What do we look at when we want to know if there will be a short squeeze to the upside in gold and silver?

Well, we look at the managed money short positions. These are the hedge funds and commodity trading advisors (CTA's). If these people go short, then the price goes down and when the get long again, the price goes up.

You can find all info on the COT report site.

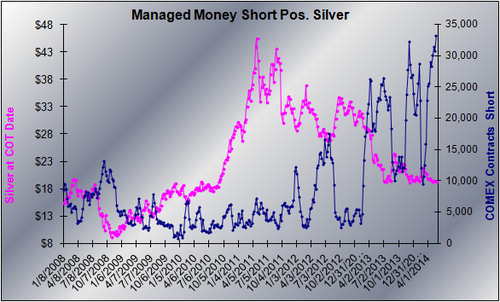

For example, the chart (May 28 2014) below indicates that there are a record amount of silver shorts at this moment. Each peak in the blue chart marks a bottom in silver price. So at least we will see some sort of price spike in the coming weeks in silver, when these hedge funds go long again from a record short positioning.

|

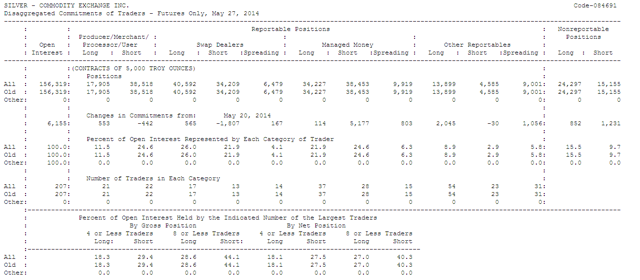

You can always find the latest numbers here. The latest managed money short number is 38453 shorts, which is a record high number of silver shorts, even higher than in the chart above. There is potential for a good short squeeze. |

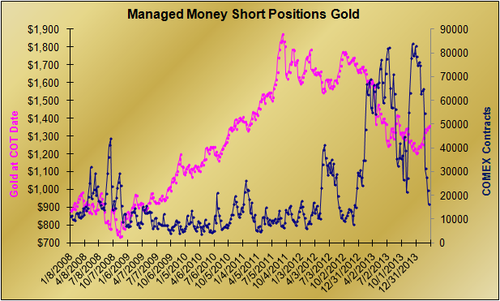

As for gold, the last chart I could find is from March 2014. But you can always find the latest numbers here.

|

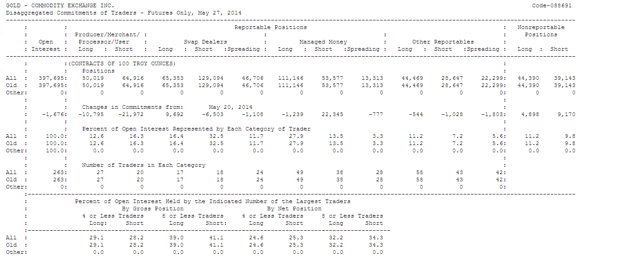

The latest number for the managed money gold shorts is 53577. If you compare that to the chart above, that's also a pretty high number. So again, there is a potential for a short squeeze a few weeks from now.

So now you will have another report to look at. This will at least give you the tools necessary to predict sudden gold/silver price spikes.