Market Moving News (Summary of 15 Articles)

Spending: Chain-store sales remain soft with Redbook's same-store sales index steady at a year-on-year plus 2.7 percent.

Manufacturing is negative on average: In the New York State manufacturing sector, the general conditions index was modestly favorable at 6.90, but order data has been very soft this quarter. New orders were minus 2.39, vs. the average of plus 2.24. Industrial production for February edged up 0.1 percent after declining 0.3 percent in January. Market expectations were for a 0.3 percent gain for February. The production of durable goods moved down 0.6 percent and the production of nondurable goods moved up 0.2 percent. The Philly Fed general conditions index held little changed at 5.0 in March vs. 5.2 in February. New orders, at 3.9, are close to zero and unfilled orders are at minus 13.8 in a sharp decline from February's plus 7.3.

Housing is weak: Housing starts in February fell a monthly 17.0 percent, vs. no change in January. The 0.897 million unit pace was down 3.3 percent annualized. This was the lowest starts level since January 2014 with a 0.897 million unit annualized pace. The housing market index slowed 2 points in March to an 8-month low of 53 and the traffic component was down 2 points to 37, a 9-month low that directly reflects the lack of first-time buyers. Despite low rates, demand for mortgage applications was down 2.0 percent in the March 13 week. The year-on-year rate is only plus 1.0 percent. Refinance applications fell 5.0 percent in the week. The average 30-year mortgage moved down 2 basis points to 3.99 percent.

Economy: Foreign accounts were big sellers, in. Net flow of US long-term securities was minus $27.2 billion in January, reflecting $39.8 billion of net selling by foreign accounts offset by $12.6 billion of net selling of foreign long-term securities by US accounts. Concentration was in US Treasuries. Demand for US equities was flat.

Inflation: Business inflation expectations for the next year were 1.7 percent in March, according to the Federal Reserve Bank of Atlanta's BIE survey.

The FOMC cited much negative data: The Fed eliminated the word "patient" from their statement, but did not change rates. Growth is no longer "solid" as noted in January, but "economic growth has moderated somewhat." On the labor market, the Fed said, "A range of labor market indicators suggests that underutilization of labor resources continues to diminish." They lowered forecasts for unemployment, GDP growth, and inflation. Production wages are still soft, up only 1.6 percent on a year-on-year basis. PCE inflation on a year-ago basis is up only 0.2 percent and Core PCE inflation is up only 1.3 percent.

Jobs: Initial jobless claims inched 1,000 higher in the March 14 week to 291,000 with the 4-week average up a modest 2,250 to 304,750. Continuing claims fell 11,000 to 2.417 million in data for the March 7 week with the 4-week average down 1,000 to 2.418 million.

Sentiment is flat

The Bloomberg Consumer Comfort Index's monthly economic expectations gauge fell to a three-month low of 51.5 vs 54 in February. The weekly measure improved to a one-month high of 44.2 in the period ended March 15 from 43.3. The weekly personal finances gauge climbed to 57.1, the highest since early February, vs. 54.8 in the previous week.

Growth in the index of leading economic indicators held steady at 0.2 percent in February. Once again the yield spread is the biggest positive for the index reflecting the Fed's near zero rate policy.

The VIX

The VIX dropped to the "complacent" range from "concern" (my definitions) as the threat of a rate rise was put off by Fed action on Wednesday.

The Market

The S&P500 bounced off 203 on the prior Thursday, and rose all week with lots of volatility on Monday and Wednesday. The index is approaching an all-time high of 211.30. We will see next week whether this move was a short-term reaction to the Fed's rate-rise pushback or a move to new highs on a developing trend. A sustained trend would require better economic data than we've recently seen.

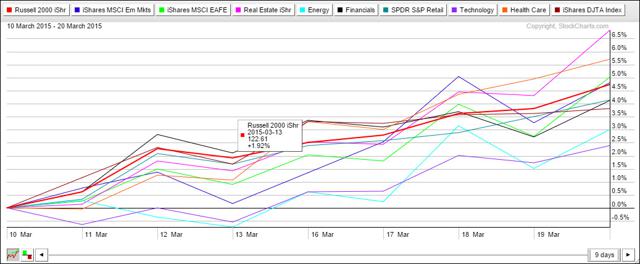

Small Caps

The Russell 2000 moved to new highs at 126 in a stronger trend off the prior week's Thursday pop. IWM is very strong and possibly a better indicator of market strength than the S&P500.

Core Sectors

The strength of IWM is evident in the core sectors chart, with only three of the core ETF's beating its trend, real estate (IYR), healthcare (XLV), and emerging markets (EEM).

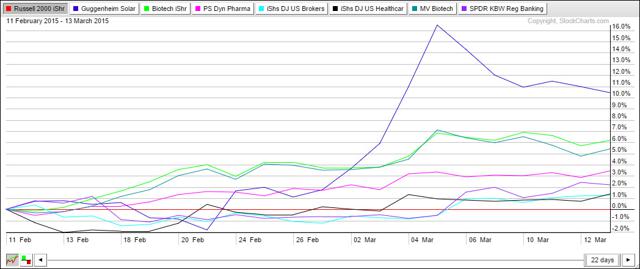

Best Relative Strength

The best relative strength among the 36 ETF's I follow shows only seven beating IWM, led by solar (TAN) with its usual volatility, biotech (IBB/BBH), pharma (PJP), regional banking (KRE), and healthcare (XLV).

XLV is a combination pharma (JNJ, PFE, MRK), healthcare providers (UNH) and biotech (AMGN, GILD, BIIB), with a bit of medical equipment (MDT) thrown in. Despite volatility, biotech (IBB, BBH) is on a tear.

For the first time ever, robotics (ROBO) became prominent, but it didn't make the cut on best relative strength. I am now following HACK, a new ETF that covers the cybersecurity market, including FEYE, PANW, CUDA, and CYBR.

Trades Last Week

Bought: BBH, SMH, TAN

I was stopped out of some ETF's by volatility.

Conclusion and Action

The Fed made the week rough for traders. Many issues moved in volatile ranges on Tuesday, and declined sharply on Wednesday before the announcement. The stench of fear ahead of the FOMC meeting was palpable, and the hype was extraordinary. The action after the announcement was different than usual. The market, led by the S&P500 futures usually swings in both directions immediately and then moves further up or down. In this case, the market took off immediately, reversing a 144-point Dow loss and then gaining 375 points over two hours to close at 18100. This action was a clinic in how emotional markets are. Buy-and-hold investors made gains; traders had to be very fast to make money.

When it was all done, the Fed did exactly what they said they would do, act based on data. If you read this blog the last few weeks, and you knew the data was poor. Cramer called the move, saying they would take out "patience" but replace it with something else, which was "no increase in April." I think I can guess what the fed will do, but not the market.

I conclude that the probable move next week is more gains from interest-rate-rise relief. I don't think the new uptrend will last longer than a week or two without substantial changes in the economic picture. In fact we may see earnings warnings ahead of April numbers, and, of course, Fed panic will resurface in April or May as the June meeting approaches.

Next week, my plan, if the market rises, is to buy IWM and IYR.

Have a great week!