10-Year Note - (1.823) My semiannual pivot is 1.903 with my annual value at 2.502. My weekly pivot is 1.841 with daily, quarterly, monthly and semiannual risky levels at 1.718, 1.687, 1.347 and 1.385.

Courtesy of Thomson / Reuters

Comex Gold - ($1762.2) Semiannual, annual and weekly value levels are $1659.5, $1635.8, $1575.8, $1388.4 and $1559.1 with quarterly pivots at $1725.5 and $1740.9, and daily and monthly risky levels at $1782.5 and $1816.4.

Courtesy of Thomson / Reuters

Nymex Crude Oil - ($96.66) Monthly, semiannual and monthly value levels are $85.62, $79.83 and $75.53 with weekly, daily and quarterly pivots at $96.94, $97.21 and $99.87, and semiannual and annual risky levels at $104.84, and $103.58 and $117.00.

Courtesy of Thomson / Reuters

The Euro - (1.3152) Semiannual, monthly, weekly and quarterly value levels are 1.2980, 1.2945, 1.2634 and 1.2499 with daily, annual and semiannual risky levels at 1.3220, 1.4239 and 1.4405.

Courtesy of Thomson / Reuters

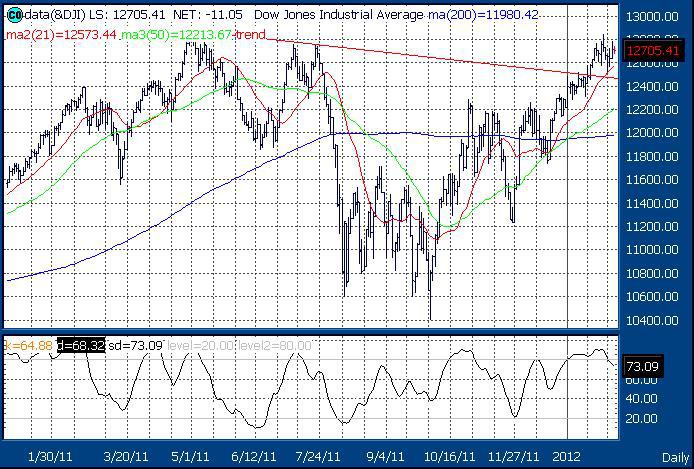

Daily Dow: (12,705) Quarterly, annual, monthly and semiannual value levels are 12,478, 12,312, 11,557, 8,425 and 8,336 with daily, weekly and quarterly pivots at 12,679, 12,733 and 12,796, the May 2, 2011 high at 12,876, and annual risky level at 14,032.

Courtesy of Thomson / Reuters

S&P 500 - (1325.6) Monthly and semiannual value levels are 1176.1, 841.7 and 829.9 with daily, quarterly and weekly pivots at 1323.1, 1305.4 and 1314.1, and quarterly, and annual risky levels at 1331.7, 1363.2 and 1562.9. The May 2, 2011 high is 1370.58.

NASDAQ - (2860) Quarterly, weekly, annual, monthly and semiannual value levels are 2777, 2758, 2698, 2512, 2012 and 1952 with daily and quarterly pivots at 2865 and 2849, and annual risky level at 3232. The May 2, 2011 high is 2887.75.

NASDAQ 100 (NDX) - (2496) Quarterly, weekly, annual, monthly and semiannual value levels are 2422, 2412, 2300, 2280, 1851 and 1743 with daily and quarterly pivots at 2503 and 2471, and annual risky level at 2603.

Dow Transports - (5306) Monthly and semiannual value levels are 4522, 4407 and 3778 with a weekly pivot at 5309, and daily, quarterly, weekly and annual risky levels at 5366, 5448, 5543, 5861 and 6111. The all time high was set at 5627.85 on July 11, 2011.

Russell 2000 - (812.90) Weekly, monthly and semiannual value levels are 787.77, 662.90, 572.90 and 510.81 with a daily pivot at 816.11, and quarterly and annual risky levels at 824.46, 829.03, 836.15 and 969.09. The all time high was set at 868.57 on May 2, 2011.

The SOX- (420.56) Weekly, quarterly, monthly, annual and semiannual value levels are 394.61, 390.17, 323.52, 269.80, 277.90 and 194.47 with a daily pivot at 416.65, and quarterly and annual risky levels at 423.32 and 520.61. The 2011 high is 474.33 set on February 18, 2011.

ValuEngine Valuation Model - Stocks are not cheap enough to chase MOJO.

- 63.0% of all stocks are undervalued / 37.0% of all stocks are overvalued. On October 4th - 93.5% of all stocks were undervalued.

- Fifteen of sixteen sectors are undervalued; only two are undervalued by double-digit percentages (10.5% / 11.7%). Back in March 2009 the sectors were undervalued by 33% to 45%. - Check out and subscribe to www.ValuEngine.com.

VE Morning Briefing - If you want expanded analysis of the US Capital Markets including a Fearless Prediction of the Week and a Stock of the Day go to this link and sign up: http://www.valuengine.com/nl/mainnl?nl=D

ValuTrader Model Portfolio - If you want to learn how to "Buy and Trade" use this link and sign up: http://www.valuengine.com/nl/mainnl?nl=V

ETF Weekly - If you want my Value Levels and Risky Levels for 30 Electronically Traded Funds use this link and sign up: http://www.valuengine.com/nl/mainnl?nl=U

ValuEngine FDIC Evaluation Report - In this report I slice and dice the FDIC Quarterly Banking Profile. We publish a ValuEngine List of Problem Banks in this publication: http://www.valuengine.com/nl/mainnl?nl=C The December FDIC report with complete analysis of the Q3 Quarterly Banking Profile is now available. I track the continuing slow improvement to the housing market and banking system, but recognize that we are not out of the war.

ValuEngine Capital Management - Over the years many of my readers have asked for investment help based upon ValuEngine and my technical analysis expertise. This is now possible through VE Capital Management LLC. If you are a Registered Investment Advisor looking for new products to offer to your clients, let me know. If you have any questions, please respond to this email.

Definition of MOJO - This is my term for technical momentum. I use what's called "12x3x3 slow stochastic readings" from daily, weekly and monthly charts. The scale is zero to 10.0 where above 8.0 is overbought and below 2.0 is oversold.

Buy and Trade Strategies for Long Positions

- Value Level - The price at which you establish an additional long position on share price weakness. This is done on a GTC Limit Order to buy weakness to the Value Level.

- Risky Level - The price at which you remove a single long position or reduce a multiple long position on share price strength. This is done on a GTC Limit Order to sell strength to the Risky Level.

Buy and Trade Strategies for Short Positions

- Value Level - The price at which you remove a single short position or reduce a multiple short position on share price weakness. This is done on a GTC Limit Order to buy weakness to the Value Level.

- Risky Level - The price at which you establish an addition short position on share price strength. This is done on a GTC Limit Order to sell strength to the Risky Level.

Richard Suttmeier

Chief Market Strategist

ValuEngine.com

(800) 381-5576

To unsubscribe from this free email newsletter list, please click http://www.valuengine.com/pub/Unsubscribe?

Send your comments and questions to Rsuttmeier@Gmail.com. For more information on our products and services visit ValuEngine.com

As Chief Market Strategist at ValuEngine Inc, my research is published regularly on the website ValuEngine.com. I have daily, weekly, monthly, and quarterly newsletters available that track a variety of equity and other data parameters as well as my most up-to-date analysis of world markets. My newest products include a weekly ETF newsletter as well as the ValuTrader Model Portfolio newsletter. You can go to http://www.valuengine.com/nl/mainnl to review sample issues and find out more about my research.

"I Hold No Positions in the Stocks I Cover."