Hosting Varney & Co 11:00 AM - 1:00 PM

Over the years, I have written periodically on the World of Online IPO s, which was marked to the top of the tech bubble. Most market historians missed this one when talking about the shenanigans of that period, in part because this was a Dutch IPO, but for me that underscores its significance even more. The kind of out-of-control mania for the market in general, and for tech stocks in particular, could be one of those occurrences that can only come around every few hundred years. It was truly the Tulip craze, and yet everyone aware of such history could barely resist the excitement.

The Scene

What would you think if I sang out of tune,

Would you stand up and walk out on me?

Lend me your ears and I'll sing you a song

And I'll try not to sing out of key.

Oh, I will get by with a little help from my friends.

-Joe Cocker

March 17, 2000: the Amsterdam Stock Exchange and the debut of World Online (WOL), was the largest IPO in the exchanges' history and largest internet IPO in European history. The place was buzzing as management brought in celebrities including Sarah Ferguson, Christopher Reeve, and Joe Cocker, in order to make it a day the world would never forget. It was only four years earlier when the company launched its Internet services and became something of a juggernaut.

Of course, one must remember that in the land of the blind, the one-eye man is king and back in those days a juggernaut did not mean profits, and in some cases, it referred solely to the hype factor.

That morning the most popular person in the room was the attractive and outgoing CEO of WOL, Nina Brink, who floated on air as she was doing more than just getting by with a little help from her friends. The shares priced at £43, giving the company a market valuation of £12 billion. This valuation also valued the 1.9 million users at £6,500 each, making Mark Zuckerberg's $42 a user price tag for 'WhatsApp' look like the steal of a lifetime.

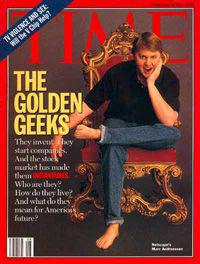

| The Big Bang The Internet was born in 1969, but the Big Bang period of hype and dreams of unlimited potential, that ushered in phrases like "paradigm shift" was birthed in 1995, with the initial public offering of Netscape. The brainchild of Jim Clark and Marc Andreessen, was sizzling as the dominate web browser with more than 90% market share. The IPO first priced at $14, but demand was so insatiable it doubled to $28 then opened the first day of trading rallying to a high of $75, before settling at $58.25 for a market cap of $2.9 billion. Despite revenue doubling each quarter in 1995, the company was still losing money. Urban legend has it that the only reason the company went public was that Jim Clark had a balloon payment due on a yacht being built and needed the money. The deal eventually landed Andreessen on the cover of Time, (sans shoes and socks) and sparked a modern-day gold rush that left millions of people sockless, shoeless, shirtless, and plain old broken and hopeless.

|

Additional red flags for WOL included:

Year 1999, revenue for the company was 64.0 million with a loss of 91.0 million.

The company was not even in the top-five in key European markets.

Nina Brink sold all her stock for a song three weeks before shares began trading!

Yes, the CEO was floating around the exchange in a star-studded, first day of trading holding a glass of champagne. When the day was over, she casually admitted that she had already sold all her shares in response to a reporter's question; what she would do with her stock.

Yikes!!!

World Online was changing hands in the grey market on the eve of the IPO at £72, as the deal was 21 times oversubscribed. The frenzied, first day of trading saw the stock halted three times, as it peaked at £50 before closing at its IPO price of £43.

The next day, the stock finished down 16%:

By March 22, the stock closed at £31.

By April, Brinks resigned in shame and proceeded to move to Belgium, in order to protect her wealth from Dutch taxes. Turns out Nina Brinks thought so much of her company; she dumped her shares in a private transaction for $6.04 each, or 90% less than some people paid for it in the market weeks later.

She was guilty of not disclosing her sell of her shares, and other mistakes on her resume.

In addition, Goldman Sacks and ABN-AMBRO were guilty and paid fines as well. In late 2000, an Italian telecommunications company bought World Online. Currently, Nina Brinks has a business fund and she has written a book: "Perception and Conception," a mirrored perspective. An Interesting title, but it probably means nothing to those caught in the web of lies and hype.

Nina sang out of key and duped all her friends and shareholders.

The King is Dead...Long Live the King

Yesterday's debut of the Kingmaker of 'Candy Crush Saga' was even more inauspicious than I thought it would be...in fact, I do not think anyone saw the stock being crushed out the gate. In that respect, the stock has something in common with World Online, but that is the end of the comparisons. King has established revenue and has made a ton of cash, and while it is easy to rule it as a one-trick pony, management seems truly committed to building the business.

The current IPO craze is not even in the same planet as 1999 and 2000, even if that is the prevailing wisdom. Consider the following names:

E-Toys (1999)

Stock opens $20, rallies to $120 before closing at $76 and a market cap of $7.6 billion.

Webvan (1999)

On the first day of trading, the stock rallies to $34, and a market cap of $15.0 billion, even though its sales were only $13 million and a loss of $144 million.

The company is one of the biggest Internet flop by CNET, edging out Pets.com, which went public in February 2000, only to file for bankruptcy protection 300 days later. However, Webvan held out longer in filing for bankruptcy in 2001.

Going into yesterday's session, I felt an unpromising start by King that would actually add credibility to the rally, but I was wrong. In fact, this is where IPO mirrors World Online, and both took down the entire tech sector. The Russell was off 1.9% and the NASDAQ off 1.4%, as investors began to dump with both hands. There are pockets of absurdity in the market, and this kind of shake-up has been long in the offing.

Judging from the calls and emails that I am beginning to receive, the situation could become worse as investors ignore fundamental arguments, and even traditional valuation metrics are associated with growth.

Tech is infamous for momentum in either direction and many investors in the market now only hear about the crash, and listen to pundits making unflattering comparisons. It is not the same, but it does not mean that a dollop of panic is not taking hold now. This happens when people are afraid of being a sucker, not when they are blindly throwing money at hysterical stories and valuations.

Today's Session

At least there will not be a farce of a strong openings as equity futures declined quickly, lead once again by serious pressure in NASDAQ names. Selling begets selling, and anxiety is mounting. This is a washout for sure, taking good names down with less quality names. It's how opportunities are created but never fun, especially when you're long a few names under pressure.

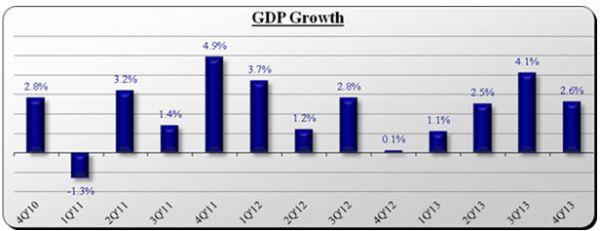

The GDP report isn't moving the market, although it didn't help, coming in slightly below consensus.