Even in a time of rapid global news dissemination provided by hundreds of thousands of journalists working around the clock, an observant Dutch blogger can still get a global scoop. How significant a scoop? The true size of China's massive total gold demand!

Just four years ago, Koos Jansen became intrigued by the relationship between gold and money, after reading my Dutch book "Overleef de kredietcrisis". In May 2013, he responded to my tweets about the exploding Asian gold demand, after the dramatic fall in the gold price a month earlier. We were surprised to learn that at the time, no reliable statistics of the total Chinese gold demand were available in the English language.

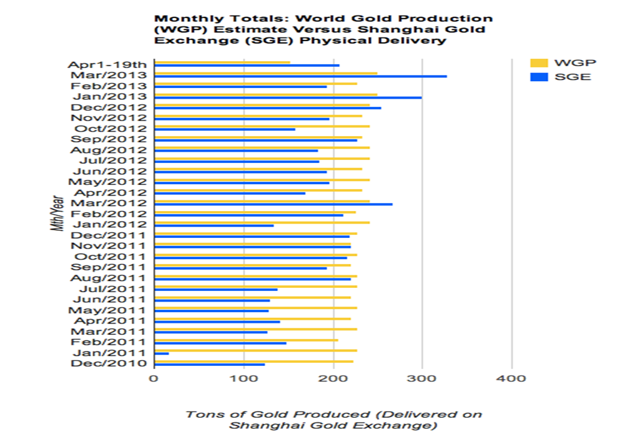

It did appear, however, that the Shanghai Gold Exchange (SGE), the Chinese counterpart of the COMEX, played a crucial role in the Chinese gold trade. Only the goldminerpulse.com website kept track of the ever increasing physical gold deliveries at the SGE, as it monitored the trade on the gold futures index. The site published the following chart, which showed that the total physical delivery had become almost as large as the total world mine production. I used the chart for our annual shareholder meeting, in April 2013.

Koos decided to dig deeper into the matter after a discussion about the accuracy of this data had arisen on Twitter. He was pointed to the differences between the English and the Chinese websites of the SGE by a Chinese person with knowledge of the matter. Koos decided to call the SGE for clarification. Sound, classic journalism. After intensive research, he came to a new understanding of the Chinese physical gold demand.

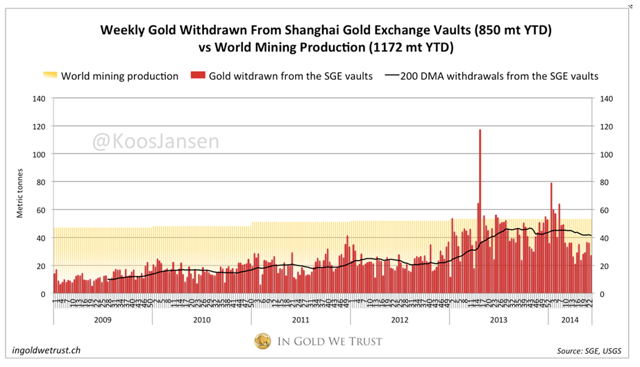

It transpired that all Chinese gold imports and domestic mine production must initially be sold through the SGE. The correct figures of how much gold is actually physically withdrawn from the SGE vaults are only published on the Chinese website of the SGE. Through his tweets this information quickly spread to thousands of followers. He soon followed up with a weekly analysis of the gold imports through his blog www.ingoldwetrust.ch.

In my previous blog titled 'Chinese Physical Gold Deliveries Match World Gold Production' (June 2013) Koos research convinced me to predict;

'Annualized, we can expect total physical deliveries from the SGE to amount to at least 2,000 tons this year.'

More and more insiders began to notice that it wasn't Reuters or Bloomberg that was making the best analysis of Chinese gold demand, but it was done by Koos Jansen. His charts showing that China's gold demand was exploding whilst the price was dropping precipitously, were increasingly seen as evidence of a possible market manipulation.

Even Canadian billionaire and gold expert Eric Sprott referred to Koos' analyses. They show that the official data published by the World Gold Council (WGC) can't be correct. Data on which banks such as the Dutch ABN/Amro have relied for years. According to the WGC, China's gold demand in 2013 is a mere 1,066 tonnes, whilst Koos shows this is in fact 2,197 tonnes. By comparison, the total world mine production is only 2,900 tonnes.

But his star really began to rise after revealing the Chinese plans for gold in relation to the financial system, by a series of important official speeches which he had translated into English. He discovered the following Chinese statements, which became very important elements of The Big Reset, my latest book.

- 'The state will need to elevate gold to an equal strategic resource as oil and energy, from the whole industry chain to develop industry planning and resource strategies

- 'Individual investment demand is an important component of China's gold reserve system; we should encourage individual investment demand for gold.'

- 'Currently, there are more and more people recognizing that the 'gold is useless' story contains too many lies. '

- 'Gold now suffers from a 'smokescreen' designed by the US, which stores 74% of global official gold reserves, to put down other currencies and maintain the US Dollar hegemony.'

- 'For the Fed, it is crucial that the dollar dominates the world and so the Fed will store gold reserves from countries all over the world to control the gold settlement system.'

v 'We should 'achieve the highest gold reserves in the shortest time.'

At a gold conference in May of 2014, Bloomberg could no longer ignore the new data so the news agency announced that it was now working on a new model that more accurately describes the Chinese gold market.

Final confirmation of the accuracy of Koos' data came after a translation of a recent speech by SGE President Xu Luode, who confirmed that China's total gold demand in 2013 was indeed more than 2,000 tonnes, double the official figures of the WGC.

Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.