Strategic Mindset - At Top Gun Options our strategic mindset is short term neutral based on debt ceiling and sequestration issues, however we are long term bullish.

Target - Goldman Sachs (GS), 141.01

Commit Criteria - This week Wall Street's flagship reported strong earnings, seeing Q4 net income nearly triple to $2.83B over $1.01B for the same period last year. GS seems to be returning to its pre-financial crisis role as the Street's ATM. Fixed income trading, once a powerhouse for the former investment bank, has returned in full force, along with their traditional investment banking business. The financial crisis also forced GS to tighten its belt; headcount has been reduced and costs slashed while its infamous compensation structure was updated to strike a balance between paying their top talent and returning equity to shareholders.

While still very far south of the mid-200's the stock visited in the past, I believe that GS has cracked the code on the "new normal" and once again will print money ahead of its peers. I am long term bullish on Goldman, however I still believe that GS, along with the rest of the financial sector, will see short term headwinds as we face a faltering economy, out of control deficits, and increased financial regulations, in addition to an unsolved European fiscal and economic crisis.

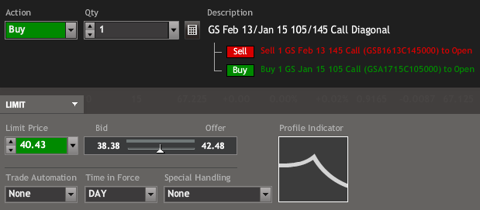

Tactic - Long Call Diagonal

Buy 1 Jan15 105 call

Sell 1 Feb13 145 call

Net debit of 40.43, or $4,043

Tactical Employment - A Long Call Diagonal is the perfect tactic to employ when we hold a short and long term strategic mindset that differs. This bullish tactic involves going out as far in time as possible and purchasing deep-in-the-money calls. When buying calls at Top Gun Options we select a strike that has a delta of at least .80. Delta is a measure of the rate of change in the price of an options relative to a change in price of the underlying stock. The higher the delta the higher the rate of change in the option price, and vice versa.

Since these .80 delta calls are expensive (loaded with time and intrinsic value), we look to sell front month, in this case, February upside calls to help 'finance' the .8 delta call purchase. After Wednesday's 4.1% pop and the stock hovering at 52 week highs, we believe the stock will stabilize as the Street battens down the hatches in preparation for the debt ceiling dogfight.

Therefore we have selected the February13 145 calls. By selling these calls we take in a credit of $1.65, reducing the cost of the deep-in-the-money Jan15 105 calls from $42.08 to $40.43.

Mid-Course Guidance - If by February expiry GS is trading below 145 we will collect the full credit of the short calls and will look to roll the short call position out to March. By continuing to sell front month upside calls we can potentially pay off the deep-in-the-money calls, own them outright, and continue selling calls to potentially further profit.

If GS is trading above 145 we will simply buy back the calls and roll them up and out to a higher strike in March, and that strike will depend upon our short term strategic mindset and current economic conditions.

We recently closed a bullish long call diagonal on RIMM for a nice profit as we anticipated a run up in the stock prior the Blackberry 10 release on January 30th. We initiated the position when RIMM was trading around $7 and closed the trade when it recently hit $14. The trade gained over $8,000 on $4,500 in risk.

Click here to learn more about our live trading services.

Exit Plan - The main risk in a diagonal is the underlying position. Stocks can go to 0, however we obviously believe that the probability of this occurring is statistically insignificant and our max loss is limited to the debit (minus the credit) for the trade.

We will exit this trade before expiry of the Jan15 105 deep-in-the-money calls for maximum profit as GS powers to the head of the financial class and shows the Street that it has the maneuverability to deliver outside returns in the new world.

Disclosure: I am long GS.