It has always amazed me, the things that make the markets move in one direction or another.

Friday it was all about employment, or more specifically, jobs creation, with a website full of analysts of one type or another predicting that 100,000 jobs would be created during June. When the June jobs creation number was announced on Friday as 80,000 jobs, the markets squatted and began the evacuation process, and didn't wipe until the closing bell.

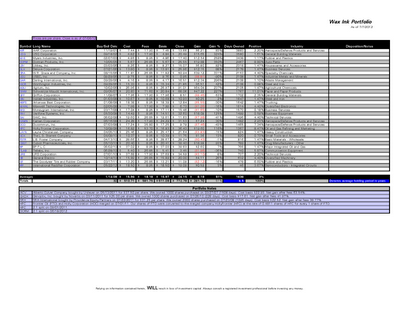

Portfolio Commentary

The Wax Ink Portfolio was up 1.0% for the week, with an average share price of $24.15.

By comparison, the Dow was down 0.8%, the Nasdaq was up 0.1%, the S&P 500 was down 0.5%, and the Russell 2000 was up 1.1%.

Year to date, the Wax Ink Portfolio is up 2.8%, while the Dow is up 4.5%, the Nasdaq is up 12.8%, the S&P 500 is up 7.7% and the Russell 2000 is up 8.9%.

Market Commentary

The markets received a little help during the week thanx to some of the world's banks, with China's central bank lowering its benchmark interest rate by 1%, along with the a 0.75& lowering by the European Central Bank and an increase in debt repurchasing by the Bank of England.

One of the ironies in all of this was an announcement by the Japanese finance minister that if the government doesn't get off of the dime pretty damn quick and pass some legislation, the government will be out of money by October. The irony is that Japan's central bank has had interest rates set at 0% for years and now the country is running out of money.

Being the simpleton that I am, even I was able to figure out two things. The first was that if you loan money out for free, eventually you will run out of money, since there are no interest payments to offset the time required to replenish the capital that was loaned out.

The second thing I was able to figure out was that if Japan's reason for lowering interest rates to 0% was to stimulate the economy by making investments in government debt far less attractive than other investments...then they need a new reason.

The other item of note during the week, aside from the lunacy that has become Wall Street, was the employment picture.

Job growth in America is almost non-existent, the "official" unemployment rate remains at 8.2%, demand for goods and services around the world has slowed, central banks in both Asia and Europe have lowered benchmark interest rates, American companies have continued to hint that the business climate is poor at best and that going forward earnings will be lackluster.

Yet with all of this empirical data staring investors in the face, they continue to follow the "Buy" recommendations of Wall Street analysts instead of doing their own equity research and taking part in their financial future.

Incredible!

Equity Commentary

The Wax Ink Portfolio benefited a bit thanx to several merger announcements made early in the week by companies that are not in the portfolio and most likely would never be in the portfolio, since the stock prices are much higher than our valuation estimates.

The one saving grace, at least in our opinion, is that the acquiring companies are overpaying for the companies being acquired.

Moving up the investment mountain during the week were building materials company USG Corporation (NYSE: USG) up 8%, custom processed steel company Worthington Industries, (NYSE: WOR), up 7%, and payday lender Moneygram International, Inc. (NYSE: MGI), up 6%.

Stocks heading into the porcelain hopper during the week were tire maker Goodyear Tire and Rubber Company (NYSE: GT), down 6%, semiconductor manufacturer International Rectifier Corporation (NYSE: IRF), down 5%, and conglomerate GE Corporation (NYSE: GE), down 4%.

Political Commentary

Well it was back to politics as usual during the week, with one political liar doing their dead level best to out lie the other political liar. Sort of reminded me of bankers testifying before Congress.

With that said, I will give Governor Christie props for asking the single most profound question of this political season, at least so far.

I can only imagine what it would be like if Governor Christie were elected President? Especially if he were to have someone as soft spoken as Ted Nugent as his Vice-President.

Regardless of what your politics are, you have to admit that both of those cats are at least...refreshing.

Wax

To enlarge the portfolio, please click on the image.

Wax Ink is comprised of individual investors, NOT licensed or registered with ANY government agency. Please obtain the advice of a registered investment professional BEFORE considering any information obtained from this site.