. Since 2008, the company and management have been in survival mode. They almost did not make it out of 2008 due to the highly levered business model and the timing of the crisis. So although they had cash at the management company level, it's understandable that management was hesitant to pay that out. Now, the board has hired a new experienced and talented management team to take the business forward. Also of note, upon his hiring, the new CEO purchased one million shares of the stock. After a strategic review, the decision was made not to liquidate or sell the business outright. Instead, they are selling off the legacy businesses and taking the proceeds with which to focus on the triple net lease space.

We believe there is a lot of merit to that business strategy; however, what's more interesting to us is that Gramercy is re-engaging with the markets in order to be successful in this new endeavor. That would be impossible for a REIT that is unwilling to pay their dividend.

Despite the issues they have had in the past and the large CDO liability on their balance sheet today, we believe there is a big margin of safety in this investment. First, the consolidated financials only tell half the story. The CDO liability, although significant, is non-recourse to the parent. So, when you look at the company's financials and net out the CDOs, the picture looks very different (see chart below). Secondly, this company has over $175 million of cash. They are using the CDO losses and tax loss carry forwards to delay dividend payment and retain their REIT status. However, this masks the true financial health of a healing, growing business.

Condensed Financial Information | |||

Consolidated | Less CDOs | Adjusted | |

Total Equity/(Deficit) | $(294,041) | $510,849 | $216,808 |

Source: Gramercy Shareholder meeting report (12/13/12) | |||

Over the course of the next year, we believe GKK will choose to pay off the accrued dividends to their preferred holders. While few investors seem to have much interest in buying this non-paying preferred now, the shareholder base and demand will shift once Gramercy becomes a dividend payer. Between receiving the accrued dividends and a market re-pricing, there is value left to be collected from this safe and cheap preferred stock.

We anticipate the common stock will likely begin paying regular dividends within a year as well. The stock will probably be worth about $6 per share by the time that they finish the process of resuming dividends.

This REIT survived the financial crisis, has restructured itself to thrive in the future, and will be well regarded as a sensible investment… after they turn on their dividends. The corporation's future is still vulnerable because it is not yet sized appropriately as a standalone entity. The major risk factor to our thesis would be if a larger competitor lobs in an acquisition offer closer to $4 per share before the company completes their transition. Such an offer would be easily justified based on the potential cost savings.

What are we watching for? Gramercy's management team is in the process of trying to sell their legacy CDO business. If they are able to announce a sale at a good price, that will be an auspicious sign that they are on track to complete this transformation. They will have evolved from the financial crisis' orphaned detritus to a staple holding of yield hungry REIT investors.

Direxion Daily 20 Year Treasury Bull 3x Shares (Public, NYSEARCA:TMF)

Event Categories:

- Special Situations

- Leveraged ETF Decay

At Rangeley Capital, we focus on identifying individual companies that trade a price that offers a wide margin of safety. We look to corporate events to unlock value for shareholders.

What causes the price of a given security to diverge from its underlying value? The markets are made up of thousands of smart, rational, self-interested investors seeking an edge and trying to profit. For us to have an edge, we prefer never to compete when our success is tied to pitting our judgment against a market that operates efficiently. Instead, we look for specific situations where the price system itself cannot work effectively, where other investors may be forced to make non-economic decisions which distort the price. This could occur as a result of too much leverage, liquidity needs, a specific narrow mandate, or an agency problem. When other shareholders must act based on something other than price and value, we have an advantage.

As we look for non-economic players in the market, we continue to come back to the demand for "safe" yield-oriented securities. To us, there is no such thing as a safe asset, only safe prices. The unfortunate paradox is that the more one pays for a "safe" asset, the riskier it becomes. Generally, yieldy securities look to be expensive, but in the US Treasury market we find one of the largest price insensitive investors in history with a publicly advertised $85 billion a month buying program.

As a result of continued monetary easing on the tail end of a 30 year white hot market for bonds, the US 30-Year Treasury trades at its lowest yield in history. The effects of low rates are global, and it is hard to predict the unintended consequences that could result from this policy. What we do know for certain though is that this scale of easing on the part of the Fed cannot continue forever, and there will come a significant re-pricing when the market loses its largest buyer.

So how does one position to protect themselves and potentially benefit? If one has access, borrowing at low fixed rates is certainly one way to take advantage. Second would be to look for investments like Gramercy Capital, where there is potential for a security to transition from a negative carry to positive carry. Third, and one of our favorite short ideas for 2013 is to short the Direxion Daily 20 Year Plus Treasury Bull 3X ETF (TMF). TMF is an exchange traded fund (ETF) that seeks the daily investment results of 300% of the price performance of the NYSE 20 Year Plus Treasury Bond Index.

Broadly, we tend to be skeptical of financial innovation, and we have been particularly interested in shorting leveraged ETFs for several years now due to their horrendous structural flaws. The mechanics used by these leveraged funds create a "constant leveraged trap" that erodes their value over time. To operate, the fund has to add or reduce leverage on a daily basis to match the index. If the underlying index goes up in value, the ETF must increase leverage; if the index goes down, the ETF must decrease leverage. Essentially, this boils down to the ETF being forced to increase leverage on up days and decrease leverage on down days (buy high/sell low). Regardless of the performance of the underlying index, all leveraged ETFs are designed to fail over the long-term. The more volatile the underlying index, the more quickly the ETF erodes.

For example, in 2011 silver declined by about 11%, as measured by the iShares ETF SLV. So if one took a basic short position, they should have profited from the trade. However, if that same investor chose to use a leveraged ETF to articulate their view, the results would have been drastically different. In 2011, despite silver declining by 11%, the Proshares Ultrashort Silver ETF (ZSL) lost nearly 60% of its value. This leveraged ETF was designed to provide 200% of the inverse daily price movement of silver, and despite being correct in the direction, the investor lost money as a result of the extremely poor structure of the vehicle.

The Direxion Daily 20 Year Plus Treasury Bull 3x Shares ETF (TMF) suffers from the same structural decay problem described above. We like this trade because, on one hand, if we are correct, our position helps to hedge the portfolio in the event of a systematic reduction in the principal value of US Treasuries. If we're wrong, and Treasuries continue their unprecedented climb to ever high prices, the structural inefficiency of the leveraged ETF itself should erode the value of the security anyway.

Disclosure: I am long GPT.