When I was married 25 years ago, my wife and I received Tupperware as a wedding gift. We're still using most of those pieces today. Like the product itself, the company has survived thorough the years and adapted with a tilt towards paying growing dividends in the last five years.

Tupperware Brands (TUP) has been hammered the last two days based on mildly missing top and bottom numbers. My thesis is that this is a huge overreaction and the stock is now oversold.

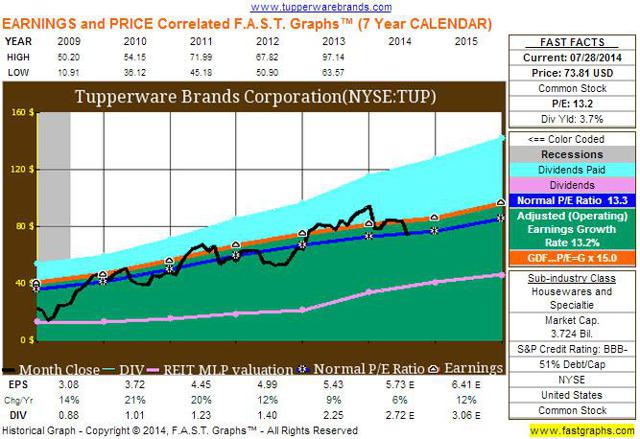

As shown in the 7 year FAST Graph below, the closing price yesterday moved the stock back to a PE of 13.2 which is in-line with history PE.

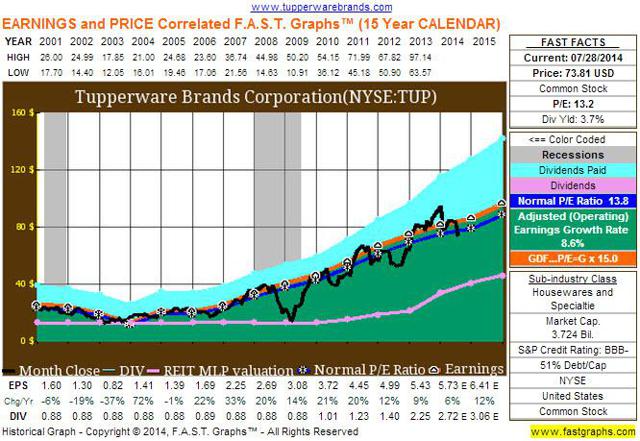

The 15 year FAST Graph is equally inviting, IMO:

While Tupperware is a company with a long history, the dividend payments only started growing in 2009. The 1, 3, and 5 year Dividend Growth Rates are 60.9%, 30.5%, and 20.3%, respectively.

Given the huge growth in the dividend in the last few years, the Chowder Rule is a very impressive 23.6.

Valuentum provides a recent overview of the business, growth opportunities, and risks.

Like so many stocks in the market today, Tupperware is not a screaming deal -- rather, even with the large recent drop, it appears to be fairly valued if you believe the numbers will hold over time.

While I don't expect to host a party and sell any product, I did open a new 1/3 position today at $72.22.

Disclosure: The author is long TUP.