By Carlos Guillen

Despite some rather positive economic data points, which suggest economic activity is still improving, investors have continued to sell as many could not refrain from following the herds.

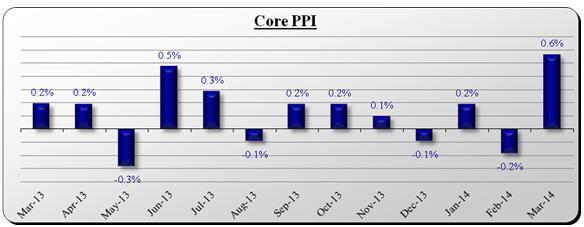

Perhaps not so encouraging for those who are expecting no tapering in the short run was news of increasing prices from a producer's perspective. According to the Department of Labor, the Producer Price Index (PPI) in March increased month-over-month by 0.5 percent; this compares with the Street's consensus estimate calling for a 0.1 percent rise. Because retailers try to pass costs on to consumers as soon as possible, the PPI can provide hints on future trends for the CPI, which overall has held pretty stable at a rate of 1.56 percent on a year-over-year basis as of February. The rather surprising increase in PPI was mostly as a result of services costs climbing by the most in four years while commodities stagnated. Excluding food and energy contributions to the price index, core PPI increased month-over-month by 0.6 percent, while economists' average forecast called for a 0.1 percent rise. These recent increases in prices are also likely to make the Fed flinch, taking away some of the inclination to remain "accommodative" as the most recent FOMC minutes suggested this past Wednesday. Nonetheless, despite the increase in cost for producers, it is difficult to see these costs going higher as there is little evidence of rising demand world-wide, which we believe will leave the Federal Reserve enabled to maintain its course on their current policy.

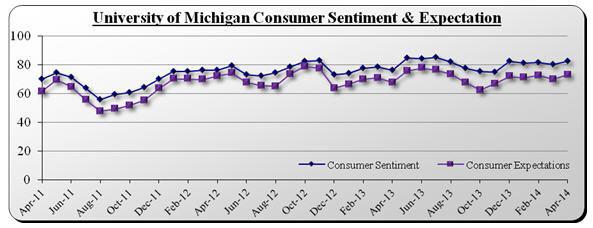

Clearly the most encouraging economic data out today was that consumer sentiment not only landed higher than expected but also reversed its negative direction from last month. The University of Michigan's Consumer Sentiment April result landed at 82.6, higher than the Street's expectation of 81.0, increasing from the 80.0 reached in March, and reaching the highest level since July of last year when it was 85.1. Given the close relation between consumer sentiment and consumer spending, this reversal in sentiment may fuel hopes that consumption may continue its uptrend. As it stands, according to the most recent government data, personal consumption expenditures increased quarter-over-quarter by 3.3 percent in the December quarter, which ramped higher from 2.0 percent in the prior quarter. Putting the icing on the cake, the index of expectations six-months from now, which more closely projects the direction of consumer spending, rose to 73.3 in April from 70.0 the month before, beating economists' forecast of 71.4.

In all, it is apparent that investors are jittery; however, we cannot say they are panicking as overall volumes are not significant enough to prove this. On a lighter note, given that volumes are not suggesting downside conviction, the losses posted this week could easily reverse next week. For certain, next week's trading session promises to be a very eventful one as a host of economic data will be on display, including retail sales, CPI, manufacturing, and housing data; as well as more 1Q earnings.