Saturday 15 February 2014

Bankers can and will steal your cash, but there is no way they can

take your personally owned and personally held gold and silver. The

ongoing plan for 2014 is to buy and hold even more gold and silver

and reduce your exposure to cash held in any bank. Just keep

enough to cover week by week expenses, and keep the rest of your

cash at home, under the mattress, in a safe, buried in the backyard,

anywhere but in a bank.

ANYONE who keeps money in any banking system in the Western

world is sending an RSVP to bankers to access your funds, and they

will not disappoint. The confiscation of Cyprus banking accounts was

bandied about as a template for other countries. "No, that would

never happen," was a constant refrain. Well, it was just the

beginning.

If there is one thing about which you can be certain, concerning cash

held on deposit, the government, [pick a country], has plans to steal

it. The bankers new motto: "What's yours is ours."

You think Cyprus was a single event? It was an elite trial balloon.

The blowback from it? Not much, really. Financial shock and awe,

to be sure, especially for Cypriots, but just like every other banker-

created scam, there are no real consequences. The elites carefully

monitored world response and learned one thing: more of the same,

in some fashion or similar form will work, and we [the bankers] will

get away with it.

Another example: Read this excerpt from the IMF October

publication "Taxing Times" which states on page 49: A One Off

Capital Levy:

The sharp deterioration of the public finances in many countries

has revived interest in a "capital levy"- a one-off tax on private

wealth-as an exceptional measure to restore debt

sustainability. The appeal is that such a tax, if it is implemented

before avoidance is possible and there is a belief that it will

never be repeated, does not distort behavior (and may be seen

by some as fair).

The cunning and planning goes on behind closed doors on an ongoing

basis. Then there was this article from Reuters: EU Executive See

Personal Savings Used To Plug Gap.

"the savings of the European Union's 500 million citizens

could be used to fund long-term investments to boost the

economy and help plug the gap left by banks since the

financial crisis, an EU document says.

In other words, all of the trillions of $$$ used to prop up every single insolvent bank in the Western world has failed to boost any

economy, and the reason why it has failed is because the bankers

are keeping the money for themselves, not lending it out. Every

economy is being starved of capital.

The solution? "The Commission will ask the bloc's insurance

watchdog in the second half of this year for advice on a possible draft law "to mobilize more personal pension savings for long-term

financing", the document said."

Doesn't that sound economically viable?! It is EU doublespeak: to

mobilize more personal savings, in normal words means "confiscate,"

or more to the point, "steal." The central planners never stop

planning, and your savings and deposits are in their crosshairs.

The bankers are not stopping there, however. The ultimate goal? All

pensions, IRAs, 401ks, whatever form your retirement funds are in

will be switched, for your own good, of course, to the safety and

guaranteed security of government bonds. You will be assured of a

few percentage points of interest. What, 1, 2, 3 percent? With

inflation running at 8 to 10 percent, minimum, at least in the real

world? Such a deal.

Obama has introduced the MyRA account, and just like Obamacare,

it is for the "benefit" of the public good. It is the prelude for

eventually taking over the country's entire pension programs, taking

over all the accounts, [stealing your lifetime savings], and

exchanging them for the US Treasury Bonds the Fed cannot sell to

countries anymore. This is the only way the US government can

cover its trillion $ [and growing] deficit spending.

What is wrong with this picture?

Who elected the bankers? Who elected the EU members that run

Europe like their own ATM? They all are empowered by the elite

shadow rulers. What is worse, people are not rebelling. Instead, all

acquiesce to the whims of the central bankers.

"All" is close but not quite accurate. There are the relatively few who

own and hold silver and gold, immune, to that extent, from the theft

of banking funds/pension funds/ mutual funds/corporate and

government bonds, any form of paper thought to have value.

Rest assured that those who impose [steal] "special situations" are

exempt themselves. All of your hard-earned money and life savings

are needed to prop up the insolvent banks, pay for all the banker

bonuses and lavish lifestyles, because the bankers will never be held

accountable to the financial problems they created, and you must

now pay for their mistakes for no bankers are ever held accountable, just you and your neighbors.

We are all free to make choices. From what we can determine,

financially smart people own and personally hold, and continue to

buy gold and silver, the most durable "wealth" preserver of all. The

word "wealth" is used for lack of a better choice in the asset class

of precious metals. There has been no wealth preservation owning

gold and silver for the past few years, stated and acknowledged.

However, that is a very short time frame from which to measure.

The choice is simple: paper or hard assets? Owning gold or silver

ETFs or futures are paper and not a claim on the physical. Accept

no substitutes. For those who choose to remain within the banking system, the risks are known, and if accepted for what the central

bankers are planning, made public by the way, there can be no

complaining when funds are lost.

The charts remain the most viable way of keeping a pulse on the

price of gold and the gold price. Some make a distinction, but the

effect has been of no consequence from a pragmatic point of view.

Our weekly charts and assessment follow:

As a reminder, the charts are in contradistinction to physical gold and silver. Everyone should be buying physical gold and silver as often as possible, and price is not the most important issue, owning it is. The

charts reference the paper form of gold and silver, but they relate to

the price of the physical, by extension, as a general guide.

The past two weeks have been the best for gold in several months.

We maintain the belief that extraordinarily higher prices for gold and

silver are not going to happen, in the near term. Maybe sometime in

2014, it is too soon to tell. What is more important are the events

like those discussed above that are setting the stage for eventual

higher prices.

What should be of primary concern for buyers of the physical is the

availability. It may not always be readily available, as it is now, and

that should be a driving motivation for their acquisition. For those

who already own PMs, particularly at higher prices, do not fret.

Their value will go back to levels paid, and much higher. Just be

patient. It is short-sighted to measure one's holdings based on price as opposed to the reason for buying them in the first place.

If you do not complain about paying for car or house insurance that

does not get used, why complain about PM holdings from higher

prices? Stay focused. Events are unfolding in an alarming manner,

and people should be very worried about what is going to happen.

Look at Cyprus, Greece, Venezuela, Ukraine to get an idea of how

ugly things can, and will get.

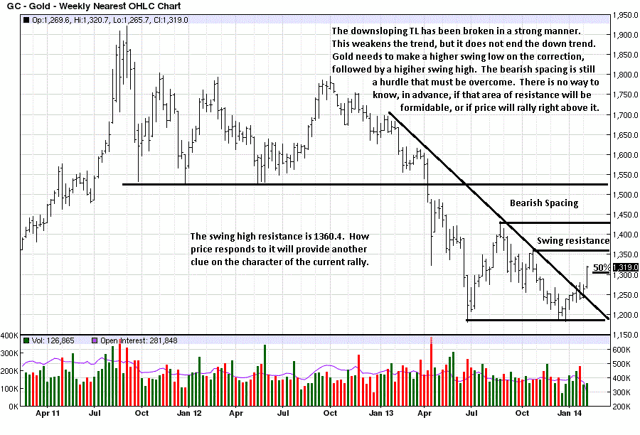

The weekly chart shows the current down trend weakening but not

ending. As is pointed out in the weekly silver chart, one only need

look at the rally that began in June, 2013. If anyone thought the

breaking of a TL [Trend Line] meant the end of a bear market, look

again. It takes time for a trend to change, and with the exception of

a "V-Bottom," there are a few phases that mark trend changes.

The Bearish Spacing still stands out for what could be formidable

resistance, yet to be determined. As a reminder, bearish spacing

exists when the last swing high, August 2013, fails to reach the lows

of the last swing low, May 2012. It indicates sellers did not feel the

need to see how the swing low would be retested. They aggressively

embarked upon their selling campaign certain that lower prices were

next.

The August swing high will be defended by those who sold at that

level, which will make it resistance. There is a relatively smaller

resistance level, marked on the chart, at 1360.4, a smaller swing

high. How the market responds to the known resistance levels will

give an indication of the character of the existing trend.

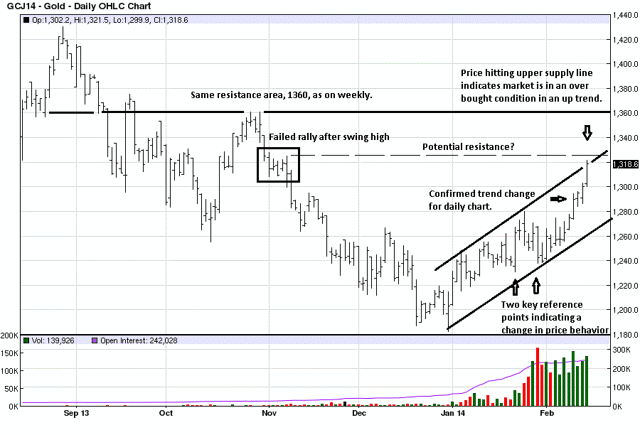

The daily trend is up, as defined by a two higher highs with a higher

low in between. Once price rallied above 1280, it formed a higher

high and confirmed a change in trend on the daily. Once that was

confirmed, it was then easier to put the previous market activity

into a context that supported the change in trend. Sometimes,

recognizing changes can only be determined in hindsight.

The two wide range bars, with arrows under each, anchored the rally in gold. There was no way to know beforehand that gold would make higher daily lows for 10 days straight, and that left no [normal]

reaction in which to buy. This is a decided change in market

behavior, and if sustained, will continue building on the up trend just

under way.

The primary resistance at 1360 is the same on the daily and weekly,

giving greater weight to the daily chart. A lesser, potential resistance level is also shown by the dashed line from a failed retest rally,

marked on the chart.

Money is not made buying potential resistance, which the 1280 area

represented, and for that reason, we were not buyers and missed

the last half of the rally. We did catch some of the earlier portion of

it, however.

What we know for certain is that every market will have a normal

correction, and it is at that point one can take a position with a more

clearly defined risk. For now, we remain on the sidelines in the paper futures.

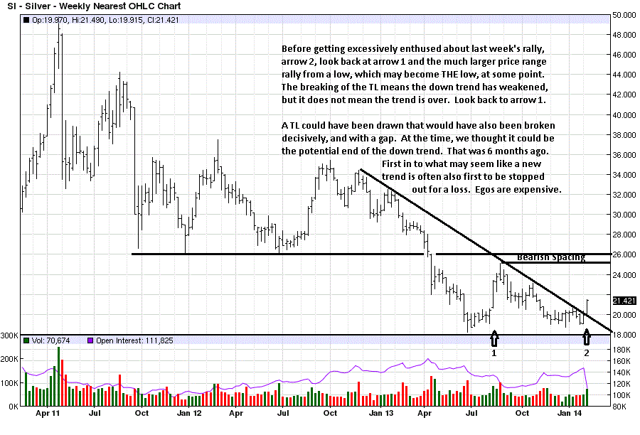

Pointing out the importance of not jumping to any conclusion that last week's strong rally has change the trend, a look back at the first

arrow shows an earlier strong rally that did not change the trend.

Everything needs to be confirmed, and the rally from the first arrow

was never confirmed as a change in trend. Patience is a virtue in the

markets.

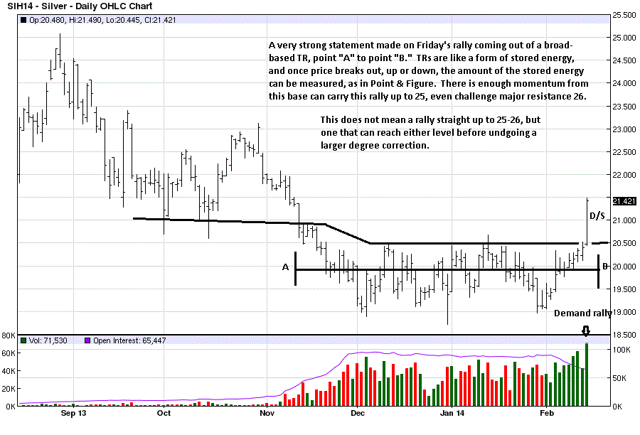

Friday's rally in silver was impressive, coming out of the protracted

TR, [Trading Range]. When you measure from point "A" to point "B,"

that "stored energy" accumulated during the trading range reveals

that the upside rally potential can carry silver to the 25 area, and

even challenge the all important 26 resistance.

Silver also has bearish spacing, shown on the weekly chart, but it is

not as great as the gold bearish spacing. There is a good possibility

that silver can outperform gold, on the next important rally.

The "D/S" designated Demand overcoming Supply, and the sharp

volume increase is very supportive of the rally. A great place to get

long is on the retest of the breakout, and we will be watching how

the next retest unfolds.