Norfolk Southern (NYSE: NSC)

Norfolk Southern (NSC) is one of two Class I railroads that operates on the U.S. east coast. In total, the NSC network comprises approximately 20,000 route miles of track in 22 states and D.C. In 2012, NSC carried 186 billion revenue ton miles of freight, accounting for 5% of total intercity freight carried in the U.S.

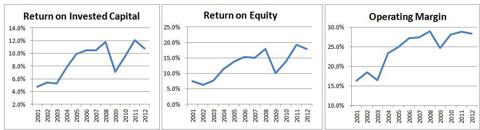

Strong Pricing Power Has Led to Much Improved Profitability

Like most Class I railroads, NSC has experienced a surge in profitability over the past decade. As the following charts show, NSC has been earning returns on invested capital in the low teens and returns on equity of almost 20% from 2007 to 2012 (minus the downturn experienced in 2009), more than double what the railroad earned in the early-2000s. In concert, NSC's operating margins have also improved dramatically, rising from 16% in 2001 to 28% in 2012, and earnings have risen nearly fourfold from $460 million in 2001 to $1.75 billion in 2012.

NSC's improvements in profitability have coincided with a strong resurgence in railroad pricing. Freight revenues per revenue ton mile for NSC are about 75% greater than they were in 2001, equating to a greater than 5% annualized rate, outstripping the rate of rail cost inflation by a fair margin. The Rail Cost Adjustment Factor (RCAF), an index for U.S. rail input costs, grew at a lower 58% even as diesel fuel prices more than tripled during this time period. Adding to this, railroads have also become more productive, continuing a trend of increasing output per unit of input. Including a productivity adjustment, the RCAF has grown at a still lower 30% over the 2001 to 2012 period. Pricing above costs is the primary catalyst behind NSC's substantially improved operating margins.

Monopolistic Industry Structure

The presence of strong pricing power is generally an indicator of a monopolistic industry. The rail industry has two inherent economic characteristics that give rise to strong market power. One, railroads provide an essential service that does not have any close substitutes. Trucking is considered rail's closest substitute but it is not competitive on long-haul routes with bulk shipments because of the substantial fuel and labor economies that railroads operate with. For example, a railroad can carry a ton of freight on one gallon of fuel four times the distance that a truck can. Moreover, just one rail employee is needed to "carry" 11 million ton miles of freight a year compared to 150,000 ton miles in a year for a trucking employee. On long haul routes, these scale efficiencies far outweigh trucking's advantages of flexibility and lower capital intensity.

Two, railroads operate in a network type industry that discourages direct competition from other railroads. Multiple railroads serving a market that can otherwise be sufficiently served by one will lead to network redundancy. Because railroads have substantial fixed costs but very low marginal costs, the price competition that ensues will be detrimental for the long-term financial viability of all incumbents which over time will tend to create only one dominating railroad. On the other hand, if a rational pricing environment is artificially imposed by the government or colluding market forces, the pricing needed to sustain all railroads in the industry must be adequate to cover each railroad's variable and fixed costs. Such pricing will necessarily be higher compared to the pricing that can prevail if only one railroad was in operation, thus leading to an inefficient outcome for both railroads and shippers alike.

Regulatory Background on the Rail Industry

In spite of rail's monopolistic industry structure, rail rates in real terms are only about a half of what they were when the Staggers Act was enacted in 1980 to deregulate the industry. The sharp fall in rates coincided with a period in which railroads dramatically improved their efficiency, competitiveness and physical and financial health. Prior to Staggers, the rail industry was in much disarray: rail infrastructure was in poor condition, nearly a quarter of the industry's track mileage was owned by bankrupt railroads and the industry had steadily ceded market share to trucking for decades. Staggers gave the railroads greater freedom to negotiate their own rates in private contracts with shippers, to abandon unprofitable lines and to merge with other railroads. The Class I railroads, in particular, ignited much of the change as they divested their regional assets and focused on the largest sized long-distance shipments.

From 1980 to 2008, railroads shed an immense amount of track: total industry miles of track fell by 40% over the time span. Class I railroads were particularly rigorous in removing track as their proportion of total industry track miles operated fell from 82% in 1987 to 70% in 2006. In addition, Class I railroads were also consolidating as the total number of Class I railroads fell from 40 in 1980 to seven by 2000. Capacity reduction combined with consolidation transformed a formerly disparate regional rail network into a more uniform nationwide network. This decades-long process of rationalization dramatically enhanced productivity and the cost-competitiveness of the industry. Railroad freight ton miles increased 72% from 932 billion in 1980 to 1.6 trillion in 2009, its share rising from 27% to 40% of total U.S. freight ton miles. Class I railroads captured an even greater share of this growth, with its ton miles growing at an even higher 93%.

The combination of increased freight volumes and decreased track miles tripled traffic densities (measured by net ton-miles divided by track miles) on Class I track from 1980 to 2006, which gave rise to much improved economies of density - that is, as traffic volume increased at a significantly higher pace than incremental costs. Rising economies of density were responsible for much of the dramatic increases in productivity and allowed railroads to reduce prices and regain market share. The trend in falling rates only began to reverse itself in early 2000s when the decades-long process of capacity reduction began to shift pricing power back to the railroads. The price increases over the past several years cannot be completely attributed to an increase in market power however. As noted above, rail input costs especially fuel have risen substantially over the last decade.

Threat of Re-Regulation

The recent rise in rail rates has spurred shipper complaints and renewed scrutiny on rail regulation. But even as rail rates have risen in recent years, the industry as a whole has hovered just above revenue sufficiency in recent years after being below sufficiency for most of the thirty years after Staggers. That is, revenues have just been modestly above total costs (including costs of capital). Moreover, the industry's return on capital, while higher than ever before, is still a fairly modest 10%. Given the rail industry's light regulation relative to regulation in other similar monopolistic industries such as utilities, it is thus surprising that neither measure of profitability suggests wide-spread abuse of market power.

The key difference between railroads and the heavily regulated utilities is that railroads are not completely devoid of competition. Rather, the rail industry should be more accurately defined as a quasi-monopolistic industry. In some geographical pockets with limited competition, railroads do have the ability to exert market power. In these cases, rail behavior and pricing is monitored and constrained by the Surface Transportation Board (STB). In other regions, competition very much exists and provides a natural constraint on rail pricing. Such competition can come in the form of substitutes such as trucking and barges but more often comes in the form of other railroads. For NSC, its chief competitor is CSX, the other major East region railroad in the U.S. In many cases, shippers on long-haul routes have a number of options to get from A to B, including the ability to use both NSC's and CSX's networks through switching agreements.

Like utilities, a railroad's operation in each region is dependent on the functioning of the entire network in a mutually symbiotic relationship. But unlike utilities, the market structure of different regions in a railroad's network can vary considerably. Different market structures will create different pricing. To earn adequate sums to reinvest in their networks, railroads essentially subsidize the operations of areas with greater competition by charging higher prices in areas where they can exert market power. This practice of subsidization, otherwise called differential pricing, disproportionately spreads rail costs across different customer groups. The exercise of market power in regions with less competition does not imply the abuse of market power however. The STB guards against unreasonable rail pricing and often just the threat of rate proceedings itself is enough to keep railroad behavior honest.

Ultimately, whether NSC can continue to grow its earnings at a satisfactory rate will depend largely on the actions of regulators. There are substantial reasons to believe that a return to regulation akin to that of the pre-Staggers era is very unlikely. For one, the relatively unregulated U.S. rail system is considered the best and cheapest in the entire world. Secondly, even as rates have increased recently, railroad profitability has not indicated the wide-spread abuse of market power. In many cases railroads simply do not have substantial market power to earn monopoly-type profits and in others, regulation and the presence of regulation place constraints on any ability to do so. And finally, history has already shown how policies that significantly limit railroads' profitability can be very costly for railroads and shippers alike.

Valuation

As mentioned before, recent increases in NSC's returns on capital have been primarily due to a surge in rail pricing. While rail prices should continue to increase at a rate somewhat above cost inflation, it should be expected that NSC's growth in returns on capital over the last 10 years will not be sustained. Nonetheless, the real value of NSC is its ability to reinvest huge amounts of capital at high returns on equity. While NSC's returns on invested capital are not exceptional, its returns on equity are attractive. This is because the company provides an essential service that produces a fairly steady and predictable earnings stream and therefore has the ability to safely and cost-effectively employ large amounts of leverage in its capital structure.

The ability to earn attractive and incrementally growing rates of return on an ever-expanding equity capital base is what will enable NSC to grow its earning power over time. Since 2002, around the time that legacy contracts started to expire and the decline in rail rates began to reverse itself, NSC's free cash flows have grown from $200 million to $1.3 billion, an almost seven fold increase. NSC's returns on equity in 2002 were approximately 6% while its book value that year was $6.5 billion. In 2012, NSC's returns on equity tripled to 18% while its book value reached $9.8 billion. In between, NSC's earnings more than quadrupled - mirroring the combined effects of a three-fold increase in return on equity capital and a 50% increase in equity capital employed.

At a current price of $74, NSC sells at a price to normalized free cash flow to shareholders ratio of about 15, entailing a free cash flow to equity yield of about 6%. Mid-teen level multiplies seldom give hint to a strong value opportunity but they may indicate a bargain if the business has growth prospects that can justify the higher multiple. If NSC's ROE remains static at 18% and the company reinvests just a third of its earnings back into the business, then the implicit growth rate in earnings would be 6%. A 6% growth rate seems very reasonable given the combination of NSC's pricing power, productivity improvements and the increasing importance of railroads in the transportation of North American goods. Assuming this 6% growth rate and a conservative discount rate of 10%, the effective earnings multiple would be 25. This entails a valuation of $116 a share based on last year's earnings, representing an over 50% premium to the current market price.

Disclosure: I am long NSC.