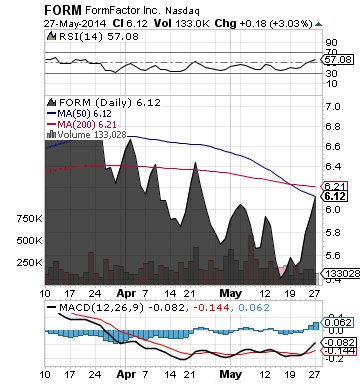

FormFactor Inc. (FORM)

FormFactor Inc. (FORM)

Keep a close eye on FORM. The company has raised its revenue guidance, driven by customer demand across the SOC and the DRAM segments.

For its fiscal second quarter of 2014, FORM expects revenue to be between $65 and $69 million, higher than its previous revenue guidance of $62 to $66 million. Non-GAAP gross margin is expected to be between 34% to 37%, higher than FORM's previous gross margin guidance of 31% to 34%.

FORM's management will further discuss the financial guidance on May 29th, 2014 at 2:00 p.m. EDT, or 11:00 a.m. PDT, at the previously scheduled Cowen and Company 42nd Annual Technology, Media & Telecom Conference.

FORM is a leader in advanced wafer test solutions. Its advanced wafer probe cards enable semiconductor manufacturers to lower their overall production costs, improve yields, and bring next-generation devices to market. The company's acquisition of MicroProbe creates the leading wafer test solution provider for both memory and non-memory semiconductor manufacturers.

More about FormFactor Inc. (FORM) at www.formfactor.com.

**

Read Full Disclaimer at www.finance.crwe-pr.com/disclaimer

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.