A few months ago I wrote about Strategic Metals (OTCPK:OTCPK:SMDZF) as an undervalued name trading below cash and marketable securities as the weight of a gold/resource bear market caused investors to flee the stock. Since then we have a had a decent recovery in gold stocks and in Strategic Metals. If we consider the Market Vectors Junior Miners ETF (GDXJ) as a proxy, it's up ~ 42% since December 12, 2013 and Strategic Metals is up ~45% (in CAD terms). While the performance has been comparable, I would argue buying a stock below cash had less risk.

I would like to focus on another small cap gold/resource stock that is trading well below its cash and marketable securities named Corona Gold (OTCPK:CRGAF)

Background

Corona Gold (CRG) is effectively a subsidiary of Dundee Corp (OTCPK:OTCPK:DDEJF) which owns 23% of the equity and management/board who are mainly officers and employees of Dundee Corp who own another 22%.

As disclosed in the Annual Information Form (available on www.sedar.com), the Company, formerly invested in mineral properties and then decided beginning in 2006 to maximize the value of these holdings by either selling for cash and/or stock in various junior mining companies. Some of the Company's biggest portfolio positions are based on these transactions. The Company has also invested these proceeds on other investments in the resource sector, straying from gold in some cases into energy and iron ore.

The performance of the investments that the company has chosen have been awful the last three years as a bear market in resources has caused many of the names in the portfolio to lose significant ground as most of them are/were in significant need of financing and found very little capital available to advance projects.

The company marks its positions to market so the net loss reported is a pretty good indicator of how badly the portfolio has done.

| Year ended | Year ended | Year ended | ||

| 12/31/2013 | 12/31/2012 | 12/31/2011 | ||

| Net Loss | ||||

| - Total | -$7,976,976 | -$3,941,574 | -$12,868,590 | |

| - Per share (basic & diluted) | -$0.37 | -$0.19 | -$0.67 |

Source: Corona Gold 2013 MD&A (www.sedar.com)

Its no surprise then that the stock has also suffered significantly.

Source: Stockhouse.com (CRG on TSX)

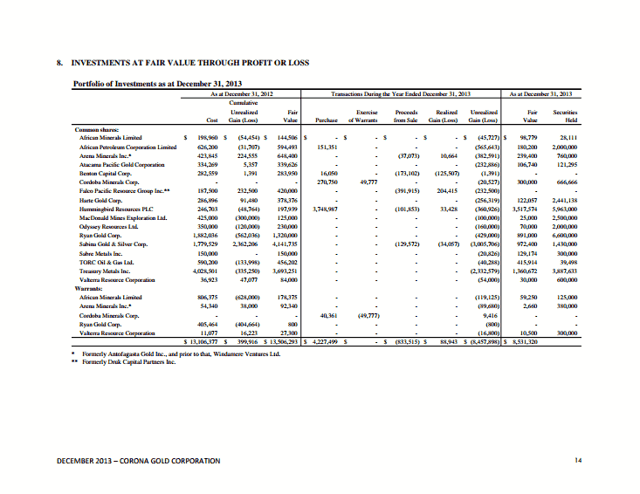

I don't have a fundamental view on any of the particular holdings that CRG has in its investment portfolio (included below) but I do think that given its somewhat depressed state, there may be an opportunity for a rebound, some of which we have already seen since year end.

Source: Corona Gold 2013 Financial Statements (www.sedar.com)

Valuation

At the Company's recent price of C$0.50 (CRG on the TSX), CRG trades at a material discount to cash and marketable securities and pretty close to its cash/share.

| Corona NAV | |||

| ($m) | (per basic share) | (per fully diluted) | |

| Cash | 10.25 | 0.48 | $0.50 |

| Net current assets ex Marketable Securities | 0.21 | 0.01 | $0.01 |

| Investment holdings | 11.37 | 0.53 | $0.48 |

| Total NAV | 21.82 | 1.02 | 0.99 |

| Share price ($) / NAV discount (%) | 0.500 | -51% | -49% |

Closing the Discount

The company has a share buyback in place but it is very inactive with the company only purchasing 35,300 shares in 2013 at an average price of $0.53.

However, a recent development with a portfolio holding of the Company may help resolve the NAV discount. The Company owns 6.6 million shares of Ryan Gold (OTCPK:RYGZF) representing a 5.6% stake. Ryan Gold (RYG on TSX) has recently decided to cease its mineral exploration and development activities and is conserving its cash. It is effectively a holding company similar to CRG with significant cross ownership. The biggest difference being that RYG trades at only a 10% discount to NAV but has a similar amount of assets.

The combination of these two companies at the same discount that RYG trades, would result in a premium to CRG of 72%. It would also result in cost savings of over $600k per year in operating expenses (per CRG outlook for 2014 expenses in 2013 MD&A) and provide the new company with cash resources of over $30m which would give more flexibility to make investments in a cash strapped resource sector and/or do a substantial share repurchase if a giant NAV discount were to reappear.

Interested investors should note that Corona only trades 1400 shares a day on the OTC but trades 16k shares a day on the TSX.

Risks

The discount could remain for a very long time if the resource sector continues to struggle. Management could use significant cash resources to make further poorly performing investments as opposed to repurchasing its stock which could result in a lower liquidation value. A potential merger with RYG is speculation and may never occur.

Disclosure: I am long CRGAF, DDEJF, SMDZF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I may add to or reduce my position in the next 72 hours.