Cisco Systems, Inc. - Not a Profitable Place for Your Money Right Now and Down the Line

Cisco Systems, Inc. is not one of the leading Dow 30 - Industrials composite Companies. The recent 20% pull-back says two things for me and hopefully for you too.

First it is telling me that it is going down in the coming months. Second the little rally since mid-December is giving Investors a chance to get out in the coming few weeks or perhaps less.

For several months I have said: Cisco could well (highly likely) be topping after a nice recovery since mid 2011. Caution is definitely Warranted. Nearly a 20% drop from its highs of July is telling me and I hope You a story. If, and I say "IF" - this late December rally is tepid, I would strongly consider Cash. So far it is TEPID !

At this writing there has been a 20% rally since the December lows. What does this say to me? Nothing Much!

My previously written articles on CSCO (just click) provide you the history of my forecasting, its accuracy and support for my performance. For over 50 years my management objective is to identify changing trends for my forecasting analytics. I simple want to have current notes to quickly refer to on the anticipated direction of this company and its industry peers.

My previously written articles on CSCO (just click) provide you the history of my forecasting, its accuracy and support for my performance. For over 50 years my management objective is to identify changing trends for my forecasting analytics. I simple want to have current notes to quickly refer to on the anticipated direction of this company and its industry peers.

My Performance (my 5-Year Table) for Cisco Systems, Inc. is available by clicking: (CSCO) I treat Cisco just like any other Company, and my performance is an excellent credential that I will not hesitate to move my Clients to Cash when my Forecast dictates.

Look at the Profits for CSCO - Over the Years

It is simple, all Companies Cycle from "Favorable" to "Un-Favorable" and in between, they are "Also Rans." This horse-racing metaphor is the best guidance I have to explain how to know the Good / Bad and the Ugly for all securities on the planet.

Cisco - has: a) gone nowhere in 20 years - - SO - - (study the peak to peak and trough to trough); b) is UP over 100% in Favorable time-frames; is DOWN over 50% in Un-Favorable time-frames; and c) has spent years as an "Also-Ran." The Company - has: a) gone Up in 20 years (study the peak to peak and trough to trough); b) is UP over 100% in Favorable time-frames; is DOWN over 50% in Un-Favorable time-frames; and c) has spent years as an "Also-Ran." What a Waste of time and money during "Un-Favorable and Also-Ran time frames - don't you think?

The Company like so many others has taken some big hits over the years!

Have a long look at this Chart, it tells you a story about how to make and preserve your profits. Click on CSCO. It is not hard to understand how Bear Markets can cause financial set-backs for years and in many cases those set-backs are never recovered. I have over 50 years of successfully doing what I call "preventative maintenance."

Make just a 5 - 10 minute Study of this chart and the others I provide in similar articles you will be convinced that "Being Selective" with the "What" and the "When" of investing your money you will become a very profitable Investor. It is my clear answer to being a Consistently Profitable for my Clients. If you are not "convinced" - - then - - stay with your mutual funds and remain an Investor willing to accept Up and Down performance similar to this Company over the coming years. I suggest that - You deserve Better . . .

( Please go-to my Wednesday - Thumb-Nail - for my articles on ""Sectors." )

You can do better / have it all and I can teach you how !

More Support for My Dow 30 Forecasting Accuracy

The following article supports my Methodology of "Investing Wisely" and with superior and consistent annual profits. Just Click.

My management objective is to identify changing trends for my Forecasting Analytics. Simple stated, I want to have current notes to quickly refer to on the anticipated direction of this Sector and Industry Group.

This week's Commentary on - Cisco Systems, Inc. (CSCO) - covers all of my Indicators, both Fundamentally for Valuations and Technically for Momentum.

A Special Note for Seniors & Retired Investors - Dividend Yield: 3.10%

I believe you folks deserve much better service and investment direction and guidance that either Wall Street or the Brokerage Community is / has been providing. Being a retired Asset Manager / Financial Analyst is a joy for me to assist you and meet your investment - needs, goals and objective. Peace of Mind for you is my mission.

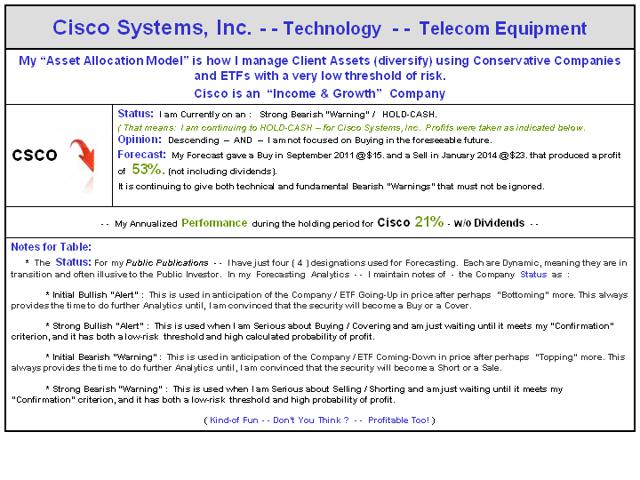

Forecast w/ 5 Year Performance

Cisco Systems, Inc. and other Networking Companies are tracking well. Although (CSCO) is in a strong Rally it is always an excellent contributor to my Analytics. A little history for my Forecast for Cisco: in 2010 was clearly on target. It was for a Pull-Back from the March highs of $26 and stuck with it all the way down to $14. - some fifteen months later. March 2010 was three and one half years ago and Cisco is just recently recovered back to $26. I hope you will read the above with an appreciation of just what Accurate Forecasting can do for you and your portfolio. Forecasting with my Methodology can be both profitable and save you heartache, in a Company or General Market Bearish time frame. You might want to - Think About That - for perhaps better / more profitable management of your portfolio in the future.

Note: The below Table is for your review, questions and perhaps thoughts. If you are seeking to "Invest Wisely" in my "Income & Growth- Asset Allocation Model" - - please Email me to open a dialog on how I go about providing super performance with a very low threshold of Risk.

My Current Forecast is not as bright as you may be lead to believe !

If you own or are considering owning Networking Companies, the securities require "Selectivity" (see below peers list). Cisco Systems, Inc. is currently strong Technically (back to the highs of early 2010 mentioned above) but I have reservations about my Fundamental Valuations, therefore I have placed it on an Initial Bearish Forecast - "Warning."

My Current Opinion is Hold-Cash !

* Fundamentally - ( weighting - - 40% ), my Valuations remains relatively strong but are producing future declining projections. This coupled with an over-bought and over-valued General Stock Market does not make for a positive fundamental picture to investing into or to perhaps even hold.

* Fundamentally - ( weighting - - 40% ), my Valuations remains relatively strong but are producing future declining projections. This coupled with an over-bought and over-valued General Stock Market does not make for a positive fundamental picture to investing into or to perhaps even hold.

* Technically - ( weighting - - 35% ), my Indicators are clearly breaking down. The recent large (near-term) pull-back is offering strong support for my Bearish "Warning." A re-bound rally was in the making and is in progress - - the strength of which is telling me to advise Clients to "Take Profits - and - move to Holding-Cash." It is selling for $24.

* Consensus Opinion - ( weighting - - 25% ): My third pillar of Research is one that is ALWAYS distorted to the Positive by most all financial analysts. I believe that is because they are afraid of being Bearish. I Am NOT! My articles on "Reality" are supportive of this - have a look.

Please read my previous postings on Cisco: CSCO for accuracy of my forecasting.

Consensus Opinion - ( weighting - - 25% ): My third pillar of Research is one that is ALWAYS distorted to the Positive by most all financial analysts. That's because they are afraid of being Bearish. I Am NOT! My articles on "Reality" are supportive of the below 20 year Chart.

I will personally and promptly reply to any serious investor's inquiry as to my very cautious position for (CSCO) !

Selectivity

"Selectivity" is what I preach (along with Discipline and Patience) and is what separates the Average Investor and Mutual Funds from the profits that come with long-hours / hard work and "Selectivity."

Here are a number of the Component Companies / Peers in the Telecom Equipment Industry Group that I focus on: (CSCO), (BRCD), (RVBD), (TIBX), (INFN), (EXTR), (QLGC), (ALVR), (XXIA), (ELX), (ALLT), (NTGR).

| Note: Should you have interest in my professional guidance and direction for your Portfolios, please Email Me with your questions or thoughts: senorstevedrmx@yahoo.com. For Daily Updates and a Deeper View into my work / Analytics, you might want to Click and Scroll Down to my "Thumb-Nail" Articles within my personal blog. Please spend some time reading my articles for a perspective of their and also viewing my Bio before making inquiries. Sharing a bit about yourself and your financial and needs, goals and objectives would be appreciated. A relationship between You and Your Asset Manager must be a "Win / Win" affair. You get the Performance and the Education and I get paid for my Analytics / Work and Experience. |

Smile, Have Fun, "Investing Wisely,"

Dr. Steve

CSCO, BRCD, RVBD, TIBX, INFN, EXTR, QLGC, ALVR, XXIA, ELX, ALLT, NTGR