Those of you who follow my Daily Picks column in Barchart.com may have noticed that I have not posted any Daily Picks in a few days. There has been a reason for that. I thought the market was unstable and didn't want anyone buying into an unstable market.

Believe it or not although I am a momentum investor my main goal is capital preservation. I'm over 65 and have accumulated a sizable portfolio I intend to live off of for the rest of my life. I strictly sell stocks that are not meeting my price momentum expectations and only buy in when the market is trading above its 20, 50 and 100 day moving averages. The Market Momentum page on Barchart makes it easy for me to determine when that point is.

The picks today are not buy picks but are for informational purposes. Yesterday 381 stocks were on the New High list for the last month. These are the ones I think you should put on your watch list.

The list includes First Potomac Realty Trust (FPO), Incyte Corp (INCY), Apollo Residential Mortgage (AMTG), National Health Investors (NHI) and an unrated stock American Airlines Group (AAL). Barchart does not apply their technical trading indicators until a stock has at least 6 months of trading activity under its belt.

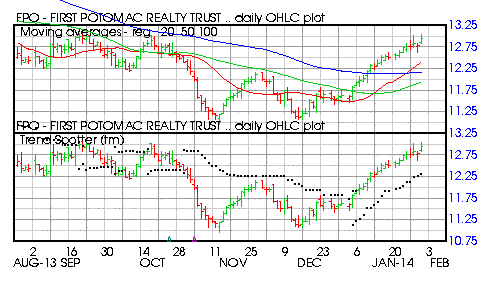

First Potomac Realty Trust (FPO)

Barchart technical indicators:

- 80% Barchart technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 18 new highs and up 11.64% in the last month

- Relative Strength Index 78.39%

- Barchart computes a technical support level at 12.95

- Recently traded at 12.95 with a 50 day moving average of 11.94

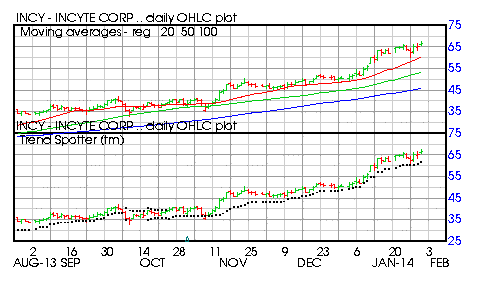

Barchart technical indicators:

- 96% Barchart technical buy signal

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 17 new highs and up 31.40% in the last month

- Relative Strength Index 71.70%

- Barchart computes technical support level at 64.78

- Recently traded at 66.48 with a 50 day moving average of 53.09

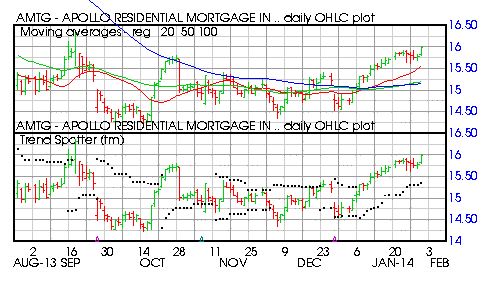

Apollo Residential Mortgage (AMTG)

Barchart technical indicators:

- 96% Barchart technical buy signals

- Trend Spotter buy signals

- Above its 20, 50 and 100 day moving averages

- 16 new highs and up 9.38% in the last month

- Relative Strength Index 70.55%

- Barchart computes a technical support level at 15.71

- Recently traded at 15.8 with a 50 day moving average of 15.19

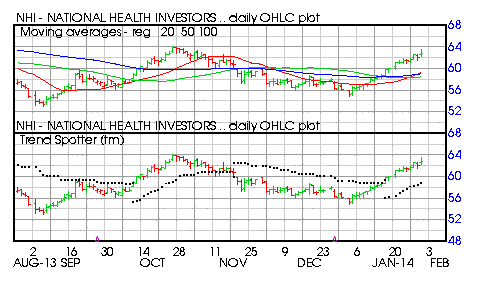

National Health Investors (NHI)

Barchart technical indicators:

- 80% Barchart technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and100 day moving averages

- 15 new highs and up 10.48% in the last month

- Relative Strength Index 71.90%

- Barchart computes a technical support level at 61.46

- Recently traded at 62.75 with a 50 day moving average of 58.44

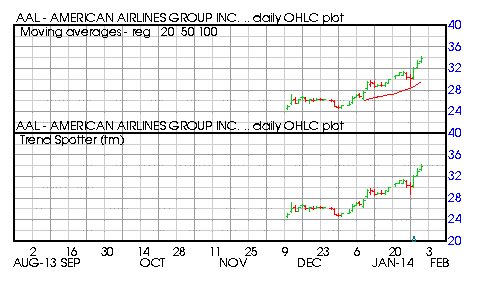

Barchart technical indicators:

- Does not have a 6 month trading history so it is unrated

- Trading above its 20 and 50 day moving averages

- 14 new highs and up 30.79% in the last month

- Relative Strength Index 71.85%

- Recently traded at 33.27