The Philadelphia Semiconductor Index (SOX) was poised for a move above its 50-day simple moving average at 445.43, but could not. The NASDAQ traded above 2800 once again but closed below once again. The NASDAQ has had daily closes below 2800 since testing 2840.51 on February 18th. All daily charts (except the SOX) are extremely overbought on their daily charts with the S&P 500, the NASDAQ and the NASDAQ 100 (NDA) below their February 18th highs at 1344.07 SPX, 2840.51 NASDAQ, and 2403.52 NDA.

Stocks Remain Overvalued Fundamentally – We are operating under a ValuEngine Valuation Watch with more than 60% of all stocks overvalued. Today 64.0% of all stocks are overvalued. In addition all 16 sectors are overvalued with 9 by double-digit percentages. A ValuEngine Valuation Warning occurs when more than 65% of all stocks are overvalued. This last occurred at the mid-February highs. The last time we had a ValuEngine Valuation Warning was February 18th.

10-Year Note – (3.551) The rise in the 10-Year yield is overdone on its daily chart. Annual and quarterly value levels are 3.796 and 4.016 with a daily pivot at 3.532 and weekly and monthly risky levels at 3.275 and 3.181.

Comex Gold – ($1461.6) Gold traded to a new all time high at $1469.8, above my semiannual pivot at $1452.6. My annual value level is $1356.5 with semiannual and daily pivots at $1452.6 and $1464.3, and weekly, quarterly and monthly risky levels at $1473.0, $1523.7 and $1559.9.

Nymex Crude Oil – ($110.14) Traded to a new 52-week high at $110.48 this morning closing in on this week’s risky level at $110.68. My annual and monthly value levels are $101.92, $101.09 and $99.91 with my semiannual pivot at $107.14, and weekly, daily and quarterly risky levels at $110.68, $111.56, $114.27 and $120.52.

The Euro – (1.4301) Traded to a new 52-week high at 1.4398 this morning and is now overbought. My monthly value level is 1.4170 with weekly, quarterly and daily pivots at 1.4328, 1.4308 and 1.4353, and semiannual risky level at 1.4624.

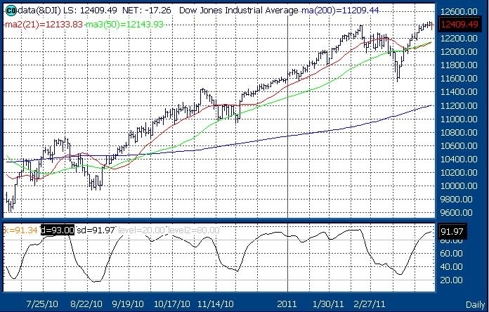

Daily Dow: (12,409) Traded to a new 52-week high at 12,450.93 on Wednesday below this month’s risky level at 12,481. Weekly, annual and semiannual value levels are 12,317, 11,491, 10,959, and 9,449 with monthly, daily, quarterly and annual risky levels at 12,481, 12,550, 13,774 and 13,890.

Courtesy of Thomson / Reuters

Key Levels for the Other Major Equity Averages – All major equity averages are overbought on their daily charts except for the Philadelphia Semiconductor Index (SOX), which has a neutral daily chart. The SOX tested its 50-day simple moving average at 445.43 again on Thursday.

Courtesy of Thomson / Reuters

S&P 500 – (1333.5) My weekly pivot at 1328.1 was tested on Thursday with the February 18th high at 1344.07, and daily and monthly risky levels at 1350.7. and 1360.0. My quarterly value level is 1277.7.

NASDAQ – (2796) My weekly pivot is 2762 with the February 18th high at 2840.51, and daily and monthly risky levels at 2842 and 2898.

NASDAQ 100 (NDX) – (2333) Closed above my weekly pivot is 2329 with the February 16th high at 2403.52, and daily, monthly, annual and quarterly risky levels at 2365, 2477, 2590 and 2685.

Dow Utilities – (415.28) My semiannual value level is 397.84 with a weekly pivot at 412.49 and daily, monthly and quarterly risky levels at 422.66, 423.25 and 448.17.

Dow Transports – (5317) Closed below my weekly pivot at 5341. My annual and monthly pivots are 5179 and 5371 with daily risky level at 5417. The high for the move is 5404.33 set on Friday, April 1st.

Russell 2000 – (849.44) Tested my weekly pivot at 848.50 on Thursday. Annual and quarterly value levels are 784.16 and 778.81 with daily and monthly risky levels at 870.65 and 856.67. Set a new high for the move on Tuesday at 858.05.

The SOX– (443.25) My weekly pivot is 427.31 with a daily pivot at 441.57, the 50-day simple moving average at 445.43, and monthly, quarterly and annual risky levels at 452.34, 498.75 and 531.14.

That’s today’s Four in Four. Have a great day.

Richard Suttmeier

Chief Market Strategist

Chief Market Strategist

ValuEngine.com

(800) 381-5576

(800) 381-5576

To unsubscribe from this free email newsletter list, please click http://www.valuengine.com/pub/Unsubscribe?

Send your comments and questions to Rsuttmeier@Gmail.com. For more information on our products and services visit www.ValuEngine.com

As Chief Market Strategist at ValuEngine Inc, my research is published regularly on the website www.ValuEngine.com. I have daily, weekly, monthly, and quarterly newsletters available that track a variety of equity and other data parameters as well as my most up-to-date analysis of world markets. My newest products include a weekly ETF newsletter as well as the ValuTrader Model Portfolio newsletter. You can go to http://www.valuengine.com/nl/mainnl to review sample issues and find out more about my research.

“I Hold No Positions in the Stocks I Cover.”