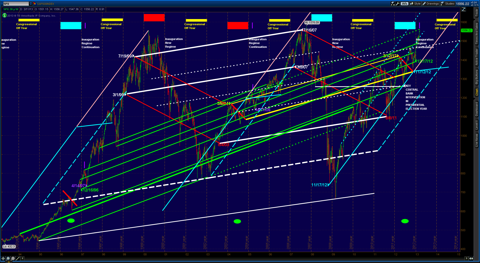

Presented Chart: SPX: S&P 500 COMPOSITE INDEX

A 21-Year Weekly OHLC Chart With Key 8-Year Regime Change Cycle EchoVectors (RCCEVs) and 4-Year Presidential Cycle EchoVectors (PCEVs) and Coordinated Forecast EchoVectors (FEVs) and Key Coordinated Echo-Back Dates (EBDs) Illustrated:

A Chart With Active and Key Bi-Regime Change Cycle EVs, Regime Change Cycle EVs, Presidential Cycle EVs, Coordinate Forecast EVs From Key And Select Pivot Point EBDs and With Upside and Downside Coordinate Pivot Extension Vectors Generated From Key Coordinated Focus Interest Echo-Back Time-Points and Time-Periods Highlighted.

Key Coordinated Echo-Back Dates and Cycle Echo-Back Time-Points. Key Highlighted And Coordinated EchoVectors And Coordinated Period UpVectors, DownVectors and Support Vectors, and Their Colors, As Illustrated On Chart:

-

1. 16-Year Bi-Regime Change Cycle EchoVector With Coordinate EchoBackDate:

12/16/96 - 12/17/12 Solid Green

Long Solid White and Long Spaced White Toward Bottom

2. 8-Year Regime Change Cycle EchoVectors With Coordinate EchoBackDates:

3/1/99 - 3/5/07 Medium Length Solid White

7/19/99 - 7/16/07 Medium Length Solid White

8/4/03 - 8/8/11 Medium Length Solid White

3/8/04 - 3/12/12 Medium Length Solid Yellow

3. 4-Year Regime Change Cycle EchoVectors With Coordinate EchoBackDates: 11/17/08 - 11/12/12 Medium Length Solid Blue

All Other Medium Length Solid Blue Vectors and Medium Length Spaced Blue Vectors Are Regime Change Cycle Period Coordinated Parallels of the Above Presidential Cycle EchoVector.

5. 4-Year 5-Month Coordinate, and Parallel, Regime Change Cycle DownVectors: Medium Length Solid Red: Four

6. Incumbent Presidential Election Year: Green Dot, Short Red Line

7. Republican Presidential Victory Year: Red Square

8. Democratic Presidential Victory Year: Blue Square

9. 1-year 8-Month Coordinate Regime Change Cycle Period Support Vector: Short Solid Blue

10. Off Year (Non-Presidential) Congressional Cycle: Yellow Square

Analytical Points of Interest:

1. Note that the year of an Incumbent Presidential Election, as won by the incumbent, and regardless of party, constituted a strong price flex point year, and inaugurated 3 following years of STRONG PPRICE MELT-UP AND STOCK PRICE VALUE GAINS.

Also note the major Price Level Decline that followed that 3-year melt-up period.

2. Note that the strong green bi-regime change cycle echovector is being fulfilled in steps, both last year and this year, and is consistent with regime change cycle period price level action in 2004 and 2005 as well. Then note that this price action is still taking place within the strong but less vigorous white regime change cycle and longer white coordinate bi-regime change cycle echovector at the base, which may dominate and limit the upside range.

However, noting both these foregoing conditions, also note that last years and this year's key regime change cycle echovector, as effected last summer by global central bank coordinated intervention, and highlighted in yellow, is now tilting the echovector price pathway up beyond the white vector coordinated pathway echo climb rate and towards the more vigorous green climb rate. How long might this echo price coorination and echo-symmetry continue in both price extension and in time extension, at this rate, before moderating factors may prevail?

The ProtectVEST and AdvanceVEST By EchoVEctorVEST MDPP ProtectVEST by EchoVectorVEST methodology is particularly well suited to help enhance major market exposed portfolio value security and overall portfolio value performance and return through the application and utilization of specialized derivatives as 'portfolio value insurancing' hedges when also combined with the power of the Motion Dynamics and Precision Pivots Forecast Model and Alert Paradigm and the ProtectVEST and AdvanceVEST By EchoVectorVEST Active Advanced Risk Management Trade Technology and Active Advanced Management Position Value Optimization Method in such a market environment, and particularly in utilizing its advanced OTAPS technology

(Click on chart to enlarge and click on chart again to open new tab then click on chart in new tab to zoom)

FOR FURTHER EXTENDED ANALYSIS AND COMMENTARY

See

A Technical EchoVector Look At The Stock Market: Moving Into March Expiration: Update With Chart

and article, Dow Chart: Toppy Or Not?, at

http://echovectorvest.blogspot.com/2013/02/dow-chart-toppy-or-not-next-months.html,

OTAPS ALERT at

http://echovectorvest.blogspot.com/2013/02/blog-post_5845.html,

and more market Commentary References at

http://www.echovectorvest.com/Commentary.html

PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP

Providing Forecasting and Trade Management Technology, Analysis, and Education Consistent With More Than Doubling the Portfolio Position Value of The Major Market(Dow 30 Industrials, DIA ETF) From Mid-2007 to Early 2009!... More Than Doubling Again from Early 2009 through 2010!... Then More Than Doubling Again in 2011!... And Then More Than Doubling Again in the First Half of 2012!... "We're keeping watch for you!"

FORECAST MODEL & ALERT PARADIGM & ACTIVE ADVANCED MANAGEMENT & TRADE TECHNOLOGY

For information on EchoVectorVEST MDPP Active Advance Management Trade Technology and Active Advance Management Position Value Optimization Methodology see:

http://echovectorvest.blogspot.com/2012/05/on-off-through-vector-target.html

*Daytraders interested in shorter-term market mechanics and OTAPS ALERTS also taking advantage of intra-day time-horizon price deltas and advanced OTAPS position management technologies for the DIA, GLD, and USO, also see:

http://www.echovectorvest.blogspot.com/

Also see Chronologies and Summaries and Results for the EchoVectorVEST MDPP Major Price Delta and Price Pivot ALERTS for the Gold Metals Market (GLD ETF /GC Futures) and the Crude Oil Market (USO ETF and /QM and /CL Futures) in Q2, 2012, and in Q1.

EchoVectorVEST MDPP: Powerful Results From A Powerful, Active, and Advanced Forecast And Position Management Methodology.

________________________________________________________

PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP

"We're keeping watch for you."

________________________________________________________

FOR TODAY'S KEY CHARTS AND ANALYSIS, SEE:

AND,

https://seekingalpha.com/author/kevin-wilbur/instablog/full_index

________________________________________________________

Click on the links below for direct access to the following:

OUR RECORD:

www.echovectorvest.com/OUR RECORD

OUR RESEARCH:

www.echovectorvest.com/OUR RESEARCH

OUR CURRENT FOCI:

www.echovectorvest.com/OUR CURRENT FOCUS INSTRUMENTS

TRADEMARK MODEL ONTOLOGY AND TERMINOLOGY MATRIX:

www.echovectorvest.com/THE ECHOVECTORVEST MDPP TRADEMARK TERMINOLOGY MATRIX

ACTIVE ADVANCED POSITION MANAGEMENT TECHNOLOGY:

www.echovectorvest.blogspot.com/PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP ADVANCED ACTIVE POSITION MANAGEMENT TECHNOLOGY:THE ON/OFF/THROUGH VECTOR TARGET APPLICATION PRICE SWITCH

EXHIBIT WEEK RESULTS:

www.echovectorvest.blogspot.com/ADVANCED MANAGEMENT EXHIBIT WEEK RESULTS FOR THE GLD ETF AND THE DIA ETF

HIGH FREQUENCY TRADING DEMONSTRATION:

www.echovectorvest.blogspot.com/ECHOVECTORVEST MDPP HIGH FREQUENCY TRADING DEMONSTRATION AND POSITION TERMINOLOGY

DIAMOND OF SUCCESS:

www.echovectorvest.com/THE DIA ETF: THE DIAMOND OF SUCCESS

GOLD METALS:

www.echovectorvest.com/THE GLD ETF AND GOLD METALS

LIGHT SWEET CRUDE OIL:

www.echovectorvest.com/THE USO AND LIGHT SWEET CRUDE OIL

BIO, FOUNDER:

www.echovectorvest.com/BIO, PRESIDENT AND FOUNDER

Posted by EchoVectorVEST

________________________________________________________

What is ECHOVECTORVEST MDPP?

________________________________________________________

DISCLAIMER

This post is for information purposes only.

There are risks involved with investing including loss of principal. PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP makes no explicit or implicit guarantee with respect to performance or the outcome of any investment or projections presented or discussed by PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP.

There is no guarantee that the goals of the strategies discussed by PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP will be achieved.

NO content published by us on the Site, our Blog, and any Social Media we engage in constitutes a recommendation that any particular investment strategy, security, portfolio of securities, or transaction is suitable for any specific person. Further understand that none of our bloggers, information providers, App providers, or their affiliates are advising you personally concerning the nature, potential, value or suitability of any particular security, portfolio of securities, transaction, investment strategy or other matter.

Again, this post is for information purposes only.

Before making any investment decisions we recommend you first consult with you personal financial advisor.

PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP

"We're keeping watch for you."

TAGS: Stock Market Education, ETF Analysis, Major Market Composite Index, Market Outlook, Market Analysis, Technical Analysis, Cyclical Analysis, Price Analysis, Economy, Macro Outlook, Trading, Day Trading, Swing Trading, Investing, Dow Futures, S&P Futures, Stock Market Education, Market Forecast, Market Opinion and Analysis, EchovectorVEST, Portfolio Insurance, Portfolio Management

Simple template. Powered by Blogger.

RELATED LINKS

MEMBER

Themes: Stock Market Education, Financials, Futures, Federal Reserve,Portfolio, Market Currents, ETFs, Macro View, Alerts, Market Outlook,Economy, ETF Long and Short Ideas, ETF Analysis, Long Ideas,Commodities, EchoVectorVEST, Technical Analysis

Stocks: SH, SSO,SDS, QQQ, PSQ, QLD, QID, IWM, RWM, UWM, UKK, TWM, DIA, DOG,DDM, DXD, TLT, TLH, IEF, UUP, UDN, GLD, GTU, DGZ, UGL, DZZ, GLL,IAU, SGOL, SLV, DBS, AGQ, ZSL, CU, PALL, PPLT

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

- EchoVectorVEST MDPP at Twitter

- EchoVectorVEST MDPP at Our Record

- EchoVectorVEST MDPP at SeekingAlpha/Instablogs

- EchoVectorVEST MDPP at SeekingAlpha/Articles

- EchoVectorVEST MDPP at LinkedIn

- EchoVectorVEST MDPP at Yahoo/Contributor

- What Is EchoVectorVEST MDPP?

- Back To Kevin Wilbur's Instablog HomePage »

- Share this Instablog

- Themes: Stock Market Education, Financials, Futures, Federal Reserve,Portfolio, Market Currents, ETFs, Macro View,Alerts,Market Outlook,Economy, ETF Long and Short Ideas, ETF Analysis,Long Ideas,Commodities, EchoVectorVEST, Technical Analysis Stocks Stocks

- Stocks: SPY, SH, SSO, SDS, QQQ, PSQ, QLD, QID, IWM, RWM, UWM,UKK, TWM, DIA, DOG, DDM, DXD, TLT, TLH, IEF, UUP, UDN, GLD, GTU,DGZ, UGL, DZZ, GLL, IAU, SGOL, SLV, DBS, AGQ, ZSL, CU, PALL, PPLT