I'm severely chopping stuff here to try and get the size down to something that causes fewer problems when I update. In that vein, links to blogs older than the 01/01/2014 version, PIPE discussions, one year charts will be found only in that and older ones. I've chopped some of the mostly historical short sales related stuff which has minimal utility and will keep it much smaller going forward.

Here's hoping this all helps and is still useful.

In the below chart the volume is inverted to enhance readability! Be aware when you view it!

(right-click and open in new tab, position cursor over image to be able to zoom and scroll)

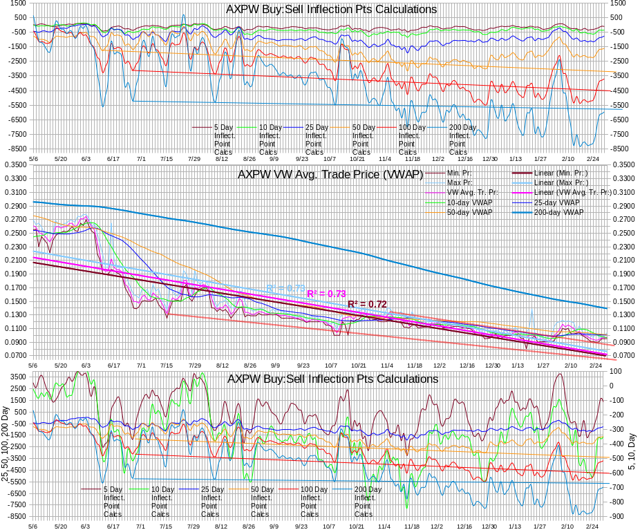

The following are modified inflection point calculations bracketing a price chart for comparison. Note that the false bullish moves and contrary moves of the 5-day has been eliminated.

The two identically calculated inflection points are calculated differently from the original above. I have two different presentations of this newer version. The top one has all periods on the same scale. The bottom one has longer periods on the left scale and shorter periods on the right scale. The hope is that shorter period changes will be easier to spot. More work to do, this is a start, hopefully.

I've identified some changes I want to try on the new inflection point calculations but haven't had time to implement them yet. I'll work them in over time after a little experimentation.

Comments and further suggestions welcome.

(right-click and open in new tab, position cursor over image to be able to zoom and scroll)

Older stuff for "2013 Dly Sht % of 'sells' values", Weekly 85% price summaries going back to 6/14/2012, and some day-to-day VWAP changes stuff going back to 10/09 are available in AXPW: Intra-Day Trade & Buy:Sell Inflection Point Charting Beginning 10/1/2013.

"Dly Sht % of 'sells'", inflection point calculation values, and end-of-week 80% (was 85%) PIPE price factors are now only in the latest daily comment.

The PIPE agreement was amended, changing the 85% calculation to 80%, among other minor things. See AXION POWER INTERNATIONAL, INC., FORM 8-K, Filed 01/03/14 for the Period Ending 01/02/14.

02/28/2014: EOD stuff partially copied to the concentrator.

# Trds: 64, MinTrSz: 400, MaxTrSz: 40900, Vol: 687500, AvTrSz: 10742

Min. Pr: 0.0952, Max Pr: 0.1039, VW Avg. Tr. Pr: 0.0974

# Buys, Shares: 31 292030, VW Avg Buy Pr: 0.0984

# Sells, Shares: 33 395470, VW Avg Sell Pr: 0.0967

# Unkn, Shares: 0 0, VW Avg Unk. Pr: 0.0000

Buy:Sell 1:1.35 (42.48% "buys"), DlyShts 239630 (34.86%), Dly Sht % of 'sells' 60.59%

In aggregate, my optimism that we won't see $0.08xx again, at least near-term, got a BIG BOOST today, mostly due to my thoughts on the well-executed market movement over this week, which are discussed much later. What happens while or after the PIPErs take their profits is not something I will guess at yet.

Parsoon's out or not, ARCA being much more well-behaved as VWAP rises on falling volume, share issue price next week of $0.0766, if I'm correct, ... The PIPErs are set to reap 21% to 27% profit next week. They have skillfully set the market for this IMO. Thinking on that in my blog.

The average of the lowest 20 VWAPs times 80% today is 02/27: 20 lowest intra-day VWAPs in 40 days avg, $0.0766 vs. $0.0767, $0.0768, $0.0768, $0.0769, $0.0772, $0.0775, $0.0777, $0.0778 and $0.0779 on prior days. 80% of today's VWAP is $0.0779 vs. $0.0773, $0.0770, $0.0749, $0.0742, $0.0752, $0.0763, $0.0785, $0.0799 and $0.0816 on prior days. These are potential prices for the next tranche of shares to the PIPErs.

Today's low, high, VWAP, trade volume, and daily short sales moved 0.21%, 3.90%, 0.82%, -15.86% and -15.07% respectively. Price spread today was 9.14% vs. 5.26%, 7.86%, 15.44%, 6.59%, 9.23%, 8.42%, 3.59%, 6.40% and 9.52% on prior days.

Without the one $0.1039 trade discussed below, using $0.10 as the high, we would've had the days high movement and price spread of 0.00% and 5.04% instead of the 3.90% and 9.14% we got. I'll be using $0.10 as the high in my comments below.

On the traditional TA front, we had (again, ignoring the $0.1039 trade) a reasonable spread, a higher low (+$0.0002 - I'm wowed!) and close, a flat high, and volume in a range that I think is reasonable.

In contrast to yesterday when most of the oscillators I watch were not able to maintain the prior small positive moves, most improved and the others stayed essentially flat. Full stochastic continued to rise after leaving oversold three days ago and is near getting above neutral. Williams %R recovered and exited oversold again. RSI recovered from ~43.6 to ~46.9 in its quest to get above neutral, 50, and momentum moved from ~0.835 to ~0.91 in it's struggle to get above neutral of 1. Ditto for MFI and ADX related stuff - both had small improvements.

There's little change in the behavior of the MACD - it remains essentially flat and it's histogram is still climbing back up towards neutral.

Price (range) remained "stable" for the fourth day. A non-traditional factor, intra-day VWAP, has moved, Friday to Friday, +3.65% on the week with the high +7.11%, thanks to the $0.1039 trade, and the low is up +4.62%. If I use the high without the $0.1039 trade, $0.10, our high for the week is +3.09%.

In the interest of "fair and balanced", be aware that I am ignoring the changes since, e.g., Monday 2/7. It's been quite ugly, as one could expect.

Unfortunately we closed lower, at $0.0975, than our open of $0.099. This still gives a green candle on the charts because of the close Thursday at $0.0952. But the volume on a down day, Thursday (lower than Wednesday's $0.097 close) was higher volume than today's - ~817K vs. today's~688Kn - suggests weakness.

The newer short-term descending resistance I've been mentioning got it's first test yesterday and passed, indeed acting as resistance as price pushed above it briefly and then fell back to close well below it. Today we got a close above it with only an intra-day low penetrating it. That resistance is ~$0.096 today. In traditional TA terms, we now need a "confirmation" of a second close above it. With the stuff I discuss below regarding the $0.1039 action, I fully expect we'll get the confirmation.

Larger trades (>= 15K) occurred on 11 of 64 trades, 17.19%. These totaled 332,270 shares, 48.33% of days volume, and traded at a VWAP of $0.0977. 4 of these trades, 36.36%, were buys of 125,000 shares, 37.62% of the larger trades volume, and traded at a VWAP of $0.0995. 7 of the larger trades, 63.64%, were sells of 207,270 shares, 62.38% of the larger trades volume, and traded at a VWAP of $0.0966.

The rest of the trades, 365,230 shares representing 53.12% of day's volume, went at a VWAP of $0.0971.

ARCA was again on the bid pre-market at $0.095 and out early, by 09:32. Each day I see this very early exit I wonder if they aren't just putting in a "floor". Today when bid got to $0.097 they exited. Thursday, 2/27, pre-market at 08:40 they had a bid of $0.095 and exited the $0.095 bid, exposing a $0.0901 lined up lower, when CSTI entered a $0.095 bid 10 minutes later. At 09:50 when bid hit $0.097 ARCA was off the buy side entirely. The prior day they bid $0.0901 pre-market and were gone, again, by 09:32. Ditto for 2/24. They could be honest-to-goodness bottom-feeding bids I guess. But why exit from the $0.095 position when early action would suggest, especially if traditional "late-day weakness" might come into play, that there is a decent chance of filling the buy? This weakness is common enough that any serious bottom-feeder ought to hang in there I would think.

On the sell side ARCA was not as aggressive as seen in the past. I don't know if it was due to fewer and less aggressive challenges or a strategy/needs change. Only ATDF and BTIG challenged them today, and later in the day BTIG stopped doing so.

ARCA entered the sell side at 11:23 with a $0.098 offer, undercutting the best $0.0998 at the time, and stayed fixed right there until exit between 14:03 and 14:28. Strangely, ADVFN "trades" shows apparently canceled orders occurred between 14:20 and 14:27, to the tune of 20K shares. I don't know if there's any relation, but I've seen canceled orders evidenced before. Unfortunately I wasn't looking to see if there was correlation with ARCA in any way so I'll leave my TFH alone here.

Anyway, ARCA returned 10 minutes later at 14:38 with a $0.097 offer and had moved back to $0.098 by 14:40, followed by a $0.0975 in the same minute to counter a transgression attempt by an ATDF offer of $0.0979 (big surprise on a 1/100th penny move, huh?). By 14:52 all was right with the PIPEr world again as ATDF had slunk off to a $0.0999 offer and ARCA reclaimed the throne with a $0.098 offer again.

Thanks to late-day strength (see the breakdown by time starting with the 14:40 period), ARCA was offering at $0.099 by 15:21. They exited around 15:34.

On the buy side, early action was weakening with the bids dropping from as high as $0.097 at 09:32 to as low as $0.0951 at 10:44 as there was little competition to get shares. From that point onward, over time, competition increased as CSTI, then CDEL, then NITE, then ETRF all began showing interest and moved the bid as high as $0.097 at 14:27 and to $0.0975 at 15:19. During this interval we did see some ebb and flow with bids getting low again - down as low as $0.096 at 14:40 (around the canceled order time). But it started improving almost immediately.

In the non-traditional TA area, today's buy percentage, 42.5%, was again weaker than the prior 43.8% and 58.9%, and was accompanied by reducing volume. With VWAP increasing ($0.0927, $0.0936, $0.0962, $0.0966 and $0.0974) while volume trends lower (in thousands: 3,002.14, 632.77, 535.65, 817.14 and 687.50) we can deduce that the market moving higher is encouraging opportunistic (or defensive?) selling much more strongly than buying pressure.

The reduced aggressive nature of ARCA has become a short-term normal for now. The prior days, which I characterized as a "tactical withdrawal" in preparation for the next assault, is still a fair assessment I think. The continued moderately aggressive behavior, such as seen again today, still seems to support the "tactical withdrawal" thought. Some of this may be due to the lessened competition from the other more active market makers. There's no way to know, but we do have observable phenomena that we can try to judge as time passes. I think next week, combined with the VWAP changes and $0.1039 extraordinary trades of this week may yield an assessment that we can make with some confidence.

Daily short percentage remains in a range I consider appropriate for the volume and buy percentage we see. I still can't judge the possibility that a change in daily short sales percentage behavior may be underway. I expect early clues to surface next week.

My original inflection point calculations' one-day changes are essentially flat today, except the 5-day which weakened a small amount. Aggregate change over five days reversed from showing all periods improving for the second day in a row to all periods weaker. Rates of change over those days moved from all improving to all weakening today. Volatility remains as no solid trend has been seen for quite some time.

The newer version, which had only one period in the one-day changes showing improvement, now has only the five-day period showing weakening while the others are essentially flat with very small degrees of improvement. The aggregate change over five days has moved from 5 weaker periods to all weaker periods. The rate of change over those five days, which have four periods showing improvement, has flopped back again to a three and tree split of weaker and improved. As with the original, volatility prevents appearance of a strong trend.

The following details my thoughts on factors that lead me to believe the PIPErs have moved the market to their benefit and to the detriment of those who thought this week might represent a turning point.

I could be wrong.

We again had an outlier single $0.1039 trade of 2,900 shares at 14:30:45 that moved the day's high well above (+3.90%) the next higher trades of the day with some volume, $0.10. What's really interesting is that ADVFN shows the bid/ask when the trade was made of $0.097/$0.10. This fits with my "snapshots" at 14:28, 14:30 and 14:35 of $0.0998, $0.10 and $0.0999. The only $0.1039 I saw during the day was a normal TEJS-provided one that gets placed in the morning and sits there all day. When it got taken it unmasked a $0.105 offer from TEJS.

Without the one $0.1039 trade, using $0.10 as the high, we would've had the days high movement and price spread of 0.00% and 5.04% instead of the 3.90% and 9.14% we got. This one trade certainly offered a rosier scenario to those who might rely solely on the charts for their entry and exit decisions. But it wasn't the first or only factor that might lead one astray.

When we had similar $0.1039 outlier trade of exactly one trade of 1K shares for $0.1039 on 2/24 (Monday), it was the first trade of the day and became the best offer at 09:28 as better offers from 08:00 through then of $0.096 from BTIG were removed. At 09:32, after the trade, offers from ATDF and others had been entered for $0.0958 and $0.096 and BTIG had moved its offer back to $0.1039 with TEJS.

I wonder why those better offers were removed. I can tell you from long observation that this is not normal behavior in this equity. NITE has done such occasionally, but normally the early bids and asks stay in place and new ones drip in as opening nears and then a bunch are entered at the open. I've seen this odd behavior before but was not then experienced enough to be suspicious of them or to try and put 2 + 2 together.

Regardless, for the rest of 2/24 day, the best offer I captured (and I captured a lot that particular day) was $0.096. I noted that day the next highest price seen was $0.0960 and if we used $0.0960 as the high, high movement was -1.03% instead of +7.11% and spread was 6.67% instead of 15.44%.

Note what has happened to VWAP and trade volume since Friday, 2/21. Keep in mind that price is most easily moved on low volume and 2/24 volume wasn't that, possibly accounting for the inability to "get it up", if someone was trying:

02/21 $0.0940 3243.91

02/24 $0.0927 3002.14

02/25 $0.0936 0632.77

02/26 $0.0962 0535.65

02/27 $0.0966 0817.14

02/28 $0.0974 0687.50

The stage is now set for next week's new shares to enter the market, likely at a price of $0.0766 to the PIPErs, which, if sold at the LOWEST VWAP from this week, can yield them a NICE FAT 21.02% PROFIT. If they can sell at Friday, 2/28's, VWAP, "FAT" goes to "OBESE" at 27.15%.

Congratulations to the PIPErs for another well-orchestrated and executed plan.

The question enters my mind: when do they start selling? Right away? Hold off a few days and see if they can push the market higher? I don't know. Looking at the charts around the start of each month might yield a clue. Most recently, February shares saw a good price rise for a week before the descent into the mud began. January shares just stayed sort of flat, but this was the first month of reduced payments at increased discounts. So I can't pick any period as a representative pattern.

Here's a trading breakdown by arbitrary time-frames.

09:30-09:30: 001500 shrs, 00.22% of vol, VWAP $0.0995, 100.0% buys

09:33-10:21: 091370 shrs, 13.10% of vol, VWAP $0.0978, 000.0% buys

10:40-12:09: 102130 shrs, 14.64% of vol, VWAP $0.0954, 055.9% buys

12:23-14:01: 053600 shrs, 07.68% of vol, VWAP $0.0976, 090.7% buys

14:01-14:20: 070000 shrs, 10.04% of vol, VWAP $0.0960, 000.0% buys

14:27-14:38: 210700 shrs, 30.21% of vol, VWAP $0.0989, 071.1% buys

14:40-15:17: 130700 shrs, 18.74% of vol, VWAP $0.0965, 003.8% buys

15:20-15:58: 037500 shrs, 05.38% of vol, VWAP $0.0985, 080.0% buys

Here's a breakdown by arbitrary price range.

$0.0952-$0.0955: 139130 shrs, 19.95% of vol, VWAP $0.0954, 038.9% buys

$0.0960-$0.0968: 160700 shrs, 23.04% of vol, VWAP $0.0965, 000.0% buys

$0.0970-$0.0979: 206370 shrs, 29.59% of vol, VWAP $0.0973, 034.7% buys

$0.0980-$0.0989: 025000 shrs, 03.58% of vol, VWAP $0.0984, 100.0% buys

$0.0990-$0.0999: 115600 shrs, 16.57% of vol, VWAP $0.0998, 078.4% buys

$0.1000-$0.1039: 050700 shrs, 07.27% of vol, VWAP $0.1002, 100.0% buys

Some day-to-day VWAP changes, with the end date shown and the percentage change from the prior day. Buy percentage is the last value on each line.

02/07 $0.1153 +02.56% 36.8%

02/10 $0.1128 -02.17% 26.6%

02/11 $0.1101 -02.35% 24.2%

02/12 $0.1046 -05.05% 46.6%

02/13 $0.1057 +01.12% 45.1%

02/14 $0.1020 -03.55% 17.7%

02/18 $0.0999 -02.08% 34.0%

02/19 $0.0981 -01.75% 43.6%

02/20 $0.0954 -02.76% 19.7%

02/21 $0.0940 -01.50% 50.1%

02/24 $0.0927 -01.30% 29.9%

02/25 $0.0936 +00.93% 47.9%

02/26 $0.0962 +02.80% 58.9%

02/27 $0.0966 +00.39% 43.8%

02/28 $0.0974 +00.82% 42.5%

Using the new 80% calculation 1/3 onward. This week's daily estimated values (older dailys in prior EOD posts in prior blog) for next share issue:

02/24: 20 lowest intra-day VWAPs in 40 days avg, $0.0962, x 80%: $0.0769

02/25: 20 lowest intra-day VWAPs in 40 days avg, $0.0960, x 80%: $0.0768

02/26: 20 lowest intra-day VWAPs in 40 days avg, $0.0960, x 80%: $0.0768

02/27: 20 lowest intra-day VWAPs in 40 days avg, $0.0958, x 80%: $0.0767

02/28: 20 lowest intra-day VWAPs in 40 days avg, $0.0957, x 80%: $0.0766

Vol in K, for above days: 3,002.14 632.77 535.65 817.14 687.50.

Week ending summaries of PIPE financing estimated 85% share pricing, "Dly Sht % of 'sells'", and inflection points here are omitted from the concentrator.

Week ending values related to the PIPE 85% (80% 1/3/14 forward) share pricing:

01/03: 20 lowest intra-day VWAPs in 40 days avg, $0.1066, x 80%: $0.0852 VWAP $0.0998

01/10: 20 lowest intra-day VWAPs in 40 days avg, $0.1039, x 80%: $0.0831 VWAP $0.1052

01/17: 20 lowest intra-day VWAPs in 40 days avg, $0.1011, x 80%: $0.0808 VWAP $0.1004

01/24: 20 lowest intra-day VWAPs in 40 days avg, $0.0996, x 80%: $0.0797 VWAP $0.0947

01/31: 20 lowest intra-day VWAPs in 40 days avg, $0.0973, x 80%: $0.0779 VWAP $0.0997

02/07: 20 lowest intra-day VWAPs in 40 days avg, $0.0973, x 80%: $0.0779 VWAP $0.1153

02/14: 20 lowest intra-day VWAPs in 40 days avg, $0.0973, x 80%: $0.0779 VWAP $0.1020

02/21: 20 lowest intra-day VWAPs in 40 days avg, $0.0966, x 80%: $0.0772 VWAP $0.0940

Vol, in thousands, for above weeks: 3,229 (4 days), 4,450, 3,657, 4,493 (4 day wk), 7,397, 8,900, 6,742, 7,753 (4 day wk).

On my ORIGINAL inflection point calculations, readings for 5, 10, 25, 50, 100 and 200 day periods:

---- 1-day change ----

02/19 +25.7% +04.6% +03.1% -00.3% -00.3% -00.6%

02/20 -53.6% -21.5% -09.1% -05.2% -02.2% -02.0%

02/21 +08.5% +01.8% +07.6% +00.6% +01.1% +00.1%

02/24 +00.4% -14.9% -11.0% -05.5% -02.6% -02.6%

02/25 +09.5% +06.5% -00.8% +01.2% +02.6% -00.1%

02/26 +13.1% +19.6% +00.3% +02.3% +01.5% +00.3%

02/27 +43.7% -02.6% +01.9% -00.1% +00.9% +00.1%

02/28 -15.2% +01.8% +08.2% +01.1% +00.7% +00.0%

---- 5-day change ----

02/19 +106.8% +016.6% +059.4% +120.0% +073.4% +027.0%

02/20 -1670.8% -086.4% -134.8% -1548.4% -664.1% -092.2%

02/21 +036.5% -023.6% +035.4% +003.2% +023.3% +011.1%

02/24 +098.6% +029.3% -010.4% -073.0% -006.6% -010.3%

02/25 +1607.8% +052.9% +041.5% +009.0% +054.1% +004.0%

02/26 -224.3% +087.0% -029.6% +029.5% +143.9% +016.9%

02/27 +1017.3% +618.2% +090.4% +077.7% +538.1% +048.0%

02/28 -024.1% -001.8% +075.2% +039.6% -009.6% -007.4%

---- 5-day rate of change ----

02/19 +289.3% -010.0% +110.4% +140.3% +2009.6% +151.4%

02/20 -104.6% -053.4% -774.0% -137.0% -154.6% -423.9%

02/21 +2217.6% -008.5% +078.0% +055.6% +040.1% +036.2%

02/24 +048.3% +058.6% +219.2% -411.1% +191.4% +025.3%

02/25 -036.4% +135.9% +260.7% -025.3% -045.7% +006.5%

02/26 -121.6% +108.0% -118.3% +002.9% +152.0% -014.6%

02/27 +1197.0% +164.5% +923.3% +166.5% +594.0% +327.7%

02/28 -028.9% +017.9% -033.7% +007.1% -016.3% -023.4%

On my NEWER inflection point calculations, for those same periods:

---- 1-day change ----

02/19 +026.05% +007.02% +004.25% +001.63% +001.58% +001.48%

02/20 -046.43% -017.01% -008.94% -005.35% -002.81% -002.81%

02/21 +006.23% -000.30% +005.64% +000.54% +001.43% +000.77%

02/24 +005.51% -006.28% -005.33% -001.32% +001.17% +001.36%

02/25 +017.90% +014.18% +008.69% +009.43% +010.52% +008.79%

02/26 +027.24% +031.98% +015.00% +015.29% +014.28% +014.35%

02/27 +050.06% +000.90% +005.42% +003.01% +003.85% +003.62%

02/28 -021.74% +003.56% +010.32% +003.31% +002.77% +002.17%

---- 5-day change ----

02/19 +104.18% +042.57% +057.07% +063.12% +058.47% +054.44%

02/20 -2158.18% -009.85% +016.37% +093.08% +114.49% +101.25%

02/21 +025.98% -056.46% -015.91% -1409.26% -538.96% -5494.71%

02/24 +137.83% +052.52% +054.84% +066.12% +159.78% +121.80%

02/25 +142.67% +100.39% +162.84% +275.02% +229.89% +425.50%

02/26 -018.62% +25397.52% +196.53% +242.71% +093.97% +120.46%

02/27 +378.81% +064.95% +084.57% +042.06% +024.89% +026.45%

02/28 -016.00% +006.44% +006.88% +007.74% +001.99% +003.15%

---- 5-day rate of change ----

02/19 +2231.13% +114.36% +263.20% +1446.58% +4271.01% +169818.42%

02/20 -021.24% +425.17% +067.24% +074.48% +095.09% +096.64%

02/21 +007.63% -204.00% -053.74% -057.86% -058.34% -058.78%

02/24 +032.92% +228.60% +091.08% +037.83% +058.96% +053.10%

02/25 -033.37% +069.05% +002.61% -021.97% -017.91% -018.79%

02/26 -078.15% +005.21% -029.71% -005.45% -006.03% -008.69%

02/27 +623.21% +034.59% +028.97% -001.20% -015.71% -020.72%

02/28 -018.72% +028.83% +010.09% +039.08% +029.04% +035.21%

Rolling 5-day ORIGINAL inflection point calculation aggregate change:

******* ******* *5 Day** *10 Day * * 25Day ** 50 Day **100Day* 200 Day

02/19 5 Day +0072.61 -1191.09 -0840.41 +0071.31 -0167.21 -1528.64

02/20 5 Day -1140.54 -2219.93 -1973.36 -1032.83 -1277.67 -2937.87

02/21 5 Day -0724.65 -2744.09 -1273.98 -0999.92 -0979.49 -2610.71

02/24 5 Day -0010.22 -1941.12 -1406.80 -1729.99 -1044.15 -2879.59

02/25 5 Day +0154.05 -0913.37 -0823.47 -1573.49 -0478.77 -2763.02

02/26 5 Day -0191.47 -0118.87 -1067.62 -1109.34 +0210.13 -2295.04

02/27 5 Day +1756.48 +0615.94 -0102.86 -0247.34 +1340.95 -1192.57

02/28 5 Day +1348.92 +0624.27 -0020.53 -0137.26 +1229.93 -1259.22

Average change/day, 5 days

____ **5 Day *10 Day *25 Day *50 Day 100 Day 200 Day

02/19 +267.26 -417.20 +039.03 +231.28 +184.33 +092.74

02/20 -012.23 -639.90 -263.11 -085.59 -100.71 -300.35

02/21 +258.96 -694.27 -057.90 -038.00 -060.38 -191.50

02/24 +384.14 -287.29 +069.02 -194.20 +055.17 -143.13

02/25 +244.29 +103.11 +248.93 -243.27 +029.94 -133.76

02/26 -052.82 +214.45 -045.44 -236.13 +075.47 -153.28

02/27 +579.40 +567.17 +374.10 +157.10 +523.72 +349.06

02/28 +414.71 +673.67 +250.69 +172.53 +441.88 +270.30

Rolling 5-day NEWER inflection point calculation aggregate change:

******* ******* *5 Day** *10 Day * * 25Day ** 50 Day **100Day* 200 Day

02/19 5 Day +0006.60 -0167.14 -0206.81 -0182.06 -0488.05 -1004.67

02/20 5 Day -0096.98 -0185.69 -0174.53 -0012.74 +0070.98 +0012.61

02/21 5 Day -0071.78 -0290.53 -0202.30 -0192.23 -0311.58 -0680.45

02/24 5 Day +0027.15 -0137.95 -0091.35 -0065.12 +0186.25 +0148.37

02/25 5 Day +0065.90 +0000.54 +0057.41 +0113.97 +0614.42 +0779.68

02/26 5 Day +0053.62 +0137.72 +0170.23 +0390.59 +1191.82 +1718.90

02/27 5 Day +0256.76 +0227.18 +0314.19 +0554.88 +1488.50 +2173.48

02/28 5 Day +0217.30 +0243.86 +0337.87 +0599.90 +1520.13 +2243.84

Average change/day, 5 days

____ **5 Day *10 Day *25 Day *50 Day 100 Day 200 Day

02/19 +0060.01 +0005.29 +0071.47 +0154.07 +0337.92 +0592.76

02/20 +0046.97 +0025.79 +0118.88 +0268.16 +0658.52 +1164.85

02/21 +0050.55 -0026.82 +0054.99 +0113.01 +0274.31 +0480.15

02/24 +0067.19 +0034.49 +0105.08 +0155.76 +0436.04 +0735.12

02/25 +0044.77 +0058.31 +0107.82 +0121.54 +0357.93 +0596.98

02/26 +0009.78 +0061.35 +0075.79 +0114.91 +0336.35 +0545.09

02/27 +0070.75 +0082.57 +0097.74 +0113.52 +0283.50 +0432.17

02/28 +0057.82 +0106.88 +0108.03 +0158.43 +0366.34 +0584.86

Dly Sht % of 'sells' values JIC it turns out to be useful...

============ 2013 ===============

Mon. 12/16: 31.39% 17.00% 35.06% 20.94% 2.10%

Mon. 12/23: 32.34% 24.95% 63.82% 32.86%

Mon. 12/30: 10.02% 6.65%

============ 2014 ===============

Thu. 01/02 12.17% 57.97% 130.29%

Mon. 01/06 130.29% 46.07% 45.62% 24.25% 69.90%

Mon. 01/13 15.61% 17.93% 32.12% 57.12% 108.76%

Tue. 01/21 110.53% 58.75% 49.16% 54.83%

Mon. 01/27 70.16% 9.32% 52.17% 23.63% 101.56%

Mon. 02/03 111.49% 65.83% 50.74% 39.44% 45.93%

Mon. 02/10 26.53% 34.19% 60.92% 50.15% 27.28%

Tue. 02/18 44.83% 53.95% 25.30% 46.39%

Mon. 02/24 23.26% 77.84% 112.52% 61.42% 60.59%

============ 2013 ===============

Oct Avg: 35.95%, min: 05.98%, max: 082.02%

Nov Avg: 28.42%, min: 05.99%, max: 050.60%

Dec Avg: 29.22%, min: 02.10%, max: 063.82%

============ 2014 ===============

Jan Avg: 54.66%, min: 09.32%, max: 130.29%

Feb Avg: 50.44%, min: 00.28%, max: 112.52%

0228 Vol 0687500, Sht 0239630 34.86% LHC 0.0952 0.1039 0.0975 b:s 1:1.35

0227 Vol 0817087, Sht 0282150 34.53% LHC 0.0950 0.1000 0.0952 b:s 1:1.28[127]

0226 Vol 0535651, Sht 0247426 46.19% LHC 0.0950 0.0970 0.0970 b:s 1.44:1

0225 Vol 0632768, Sht 0256707 40.57% LHC 0.0903 0.0974 0.0970 b:s 1:1.09[126]

0224 Vol 3002135, Sht 0489500 16.31% LHC 0.0900 0.1039 0.0910 b:s 1:2.34

0221 Vol 3243908, Sht 0719700 22.19% LHC 0.0910 0.0970 0.0915 b:s 1.05:1[125]

0220 Vol 1739714, Sht 0350800 20.16% LHC 0.0910 0.0994 0.0926 b:s 1:4.04[124]

0219 Vol 1885454, Sht 0563000 29.86% LHC 0.0950 0.1030 0.0964 b:s 1:1.27

0218 Vol 0872226, Sht 0260308 29.84% LHC 0.0975 0.1010 0.1000 b:s 1:1.95[123]

0214 Vol 2006349, Sht 0429309 21.40% LHC 0.1000 0.1064 0.1000 b:s 1:4.42[122]

0213 Vol 1880123, Sht 0513540 27.31% LHC 0.1040 0.1139 0.1042 b:s 1:1.21

0212 Vol 0252101, Sht 0082000 32.53% LHC 0.1031 0.1067 0.1045 b:s 1:1.15

0211 Vol 1805486, Sht 0452259 25.05% LHC 0.1021 0.1185 0.1060 b:s 1:3.02

0210 Vol 0798299, Sht 0155395 19.47% LHC 0.1025 0.1200 0.1140 b:s 1:2.76

0207 Vol 1974244, Sht 0570127 28.88% LHC 0.1101 0.1210 0.1113 b:s 1:1.71

0206 Vol 0665900, Sht 0132100 19.84% LHC 0.1085 0.1200 0.1131 b:s 1:1.04[121]

0205 Vol 0967658, Sht 0301064 31.11% LHC 0.1102 0.1220 0.1179 b:s 1:1.52[120]

0204 Vol 2174203, Sht 0848197 39.01% LHC 0.1026 0.1199 0.1199 b:s 1:1.46

0203 Vol 2989364, Sht 1411565 47.22% LHC 0.1001 0.1190 0.1020 b:s 1.32:1[119]

0131 Vol 2600482, Sht 1012719 43.88% LHC 0.0920 0.1130 0.0999 b:s 1.25:1[118]

0130 Vol 1104532, Sht 0210945 19.10% LHC 0.0909 0.0988 0.0915 b:s 1:8.38[117]

0129 Vol 0521125, Sht 0189844 36.43% LHC 0.0907 0.1000 0.0910 b:s 1:2.31 [116]

0128 Vol 1283588, Sht 0098700 07.69% LHC 0.0906 0.0919 0.0907 b:s 1:4.72

0127 Vol 1886785, Sht 0875619 46.41% LHC 0.0907 0.0970 0.0908 b:s 1:1.79[115]

0124 Vol 0486814, Sht 0201491 41.39% LHC 0.0905 0.0970 0.0950 b:s 1:3.15

0123 Vol 2069515, Sht 0709580 34.29% LHC 0.0900 0.1017 0.0940 b:s 1:2.53[114]

0122 Vol 0753817, Sht 0313100 41.54% LHC 0.0993 0.1040 0.0993 b:s 1:2.33[113]

0121 Vol 1162333, Sht 0587663 50.57% LHC 0.0960 0.1390 0.0985 b:s 1.13:1[112]

0117 Vol 0194787, Sht 0079500 40.81% LHC 0.0961 0.1098 0.0980 b:s 1.66:1

0116 Vol 0890792, Sht 0324000 36.37% LHC 0.0800 0.1050 0.0950 b:s 1:1.83

0115 Vol 0895136, Sht 0245533 27.43% LHC 0.0955 0.1010 0.0960 b:s 1:5.84[111]

0114 Vol 0743671, Sht 0091633 12.32% LHC 0.0960 0.1040 0.1000 b:s 1:2.08

0113 Vol 0904633, Sht 0104590 11.56% LHC 0.1005 0.1070 0.1005 b:s 1:3.79

0110 Vol 1967208, Sht 0532152 27.05% LHC 0.1006 0.1118 0.1026 b:s 1.49:1[110]

0109 Vol 0784373, Sht 0162000 20.65% LHC 0.1000 0.1055 0.1055 b:s 1:2.51[109]

0108 Vol 0535199, Sht 0164199 30.68% LHC 0.1000 0.1019 0.1010 b:s 1:2.05

0107 Vol 0849599, Sht 0279266 32.87% LHC 0.1000 0.1058 0.1000 b:s 1:2.60

0106 Vol 0163250, Sht 0056675 34.72% LHC 0.0990 0.1070 0.1040 b:s 2.64:1

0103 Vol 0331282, Sht 0104908 31.67% LHC 0.0953 0.1005 0.1003 b:s 1:1.20

0102 Vol 1429453, Sht 0115332 08.07% LHC 0.0960 0.1070 0.0960 b:s 1:1.97

[108] There was a pre-market trade of 10K that FINRA-reported daily short sales don't include. Adding that to the FINRA trade volume raises it from 993,469 to 1,003,469 and would lower the short percentage from 4.51% to 4.47%. If the shares are also added to the short sales, the short volume moves from 44,840 to 54,840 and the short percentage would be 5.66%.

[109] FINRA data was adjusted +23 on trade volume to account for a trade of that size that FINRA omits for some reason (bug somewhere). There was two after-hours trades of 145K and 5K that FINRA-reported daily short sales don't include. Adding that to the FINRA trade volume raises it from 784,373 to 934,373 and would lower the short percentage from 20.65% to 17.34%. If the shares are also added to the short sales, the short volume moves from 162,000 to 312,000 and the short percentage would be 34.69%.

[110] FINRA data was adjusted +08 on trade volume, from their 1,967,200 to the correct 1,967,208, to compensate for their inability to correctly report trade volume even after multiple reports, with snapshots, references and their attempts to provide a "work-around", which didn't.

[111] Initial FINRA data had no entry for AXPW, indicating 0 short sales. We didn't know if that was correct or they were just missing a big piece of the file. It turned out the whole entry was omitted and there are 245,533 shorts. Their daily trade volume was short 4 shares, as I originally posted would be the case, 2 trades of 2 shares each at $0.0960. The volume was adjusted appropriately.

[112] Initial FINRA data was missing 20K of trade volume for AXPW. This is large enough that it likely includes some short sales. If corrections come though, I'll update everything as needed. UPDATED! Next morning "work-around" did and 10K more of short sales appeared.

[113] Initial FINRA data was missing 20,087 of trade volume for AXPW. This is large enough that it likely includes some short sales. Corrections came through, but still missing 87 shares. Before corrections FINRA-reported trade volume was 753,817, short volume was 313100, yielding 40.46%. Corrected data, excluding the 87 shares, has trade volume of 773,817, short volume of 318,100, yielding 41.11%. With the 87 shares the percentage is 41.10%.

[114] Initial FINRA data was missing 82,141 shares of trade volume for AXPW. This is large enough that it likely included some short sales. Corrections came through, but still missing 141 shares. Before corrections FINRA-reported trade volume was 1,987,515, short volume was 709,580, yielding 35.70%. Corrected data, excluding the 141 shares, has trade volume of 2,069,515, short volume remained 709,580, yielding 34.29%. With the 141 shares the percentage is 34.28%.

[115] Initial FINRA data was missing 17,877 shares of trade volume for AXPW. This is small enough that it likely doesn't a substantial quantity of short sales. When corrections came through. Before corrections FINRA-reported trade volume was 1,868,908, short volume was 875,619, yielding 46.85%. Corrected data included no additional short sales, the daily short sales percentage moved to 46.41%.

[116] Initial FINRA data was missing 50 shares of trade volume for AXPW. This is small enough that it likely doesn't have any short sales. I corrected the data. Before corrections FINRA-reported trade volume was 521,075, short volume was 189,844, yielding 36.43%. With the additional 50 shares the daily short sales percentage was unchanged.

[117] FINRA data is missing 20 shares of trade volume for AXPW. The quantity is a single odd-lot trade and has no effect on eithr short sales volume or percentage. I adjusted the volume.

[118] FINRA data is missing 238,888 shares of trade volume for AXPW. The quantity is large enough that we should expect more short sales to appear Monday morning. I'll adjust everything when they appear. Using the initially reported FINRA volume of 2,361,594 and short volume of 1,012,719 the short percentage was 42.88%. I'm guesstimating around 55K more daily shorts. When correct volume appeared, shorts increase by more than double my estimate, which I based on shorts/buys, by 128,388. So a lot of sells were apparently short sales as well. New short volume is 1,141,107 and percentage is 43.88%.

[119] There was a pre-market trade of 5K that FINRA-reported daily short sales don't include. Adding that to the FINRA trade volume raises it from 2,989,364 to 2,994,364 and would lower the short percentage from 47.22% to 47.14%. If the shares are also added to the short sales, the short volume moves from 1,411,565 to 1,415,565 and the short percentage would be 47.31%.

[120] There was a pre-market trade of 15K that FINRA-reported daily short sales don't include. Adding that to the FINRA trade volume raises it from 967,658 to 982658 and would lower the short percentage from 31.11% to 30.64%. If the shares are also added to the short sales, the short volume moves from 301,064 to 316,064 and the short percentage would be 33.35%.

[121] There were 5 AH trades of totaling 109K that FINRA-reported daily short sales don't include. Adding that to the FINRA trade volume raises it from 665,900 to 774,900 and would lower the short percentage from 19.84% to 17.05%. If the shares are also added to the short sales, the short volume moves from 132,100 to 241,100 and the short percentage would be 32.59%. These were marked "seq", meaning they were traded during normal market hours but were not reported in a timely manner. With our buy percentage above 40% today I suspect a goodly portion of this 109K were short sales.

[122] FINRA data was missing 50 shares of trade volume for AXPW due to small odd lot trades. The initially reported FINRA volume was 2,006,299 and short volume was 429,269. When correct volume of 2,006,349 appeared, shorts increased by 40 shares, to 429,309. The change was small enough that no effect, to two decimal places, was seen, leaving the short percentage at 21.40%.

[123] There was 1 AH trade of 7K that FINRA-reported daily short sales don't include. Adding that to the FINRA trade volume raises it from 872,226 to 879,226 and would lower the short percentage from 29.84% to 29.61%. If the shares are also added to the short sales, the short volume moves from 260,308 to 267,308 and the short percentage would be 30.40%.

[124] There was 1 AH trade of 7K that FINRA-reported daily short sales don't include. Adding that to the FINRA trade volume raises it from 1,739,714 to 1,744,714 and would lower the short percentage from 20.16% to 20.11%. If the shares are also added to the short sales, the short volume moves from 350,800 to 355,800 and the short percentage would be 20.39%.

[125] FINRA data was missing 100 shares of trade volume for AXPW due to small odd lot trades. The initially reported FINRA volume was 3,243,808 and short volume was 719,671. When correct volume of 3,243,908 appeared, shorts increased by 29 shares, to 719,700. The change was small enough that no effect, to two decimal places, was seen, leaving the short percentage at 22.19%.

[126] FINRA data was missing 22 shares of trade volume for AXPW due to small odd lot trades. The initially reported FINRA volume was 632,746 and short volume was 256,707. When corrected volume of 632,768 appeared, shorts did not increase.

[127] FINRA data was missing 50 shares of trade volume for AXPW due to one small odd lot trade. The initially reported FINRA volume was 817,087 and short volume was 282,150. When corrected volume of 817,137 appears, shorts may increase, in which case I'll correct what's needed.

02/27/2014: EOD stuff partially copied to the concentrator.

# Trds: 65, MinTrSz: 50, MaxTrSz: 60000, Vol: 817137, AvTrSz: 12571

Min. Pr: 0.0950, Max Pr: 0.1000, VW Avg. Tr. Pr: 0.0966

# Buys, Shares: 28 357793, VW Avg Buy Pr: 0.0979

# Sells, Shares: 37 459344, VW Avg Sell Pr: 0.0956

# Unkn, Shares: 0 0, VW Avg Unk. Pr: 0.0000

Buy:Sell 1:1.28 (43.79% "buys"), DlyShts 282150 (34.53%), Dly Sht % of 'sells' 61.42%

The average of the lowest 20 VWAPs times 80% today is 02/27: 20 lowest intra-day VWAPs in 40 days avg, $0.0958, x 80%: $0.0767 vs. $0.0768, $0.0768, $0.0769, $0.0772, $0.0775, $0.0777, $0.0778, $0.0779 and $0.0779 on prior days. 80% of today's VWAP is $0.0773 vs. $0.0770, $0.0749, $0.0742, $0.0752, $0.0763, $0.0785, $0.0799, $0.0816 and $0.0846 on prior days. These are potential prices for the next tranche of shares to the PIPErs.

Today's low, high, VWAP, trade volume, and daily short sales moved 0.00%, 3.09%, 0.39%, 52.55% and 14.03% respectively. Price spread today was 5.26% vs. 7.86%, 15.44%, 6.59%, 9.23%, 8.42%, 3.59%, 6.40%, 9.52% and 3.49% on prior days.

In aggregate, my optimism that we won't see $0.08xx again took a small hit, mostly due to reducing volume with a volume rise on a lower close day, a few traditional TA indications and my newer experimental inflection point calculations.

On the traditional TA front, we had a reasonable spread and increased volume in a range that I think is reasonable, likely due to the less aggressive nature of ARCA and others today. But price remained "stable" for the third day as well with a high down only 3/10ths of a penny and a flat low of $0.095. Unfortunately we could not replicate yesterday's close at the open and high for the day. We opened at $0.095 and closed at $0.095, the low for the day. With a rise in volume, this suggests weakness.

The oscillators I watch had most not able to maintain the small positive moves of yesterday. Williams %R, which exited oversold two days back, descended back into oversold - barely though. RSI weakened from the ~45.7 to ~43.6. Momentum, which had achieved 0.8715 fell back to ~0.835. MACD remains essentially flat and it's histogram has slowed the rate of climb back up towards neutral, begun several days ago.

The items that maintained their trend were a mixed bag: full stochastic continues to rise after leaving oversold two days ago, ADX and related still can't do much but remain flat, MFI continues to weaken.

The short-term descending resistance I've been mentioning got it's first test today and passed - price pushed above it briefly and then fell back to close well below it. That resistance should be ~$0.098 today. The high of $0.10 also fell just short of the 50-day SMA, $0.1009. Remember that resistance drops roughly 9/10ths of a penny per week. I had mentioned this is the first thing to watch if we try to move up. The long-term descending resistance lays in wait as well, around $0.102.

When combined with previously falling volume, which I had mentioned might suggest a bottom was near, this is concerning. Relating to the weakening volume I had said "And from that "strength" we get two consecutive green candles with higher opens and two essentially flat high closes near the day's highs", as I was letting my TFH-inspired thoughts run about how the chart was manipulated. Looks like TFH might have been spot-on with today's rise in volume on a lower close.

Larger trades (>= 15K) occurred on 19 of 65 trades, 29.23%. These totaled 538,650 shares, 65.92% of days volume, and traded at a VWAP of $0.0968. 11 of these trades, 57.89%, were buys of 257,150 shares, 47.74% of the larger trades volume, which traded at a VWAP of $0.0982. 8 of the larger trades, 42.11%, were sells of 281,500 shares, 52.26% of the larger trades volume, which traded at a VWAP of $0.0955.

The rest of the trades, 278,487 shares representing 34.08% of day's volume, went at a VWAP of $0.0962.

ARCA was on the bid, but only somewhat similarly to what we've seen - in pre-market and out early, but later than before. Today, again, they appear on the bid pre-market, at $0.0901. They didn't disappear immediately after market open today. They left right when a trade went off at the third trade of the day at 9:50 for 10K shares at $0.0975. I don't know if ARCA was involved with that trade or not, but I know they disappeared simultaneously with that trade. There were no trades near the $0.0901 bid they had in.

On the sell side ARCA was not as passive as recently seen, but not as aggressive as seen in the past. They entered at 11:39 with a $0.097 offer, undercutting the best $0.0974 at the time, and moved to $0.0965 when BTIG joined them. They then moved back to $0.097 with BTIG and then back to $0.0965. When ARCA exited at 12:02, NITE took the lead with a $0.099 offer, followed by ATDF offering at $0.0998 when NITE dropped off. After the NITE buy-side action described next completed, ARCA returned at 12:31 with a $0.098 offer and tussled with BTIG and ATDF, finally settling at a $0.0965 offer by ARCA at 13:07. They stayed in the rest of the day with offers going no lower than $0.096 and hanging mostly around $0.0963/4.

A nice 2.52% bid improvement was seen when the best bid of $0.0951 moved to $0.0975 when NITE entered the buy side around twenty minutes after ARCA entered the sell side and had dropped the offer by 4/100ths of a penny. This was also just two minutes before ARCA left. 82,050 shares went at that price in the next 10 minutes, 1 "buy" of 57K and three trades totaling 25,050 shares as "sells". NITE then disappeared sometime between 12:10 and 12:16. ARCA then returned on the sell side with a $0.098 offer at 12:31.

In the non-traditional TA area, today's buy percentage of 43.8% was weaker than yesterday's 58.9%, up from 47.9%, but still better than Monday's (2/24) 29.9%. I mentioned yesterday that if it came with volume it would be very heartening but without volume it was what we've seen many times before with the PIPErs - low volume produces price stability and high buy percentages. Today's lower percentage fits with what might be expected with several days' lower volume after several days of extremely high volume.

If the volume was an indication of the exhaustion of PIPErs, it was certainly possible we could be seeing moves up. But my suspicious nature led me to think ...

The passive nature of ARCA the prior two days was characterized by me as a "tactical withdrawal" in preparation for the next assault. Today's return of ARCA, with a moderately aggressive behavior seems to support the "tactical withdrawal" thought.

Three days back I groused that the buy percentage didn't produce as big a short percentage as I would've expected and then the last two days the buy percentage popped up and daily short sales percentage rose just like it should. With today's slightly lower buy percentage, we also have a slightly lower daily short sale percentage, 34.53 vs. 46.19% and 40.57%. So that relationship seems to be intact again.

There is still a possibility that a change in behavior may be underway.

My original inflection point calculations, with one-day changes quite volatile recently, had only two periods up today, vs. all periods up yesterday. Aggregate change over five days showing all periods improving for the second day in a row, with rates of change going from yesterday's split with three improved and three weakened moving to all improving today.

The newer version has only one period in the one-day changes showing improvement, a switch from showing all periods improved over one day, to a small degree. The aggregate change over five days, which had the 5 and 25-day weakening while the other periods had marginal improvement, now has 5 weaker periods. The rate of change over those five days has four periods showing improvement.

Here's a trading breakdown by arbitrary time-frames.

09:30-09:30: 002900 shrs, 00.35% of vol, VWAP $0.0950, 000.0% buys

09:50-10:17: 054000 shrs, 06.61% of vol, VWAP $0.0969, 018.5% buys

10:47-11:46: 133000 shrs, 16.28% of vol, VWAP $0.0971, 100.0% buys

11:46-12:00: 105500 shrs, 12.91% of vol, VWAP $0.0953, 009.5% buys

12:02-12:30: 197350 shrs, 24.15% of vol, VWAP $0.0987, 087.3% buys

12:38-13:54: 091894 shrs, 11.25% of vol, VWAP $0.0953, 000.0% buys

14:17-14:46: 037493 shrs, 04.59% of vol, VWAP $0.0964, 086.7% buys

14:58-15:43: 195000 shrs, 23.86% of vol, VWAP $0.0955, 000.0% buys

Here's a breakdown by arbitrary price range.

$0.0950-$0.0955: 345794 shrs, 42.32% of vol, VWAP $0.0953, 000.0% buys

$0.0960-$0.0965: 102493 shrs, 12.54% of vol, VWAP $0.0963, 051.2% buys

$0.0970-$0.0975: 253550 shrs, 31.03% of vol, VWAP $0.0972, 074.9% buys

$0.0980-$0.0998: 065150 shrs, 07.97% of vol, VWAP $0.0992, 100.0% buys

$0.1000-$0.1000: 050150 shrs, 06.14% of vol, VWAP $0.1000, 100.0% buys

Some day-to-day VWAP changes, with the end date shown and the percentage change from the prior day. Buy percentage is the last value on each line.

02/06 $0.1124 -03.33% 41.7%

02/07 $0.1153 +02.56% 36.8%

02/10 $0.1128 -02.17% 26.6%

02/11 $0.1101 -02.35% 24.2%

02/12 $0.1046 -05.05% 46.6%

02/13 $0.1057 +01.12% 45.1%

02/14 $0.1020 -03.55% 17.7%

02/18 $0.0999 -02.08% 34.0%

02/19 $0.0981 -01.75% 43.6%

02/20 $0.0954 -02.76% 19.7%

02/21 $0.0940 -01.50% 50.1%

02/24 $0.0927 -01.30% 29.9%

02/25 $0.0936 +00.93% 47.9%

02/26 $0.0962 +02.80% 58.9%

02/27 $0.0966 +00.39% 43.8%

Using the new 80% calculation 1/3 onward. This week's daily estimated values (older dailys in prior EOD posts in prior blog) for next share issue:

02/24: 20 lowest intra-day VWAPs in 40 days avg, $0.0962, x 80%: $0.0769

02/25: 20 lowest intra-day VWAPs in 40 days avg, $0.0960, x 80%: $0.0768

02/26: 20 lowest intra-day VWAPs in 40 days avg, $0.0960, x 80%: $0.0768

02/27: 20 lowest intra-day VWAPs in 40 days avg, $0.0958, x 80%: $0.0767

Vol in K, for above days: 3,002.14 632.77 535.65 817.14.

Week ending summaries of PIPE financing estimated 85% share pricing, "Dly Sht % of 'sells'", and inflection points here are in the latest daily post above.

02/26/2014: EOD stuff partially copied to the concentrator.

# Trds: 55, MinTrSz: 701, MaxTrSz: 30000, Vol: 535651, AvTrSz: 9739

Min. Pr: 0.0950, Max Pr: 0.0970, VW Avg. Tr. Pr: 0.0962

# Buys, Shares: 31 315751, VW Avg Buy Pr: 0.0968

# Sells, Shares: 24 219900, VW Avg Sell Pr: 0.0955

# Unkn, Shares: 0 0, VW Avg Unk. Pr: 0.0000

Buy:Sell 1.44:1 (58.95% "buys"), DlyShts 247426 (46.19%), Dly Sht % of 'sells' 112.52%

The average of the lowest 20 VWAPs times 80% today is $0.0768 vs. $0.0768, $0.0769, $0.0772, $0.0775, $0.0777, $0.0778, $0.0779, $0.0779 and $0.0779 on prior days. 80% of today's VWAP is $0.0770 vs. $0.0749, $0.0742, $0.0752, $0.0763, $0.0785, $0.0799, $0.0816, $0.0846 and $0.0836 on prior days. These are potential prices for the next tranche of shares to the PIPErs.

Today's low, high, VWAP, trade volume, and daily short sales moved 5.20%, -0.41%, 2.80%, -15.35% and -3.62% respectively. Price spread today was 7.86% vs. 15.44%, 6.59%, 9.23%, 8.42%, 3.59%, 6.40%, 9.52%, 3.49% and 16.06% on prior days.

On the traditional TA front, we had a very narrow spread and, for the second consecutive day, lower volume. But price was "stable" for the second day as well with a high down only 4/100ths of a penny and a higher low of $0.095, up 47/100ths from yesterday's $0.0903. We also had a close at the open and high for the day. If we had volume I might be tempted to discard my TFH-inspired theories entirely. But sans volume, I remain in the camp of "evil is afoot" but must soften my conviction in light of the other factors.

Yesterday I detailed a new short-term descending resistance that was ~$0.10, very near the descending 50-day SMA of $0.1015 (I erroneously said $0.1012 - that's today's value). That descends $0.008944, call it 9/10ths of a penny, each week. So today we can say it's still at $0.10 and be in the ballpark. If we try to move up, this is the level to watch first. We still have the long-term descending resistance on the back burner and my intermediate-term descending support in play.

Yesterday I (lamented?) "At last I have a reason to change my thinking from my belief that we'll sink on down into at least the $0.08xx area again" and suggested that professional construction of a bullish chart pattern yielded better than a 50/50 chance of not going to $0.08xx again. Today continues that assessment, with the added caveat that I worry what happens on/after Monday (when new shares are issued?). On the sell side ARCA was passive yesterday and AWOL today, allowing price stability and a decent buy percentage two consecutive days. I assume they will know their price Friday. If they are still focused on getting cheap shares Friday would be the day for them to hammer I guess.

As with yesterday, it's still impressive what can be accomplished with a low-volume trading day. From Monday's 10-day average of ~1.784MM we did a paltry ~632.8K yesterday and ~535.6K today. And from that "strength" we get two consecutive green candles with higher opens and two essentially flat high closes near the day's highs. I mentioned this could be a bottoming process - low volume can suggest a trend may be ending.

Several of the oscillators I watch continued the positive ticks begun yesterday. Full stochastic continued to rise after leaving oversold yesterday while Williams %R, which also exited oversold yesterday, continued to rise marginally. RSI went flat again, holding at the ~45.7 it rose to yesterday. I'd feel better if that hadn't gone flat, but continued to rise. Momentum, which had recently risen from 76.31 to 0.8576, continues improvement with a reading today of 0.8715, still below neutral but making an effort to go positive. MACD, which had ceased accelerating downward and flattened out, remains essentially flat. It's histogram continues the move back up towards neutral, begun a couple days ago.

ADX and related stopped weakening yesterday and went flat, but is again weakening, albeit only marginally. MFI, which was late to begin a trend down continues sinking.

All told, this represents a time of uncertainty, due mostly to conflicting signals, compressing price and reducing volume while price moved up.

Larger trades (>= 15K) occurred on 12 of the 55 trades, 21.82%. These totaled 257,475 shares, 48.07% of days volume, and traded at a VWAP of $0.0964. 9 of these trades, 75.00%, were buys of 190,475 shares, 73.98% of the larger trades volume, which traded at a VWAP of $0.0967. 3 of the larger trades, 25.00%, were sells of 67,000 shares, 26.02% of the larger trades volume, which traded at a VWAP of $0.0954.

The rest of the trades, 278,176 shares representing 51.93% of day's volume, went at a VWAP of $0.0961.

In the non-traditional TA area, today's buy percentage of 58.9%, up from 47.9% and 29.9% the prior two days, is almost as strong as in "The Good Old Days" (TM). If it came with volume, it would be very heartening. As it is, I see it as what we've seen many times before with the PIPErs - low volume produces price stability and high buy percentages (remember when I was saying if we could stay around 7xxK I thought we could hold in the price range at the time?). If the volume is an indication of the exhaustion of PIPErs, it's certainly possible we could be seeing moves up. But my suspicious nature leads me to think ...

The passive nature of ARCA yesterday and absence today was a "tactical withdrawal" in preparation for the next assault. But that's not traditional TA, so I'll leave it there.

Two days back I groused that the buy percentage didn't produce as big a short percentage as I would've expected and I thought this was not good. Then yesterday the buy percentage popped up and daily short sales percentage rose just like it should. Today was a repeat. Two days of strong buy percentage, 47.9% and 58.9%, produced daily short sales in the area I would expect - 40.57% and 46.19%.

This still leaves in place the possibility that a change in behavior may be underway since we never got the leg down that past behavior suggested should have occurred. Check the chart and you'll see what makes me think a change may be under way.

On the bid side, ARCA has been doing something strange off and on. Today, again, they appear on the bid pre-market but disappear immediately after market opens - at least by 9:32 when I try and make an initial check. They did this Monday and a few other times over the last couple of weeks. Their bids are nothing extraordinary, usually being about third in line in a typical bottom-feeder stance. Don't know what's up with that.

On the ask side, ARCA was AWOL. Yesterday they were passive. Too soon to guess why, and with new shares about to spew forth, foolish to do so at this time.

My original inflection point calculations, with one-day changes quite volatile recently, had those changes with all periods up today, from five up yesterday. The changes, as usual, are quite small at this time. Aggregate change over five days, which had switched from all periods improving for three consecutive days to only the 5 and 10-day periods improving while the rest weaken, is now showing all periods improving. Rates of change are split with three improved and three weakened.

The newer version switched from one-day changes with all but the 200-day period weakening after all had improved the prior day, to a small degree, to showing all periods improved over one day, to a small degree. The aggregate change over five days now had all periods improving but today has the 5 and 25-day weakening while the other periods have marginal improvement. The BIG discrepancy seen yesterday in the rate of change over those five days - rate all weakening when all aggregate five day changes were improving yesterday - has dissipated with the rate of change being more in sync with the three shortest periods weakening, along with the 200-day period.

Regardless, for detecting likely changes, "Use the charts Luke"!

Here's a trading breakdown by arbitrary time-frames.

09:30-09:43: 073701 shrs, 13.76% of vol, VWAP $0.0967, 089.1% buys

09:47-11:40: 162900 shrs, 30.41% of vol, VWAP $0.0955, 032.2% buys

12:11-13:04: 113400 shrs, 21.17% of vol, VWAP $0.0964, 080.2% buys

13:08-14:27: 106000 shrs, 19.79% of vol, VWAP $0.0965, 044.3% buys

14:39-15:59: 079650 shrs, 14.87% of vol, VWAP $0.0967, 074.9% buys

Here's a breakdown by arbitrary price range.

$0.0950-$0.0952: 135900 shrs, 25.37% of vol, VWAP $0.0950, 003.7% buys

$0.0960-$0.0969: 322400 shrs, 60.19% of vol, VWAP $0.0966, 072.4% buys

$0.0970-$0.0970: 077351 shrs, 14.44% of vol, VWAP $0.0970, 100.0% buys

Some day-to-day VWAP changes, with the end date shown and the percentage change from the prior day. Buy percentage is the last value on each line.

02/05 $0.1163 +06.52% 39.6%

02/06 $0.1124 -03.33% 41.7%

02/07 $0.1153 +02.56% 36.8%

02/10 $0.1128 -02.17% 26.6%

02/11 $0.1101 -02.35% 24.2%

02/12 $0.1046 -05.05% 46.6%

02/13 $0.1057 +01.12% 45.1%

02/14 $0.1020 -03.55% 17.7%

02/18 $0.0999 -02.08% 34.0%

02/19 $0.0981 -01.75% 43.6%

02/20 $0.0954 -02.76% 19.7%

02/21 $0.0940 -01.50% 50.1%

02/24 $0.0927 -01.30% 29.9%

02/25 $0.0936 +00.93% 47.9%

02/26 $0.0962 +02.80% 58.9%

Using the new 80% calculation 1/3 onward. This week's daily estimated values (older dailys in prior EOD posts in prior blog) for next share issue:

02/24: 20 lowest intra-day VWAPs in 40 days avg, $0.0962, x 80%: $0.0769

02/25: 20 lowest intra-day VWAPs in 40 days avg, $0.0960, x 80%: $0.0768

02/26: 20 lowest intra-day VWAPs in 40 days avg, $0.0960, x 80%: $0.0768

Vol in K, for above days: 3,002.14 632.77 535.65.

Week ending summaries of PIPE financing estimated 85% share pricing, "Dly Sht % of 'sells'", and inflection points here are in the latest daily post above.

02/25/2014: EOD stuff partially copied to the concentrator.

# Trds: 65, MinTrSz: 22, MaxTrSz: 40000, Vol: 632768, AvTrSz: 9735

Min. Pr: 0.0903, Max Pr: 0.0974, VW Avg. Tr. Pr: 0.0936

# Buys, Shares: 37 302968, VW Avg Buy Pr: 0.0944

# Sells, Shares: 28 329800, VW Avg Sell Pr: 0.0929

# Unkn, Shares: 0 0, VW Avg Unk. Pr: 0.0000

Buy:Sell 1:1.09 (47.88% "buys"), DlyShts 256707 (40.57%), Dly Sht % of 'sells' 77.84%

The average of the lowest 20 VWAPs times 80% today is $0.0768 vs. $0.0769, $0.0772, $0.0775, $0.0777, $0.0778, $0.0779, $0.0779, $0.0779 and $0.0779 on prior days. 80% of today's VWAP is $0.0749 vs. $0.0742, $0.0752, $0.0763, $0.0785, $0.0799, $0.0816, $0.0846, $0.0836 and $0.0881 on prior days. These are potential prices for the next tranche of shares to the PIPErs.

Today's low, high, VWAP, trade volume, and daily short sales moved 0.33%, -6.26%, 0.93%, -78.92% and -47.56% respectively. Price spread today was 7.86% vs. 15.44%, 6.59%, 9.23%, 8.42%, 3.59%, 6.40%, 9.52%, 3.49% and 16.06% on prior days.

Larger trades (>= 15K) occurred on 12 of the 65 trades, 18.46%. These totaled 263,501 shares, 41.64% of days volume, and traded at a VWAP of $0.0938. 6 of these trades, 50.00%, were buys of 115,500 shares, 43.83% of the larger trades volume, which traded at a VWAP of $0.0942. 6 of the larger trades, 50.00%, were sells of 148,001 shares, 56.17% of the larger trades volume, which traded at a VWAP of $0.0935.

The rest of the trades, 369,267 shares representing 58.36% of day's volume, went at a VWAP of $0.0935.

At last I have a reason to change my thinking from my belief that we'll sink on down into at least the $0.08xx area again. The traditional TA stuff, along with some of my non-traditional stuff, suggests professional participation in constructing a bullish appearance on the charts. With their record of success any sensible person would give at least even odds they will be successful in producing results from this effort. I believe I'm sensible. So better than 50/50 is my assessment for now.

On the traditional TA front, if we had volume today (and/or no TFH) I would reverse yesterday's "The chance for continued support by my medium-term support grows increasingly suspect" and "I think Wednesday we are likely to be below the line into the $0.08xx area". With low volume and the recent evidence of manipulation attempts (my humble and TFH-influenced assessment) I remain skeptical of the TA indicators that would normally allow some possibility of bullish sentiment.

A little bad news is that I've identified a short-term descending resistance now that I have an origin at the high of 2/10, $0.12, and three touch points at the highs of 2/11 ($0.1185), 2/13 ($0.1139 and 2/24 ($0.1039). If we should by any accident make an attempt to move up, we should watch for this resistance, ~$0.10 today, very near the descending 50-day SMA of $0.1012.

It's impressive what can be accomplished with a low-volume trading day. As of Monday the 10-day average was ~1.784MM. Today a paltry ~632.8K. And from that "strength" we get a green candle with a higher open and close. Unfortunately, yesterday's 1K trade at $0.1039 spoiled today's party, preventing a higher high. Just shows that short-term thinking and poor planning can thwart the best laid plans of mice and men.

Keeping in mind that I discounted yesterday's 1K $0.1039 "high" and used $0.0960 instead, the lower highs ended at three in a row with today's $0.0974 high. We avoided continuing the lower lows string that restarted yesterday by posting a $0.0903, a whopping 3/100ths of a penny above yesterday's $0.09. We also broke the string of four consecutive lower closes with today's close of $0.097, well above the prior $0.091. The intra-day low, $0.0903, produced a very small gap above my intermediate-term descending support, ~$0.09 today AFAICT. If we had any volume I would be less jaundiced about what's going on. Of course this could be a bottoming process - low volume can suggest a trend may be ending.

Several of the oscillators I watch made the first positive ticks I've seen in a while. Full stochastic and Williams %R both moved out of oversold. RSI, which was weakening and went flat at ~37, "popped" up to ~45.7, still below neutral but improving. MFI, which was late to begin a trend down continues sinking. Momentum, which had finally stopped its down move at 77.18, up from the prior 76.31, is now up to 0.8576, still below neutral, but it is an improvement. ADX and related stopped weakening yesterday and is flat for now. MACD stopped accelerating downward and has flattened out while it's histogram has started moving back up towards neutral.

In the non-traditional TA area, today's buy percentage of 47.9%, up from yesterday's 29.9%, is almost as strong (in both magnitude and degree of improvement) as that of Friday 2/21, 50.1%, which was up from 19.7%. 2/21 had ~2.344MM in trading volume though and it resulted in a down day followed by another down day with buy percentage retreating to 29.9%. Let's hope that today's stronger percentage on lower volume can produce a much better result. If the volume is an indication of the exhaustion of PIPErs, it's certainly possible.

Yesterday I groused that the buy percentage didn't produce as big a short percentage as I would've expected and I thought this was not good. Without repeating my reasoning, yesterday's drop from 22.19% to 16.31% made me think the down leg I've been expecting had again finally started. I said I bet it's low again tomorrow, along with price. Well, any time the buy percentage is up in relative strong territory, daily short sales percentage should rise and I would be wrong again. It was, it did and I am again.

This does resurrect the possibility that a change in behavior may be underway. Take a look at the "AXWP Daily Volumes & Short Sales" chart and you'll see sound evidence that this question is worth asking.

ARCA was not on the bid today.

ARCA didn't appear on the offer until 10:50, they were uncharacteristically passive with only one move to $0.0935 from their initial offer of $0.94. They left at 12:46. That likely explains why we had a general trend of strengthening VWAP throughout the day (see trading breakdown by arbitrary times). I think it means the PIPErs were generally not aggressively in the market today. Given low volume with that, it's not surprising to see buy percentage and VWAP improve, along with daily short sales moved substantially upward.

My original inflection point calculations continue with the volatility in one-day changes. From all periods weakening, back to all showing improvement to a very small degree, to all weakening again, and now all improving by a smidgen. The net result, seen on the chart, is still a long slow weakening trend. Aggregate change over five days, which had switched from all periods improving for three consecutive days to only the 5 and 10-day periods improving while the rest weaken, is now showing all periods improving. Rates of change are split with three improved and three weakened.

The newer version switched from one-day changes with all but the 200-day period weakening after all had improved the prior day, to a small degree, to showing all periods improved over one day, to a small degree. This is the fifth day of flip-flopping, so the volatility is here also. The aggregate change over five days now has all periods improving. A BIG discrepancy appears in the rate of change over those five days - all weakening when all were improving yesterday. The changes are not tiny, but not real big either.

Keep in mind the chart patterns are the best indicator of if/when something is seriously about to change and I'm also suspicious of the utility of these items when we have the PIPE condition still in play. Having said that, the charts suggest that decline is weakening. It does not yet suggest that bullishness is in play yet.

Here's a trading breakdown by arbitrary time-frames.

09:30-09:35: 022499 shrs, 03.56% of vol, VWAP $0.0926, 077.8% buys

09:42-09:54: 054801 shrs, 08.66% of vol, VWAP $0.0938, 007.3% buys

10:15-10:50: 054000 shrs, 08.53% of vol, VWAP $0.0941, 081.5% buys

10:50-11:19: 061022 shrs, 09.64% of vol, VWAP $0.0914, 034.4% buys

12:15-12:35: 091000 shrs, 14.38% of vol, VWAP $0.0920, 022.0% buys

12:40-14:35: 078946 shrs, 12.48% of vol, VWAP $0.0929, 041.1% buys

14:46-14:59: 095500 shrs, 15.09% of vol, VWAP $0.0946, 078.5% buys

15:00-15:15: 092500 shrs, 14.62% of vol, VWAP $0.0945, 026.5% buys

15:49-15:59: 082500 shrs, 13.04% of vol, VWAP $0.0954, 078.2% buys

Here's a breakdown by arbitrary price range.

$0.0903-$0.0911: 040000 shrs, 06.32% of vol, VWAP $0.0908, 000.0% buys

$0.0920-$0.0929: 179999 shrs, 28.45% of vol, VWAP $0.0921, 026.7% buys

$0.0930-$0.0938: 116769 shrs, 18.45% of vol, VWAP $0.0935, 036.4% buys

$0.0944-$0.0948: 257500 shrs, 40.69% of vol, VWAP $0.0946, 067.6% buys

$0.0970-$0.0974: 038500 shrs, 06.08% of vol, VWAP $0.0973, 100.0% buys

Some day-to-day VWAP changes, with the end date shown and the percentage change from the prior day. Buy percentage is the last value on each line.

02/04 $0.1092 +05.16% 40.5%

02/05 $0.1163 +06.52% 39.6%

02/06 $0.1124 -03.33% 41.7%

02/07 $0.1153 +02.56% 36.8%

02/10 $0.1128 -02.17% 26.6%

02/11 $0.1101 -02.35% 24.2%

02/12 $0.1046 -05.05% 46.6%

02/13 $0.1057 +01.12% 45.1%

02/14 $0.1020 -03.55% 17.7%

02/18 $0.0999 -02.08% 34.0%

02/19 $0.0981 -01.75% 43.6%

02/20 $0.0954 -02.76% 19.7%

02/21 $0.0940 -01.50% 50.1%

02/24 $0.0927 -01.30% 29.9%

02/25 $0.0936 +00.93% 47.9%

Using the new 80% calculation 1/3 onward. This week's daily estimated values (older dailys in prior EOD posts in prior blog) for next share issue:

02/24: 20 lowest intra-day VWAPs in 40 days avg, $0.0962, x 80%: $0.0769

02/25: 20 lowest intra-day VWAPs in 40 days avg, $0.0960, x 80%: $0.0768

Vol in K, for above days: 3,002.14 632.77.

Week ending summaries of PIPE financing estimated 85% share pricing, "Dly Sht % of 'sells'", and inflection points here are in the latest daily post above.

02/24/2014: EOD stuff partially copied to the concentrator.

# Trds: 162, MinTrSz: 365, MaxTrSz: 110000, Vol: 3002135, AvTrSz: 18532

Min. Pr: 0.0900, Max Pr: 0.1039, VW Avg. Tr. Pr: 0.0927

# Buys, Shares: 59 897850, VW Avg Buy Pr: 0.0945

# Sells, Shares: 103 2104285, VW Avg Sell Pr: 0.0920

# Unkn, Shares: 0 0, VW Avg Unk. Pr: 0.0000

Buy:Sell 1:2.34 (29.91% "buys"), DlyShts 489500 (16.31%), Dly Sht % of 'sells' 23.26%

The average of the lowest 20 VWAPs times 80% today is $0.0769 vs. $0.0772, $0.0775, $0.0777, $0.0778, $0.0779, $0.0779, $0.0779, $0.0779 and $0.0779 on prior days. 80% of today's VWAP is $0.0742 vs. $0.0752, $0.0763, $0.0785, $0.0799, $0.0816, $0.0846, $0.0836 $0.0881 and $0.0902 on prior days. These are potential prices for the next tranche of shares to the PIPErs.

Today's low, high, VWAP, trade volume, and daily short sales moved -1.10%, 7.11%, -1.30%, -7.45% and -31.99% respectively. Price spread today was 15.44% vs. 6.59%, 9.23%, 8.42%, 3.59%, 6.40%, 9.52%, 3.49%, 16.06% and 17.07% on prior days.

It should be noted we had exactly one trade of 1K shares for $0.1039. The next highest price seen was $0.0960. If we used $0.0960 as the high, high movement was -1.03% instead of +7.11% and spread was 6.67% instead of 15.44%.

Larger trades (>= 15K) occurred on 59 of 162, 36.42%, trades. These totaled 2,194,150, 73.09% of days volume, and traded at a VWAP of $0.0927. 19 of these trades, 32.20%, were buys of 604,700 shares, 27.56%, of the larger trades volume, which traded at a VWAP of $0.0948. 40 of the larger trades, 67.80%, were sells of 1,589,450 shares, 72.44% of the larger trades volume, which traded at a VWAP of $0.0919.

The rest of the trades, 807,985 shares representing 26.91% of day's volume, went at a VWAP of $0.0930.

On the traditional TA front, I'm going to discount the garbage first. That single $0.1039 trade for 1000 shares strikes me as intentionally introduced noise. So although a typical chartist would see that as a higher high, indicating something useful about trading sentiment. I don't. I see it as someone being careless or intentionally distorting perceptions. I will use the $0.0960 I mentioned above as the high in my considerations.

The lower highs continued today, making three consecutive lower highs, and the string of lower lows restarted with a low of 186,650 shares in four trades at $0.0900. We now also have four consecutive lower closes. For the third straight day the intra-day low, $0.09, appears to be riding atop my intermediate-term descending support, ~$0.0905 today AFAICT. The close was up 1/10th at $0.0910.

Deep in oversold is full stochastic, which is flat, and Williams %R, also flat. RSI, which was weakening, is now flat at ~37, just above oversold of 30. MFI, which was had finally began a trend down has gone back to flat. Momentum finally stopped its down move at 77,18, up from yesterday's 76.31. This is still a far cry from hallelujah time though - remember we dropped from 0.9078 and 0.965 readings just four and three days ago. ADX and related stopped weakening. MACD and it's histogram are negative and continue accelerating downward.

Interesting that the lone $0.1039 trade of 1K shares "bumped it's head" on my long-term descending resistance. Even with that, six days we've traded completely below my longer-term descending resistance and, if we discount that "Lone Ranger", continue to depart from it to the downside at a high rate. It was "increasing rate", but now I can't tell for sure.

The chance for continued support by my medium-term support grows increasingly suspect. I said yesterday the combination of the oscillators' stances and the high volume leave me doubtful that it can do it another day or two. It did another day. The volume was high again today, on a down day, the "volume spike" which might have been signaling end of trend yesterday, wasn't. I think Wednesday we are likely to be below the line into the $0.08xx area.

The next potential support continues to be my long-term descending support, still around ~$0.081, very near the most recent new all-time low.

In the non-traditional TA area, today's buy percentage of 29.9%, down from 50.1% which was up from 19.7%, is not so much a sign of weak buying sentiment, I think, as it is a sign of the PIPErs, and maybe other, selling pressure. The common effect of falling price drawing in more buyers has limited effect over time as buyers become leery and exhausted at a given price level. I think that's what's going on here.

I said yesterday the buy percentage didn't produce as big a short percentage as I would've expected and I thought this was not good. It meant there's a lot more shares that are being handled by the MMs that are in their portfolios (likely from earlier covering buys and then shares backing processed sell orders flowing in), so they don't have to flag short, or there's a whole lot of intra/inter-broker trades going on. Today seems to bear this out as the lowered buy percentage finally let the daily short percentage show its true colors - down to 16.31% today. The down leg I've been expecting, which seemed determined to thwart me, has finally started (again?). We'll see, but I bet it's low again tomorrow, along with price.

There's no reason to change my thinking from my belief that we'll sink on down into at least the $0.08xx area again.

ARCA was again on the bid today from pre-market, not at 08:00 but at 09:05 when I checked again, and left right after the open, 09:32 or sooner. Of course, I still don't know why they've been doing this off and on.

ARCA didn't appear on the offer until 12:24. Even though they did another day of peek-a-boo, they manged to influence trading with their first offer of $0.095, just under the best $0.096. In 27 minutes they were at $0.094 and then left after a few minutes. On return at 13:03, $0.095 again. Left at 13:15 and returned at 14:21 with $0.095 again. Left at 14:44 and returned at 15:01 with a $0.92 offer. I couldn't track after 15:21 when ARCA was offering at $0.091.

Even with that, we had early pressure awaiting us as I saw an 867K offer at $0.096 from ATDF at 09:32 that was hidden quite a bit of the day. It became best offer at 10:47 but was again hidden by 10:51. It was at the top again at 11:07 with 706K remaining at $0.096. It got nibbled down for a good part of the day and ...

It looks like they capitulated with a $0.095 offer with 602.6K shares remaining at 14:21. At 15:01 a different offer at $0.093 with 462K appeared and after it was gone (gobbled up?) the $0.095 by 602.6K returned at 15:21.

My original inflection point calculations continues with the volatility. From all periods weakening two days prior, to all showing improvement to a very small degree, to all weakening today. The net result, seen on the chart, is a long slow weakening trend. Change over five days switched from all periods improving for three consecutive days to only the 5 and 10-day periods improving while the rest weaken. Rates of change switched from having all periods improving to three and three, reduced strengthening vs. increased strengthening.

The newer version, has all but the 200-day period weakening after all improved over one day, to a small degree, yesterday. They had just switched from all weakening two days ago. This is the fourth day of flip-flopping, so the volatility is here also. The aggregate change over five days now has only one period weakening whereas yesterday had all but the five-day period weakening. Rate of change, which had five weakening, now has all with improvement.

Keep in mind the chart patterns are the best indicator of if/when something is seriously about to change and I'm also suspicious of the utility of these items when we have the PIPE condition still in play.

Here's a trading breakdown by arbitrary time-frames.

09:30-09:30: 001000 shrs, 00.04% of vol, VWAP $0.1039, 100.0% buys

09:30-10:47: 125000 shrs, 05.23% of vol, VWAP $0.0958, 093.2% buys

10:48-11:13: 396250 shrs, 16.57% of vol, VWAP $0.0956, 049.7% buys

11:20-12:18: 331500 shrs, 13.86% of vol, VWAP $0.0955, 056.6% buys

12:19-12:59: 090570 shrs, 03.79% of vol, VWAP $0.0937, 033.1% buys

13:09-13:46: 070000 shrs, 02.93% of vol, VWAP $0.0946, 042.9% buys

14:05-14:23: 114500 shrs, 04.79% of vol, VWAP $0.0949, 060.7% buys

14:27-14:59: 082400 shrs, 03.45% of vol, VWAP $0.0936, 003.6% buys

15:00-15:00: 118300 shrs, 04.95% of vol, VWAP $0.0931, 000.0% buys

15:01-15:06: 216000 shrs, 09.03% of vol, VWAP $0.0919, 025.5% buys

15:20-15:24: 626915 shrs, 26.22% of vol, VWAP $0.0910, 004.7% buys

15:26-15:28: 212700 shrs, 08.90% of vol, VWAP $0.0901, 018.8% buys

15:30-15:59: 617000 shrs, 25.80% of vol, VWAP $0.0909, 022.5% buys

Here's a breakdown by arbitrary price range.

$0.0900-$0.0900: 186650 shrs, 06.22% of vol, VWAP $0.0900, 000.0% buys

$0.0901-$0.0905: 452415 shrs, 15.07% of vol, VWAP $0.0903, 008.8% buys

$0.0910-$0.0917: 768550 shrs, 25.60% of vol, VWAP $0.0911, 007.6% buys

$0.0920-$0.0925: 255000 shrs, 08.49% of vol, VWAP $0.0921, 060.8% buys

$0.0930-$0.0937: 240200 shrs, 08.00% of vol, VWAP $0.0932, 004.2% buys

$0.0940-$0.0940: 158070 shrs, 05.27% of vol, VWAP $0.0940, 014.6% buys

$0.0950-$0.0959: 624250 shrs, 20.79% of vol, VWAP $0.0954, 047.4% buys

$0.0960-$0.0960: 316000 shrs, 10.53% of vol, VWAP $0.0960, 099.5% buys

$0.1039-$0.1039: 001000 shrs, 00.03% of vol, VWAP $0.1039, 100.0% buys

Some day-to-day VWAP changes, with the end date shown and the percentage change from the prior day. Buy percentage is the last value on each line.

02/03 $0.1038 +04.14% 55.6%

02/04 $0.1092 +05.16% 40.5%

02/05 $0.1163 +06.52% 39.6%

02/06 $0.1124 -03.33% 41.7%

02/07 $0.1153 +02.56% 36.8%

02/10 $0.1128 -02.17% 26.6%

02/11 $0.1101 -02.35% 24.2%

02/12 $0.1046 -05.05% 46.6%

02/13 $0.1057 +01.12% 45.1%

02/14 $0.1020 -03.55% 17.7%

02/18 $0.0999 -02.08% 34.0%

02/19 $0.0981 -01.75% 43.6%

02/20 $0.0954 -02.76% 19.7%

02/21 $0.0940 -01.50% 50.1%

02/24 $0.0927 -01.30% 29.9%

Using the new 80% calculation 1/3 onward. This week's daily estimated values (older dailys in prior EOD posts in prior blog) for next share issue:

02/24: 20 lowest intra-day VWAPs in 40 days avg, $0.0962, x 80%: $0.0769

Vol in K, for above days: 3,002.14.

Week ending summaries of PIPE financing estimated 85% share pricing, "Dly Sht % of 'sells'", and inflection points here are in the latest daily post above.

02/21/2014: EOD stuff partially copied to the concentrator.

# Trds: 159, MinTrSz: 29, MaxTrSz: 125000, Vol: 3243908, AvTrSz: 20402

Min. Pr: 0.0910, Max Pr: 0.0970, VW Avg. Tr. Pr: 0.0940

# Buys, Shares: 77 1625042, VW Avg Buy Pr: 0.0947

# Sells, Shares: 76 1551396, VW Avg Sell Pr: 0.0932

# Unkn, Shares: 6 67470, VW Avg Unk. Pr: 0.0946

Buy:Sell 1.05:1 (50.10% "buys"), DlyShts 719700 (22.19%), Dly Sht % of 'sells' 46.39%

The average of the lowest 20 VWAPs times 80% today is $0.0772 vs. $0.0775, $0.0777, $0.0778, $0.0779, $0.0779, $0.0779, $0.0779, $0.0779 and $0.0779 on prior days. 80% of today's VWAP is $0.0752 vs. $0.0763, $0.0785, $0.0799, $0.0816, $0.0846, $0.0836 $0.0881, $0.0902 and $0.0922 on prior days. These are potential prices for the next tranche of shares to the PIPErs.

Today's low, high, VWAP, trade volume, and daily short sales moved 0.00%, -2.41%, -1.50%, 85.93% and 105.16% respectively. Price spread today was 6.59% vs. 9.23%, 8.42%, 3.59%, 6.40%, 9.52%, 3.49%, 16.06%, 17.07% and 9.90% on prior days.