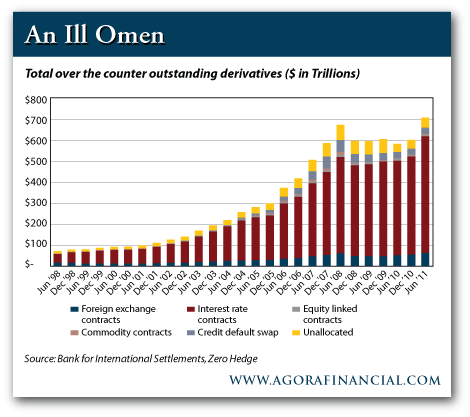

The record nominal value for derivatives has just been broken. The following graph from the 5 Min. Forecast (Monday Nov. 28) tells the story:

Readers should be aware that notional values are not the only way to measure the amount of derivatives that are in existence. Here are the three ways total derivative values are measured:

Notional value: the face value all assets covered by derivatives. In other words, if all "insured" values went to zero this would be the required cash flow for settlement.

Gross market value: the cost of replacing all currently open contracts.

Gross credit exposure: The net amount remaining after all positions are offset. In other words, this is the theoretical amount that would be required to close all positions after canceling all the offsetting contracts.

I don't have the exact numbers at hand, but the first measure now sits at about $707 trillion.

The second value is only 5% or 6% of the above total, or something in the $30-$40 trillion

range.

The third value is only around $3 trillion +/-.

So the exposure seems pretty benign, based on the third value especially.

However, the problem is counter party risk. If there is a potential cash flow requirement of $707 trillion and a couple of counter parties, even smaller players, are unable to stand good for CDSs they hold a domino effect can cascade through the entire network of insurance guarantees. If B depends on A to pay its obligation in order for B to pay theirs, then C, who is depending on B, doesn't get paid and can't pay D, etc., etc., etc.

This is why the bankruptcy of Lehman Brothers, a fairly small CDS player, brought the world to the edge of a cliff.

What the graph is showing us is that the dynamite is packed into the truck. All could remain okay unless the truck hits a bump in the road.

Derivatives: The Explosives are Packed in the Truck

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.