-----My apologies, not sure if OTR or OTP exist anymore, they may be somewhere in some sort of ETF purgatory, still existing in various online databases, and on the Ocean Tomo 300's website's text, but not on the Guggenheim(related to Claymore) products page for example. I believe the index its self is still alright, but OTR/OTP may perhaps be sort of ethereal investments per se. The growth oriented index being; OTPATG with the normal index being simply OTPAT. Thanks again for reading, my apologies if that caused any confusion.

Guggenheim Etf's;

guggenheiminvestments.com/products/etf/product-list

---------

The sort of casino-reminiscent nature of the sometimes semi-random quotes that are generated at the bottom of a Google finance quote lookup have today generated a really interesting gem, perhaps amongst the sea of investment opportunities that reside on the stock exchange per se.

__________________

Perhaps the intrigue of the abbreviated name as it appeared in the little spreadsheet per se was just too much, however, today I was introduced by chance, to an index that providentially perhaps, seems to really sort of intertwine with some previous writings and musings per se on the new age of technology that perhaps lies ahead of us and amongst us now.

source;

mydomadesign.com/wp-content/uploads/2013...

__________________

Hence in searching for latest news on FIW, a water index, which I like for mostly international diversification reasons(price to book for FIW is looking decent for this sort of investment per se aswell, though most similarly themed indexes have relatively similarly ratios in said regard)relative to other indices, I came upon OTP and OTR. OTP is the sort of I guess rudimentary if one could call it that, version of the aforementioned index(in fund form), while OTR is the growth oriented version. The index its self has the Amex ticker of OTPAT, or good old overtime-Pat if one is feeling poetic. As a side note, though the two funds, OTR & OTP seem to be quite similar in so far as performance is concerned, it seems that OTR seems to pull ahead to the upside on occasion, converging later etc etc. In fact this might be an interesting sort of options trade per se if one will, if that is to one's taste per se.

__________________

Either way, the index its self is quite interesting. According to the portion of the website of Ocean Tomo, that's dedicated to the index;

The index is currently weighted as follows;

Small Cap

10%

Mid"

40%

Large"

50%

--

Tech

35%

Cons. Non-Durable

29%

Basic Mats.

10%

__________________________

The companies represented by the index's holdings per se, are according to the description of the index, chosen based on their quality whereby they represent a model whereby a large proportion of their organization's assets per se are represented by intangible assets, or something of that nature.

_____________

The list of companies which comprise the index seems to be quite varied and interesting perhaps, and can be found on this link here;

www.oceantomo.com/system/files/2009-2010%20OT300%20Constituents%20by%20Company.pdf

____________

This is perhaps an interesting sort of index in that it may sort of represent, like HTGC et al., an opportunity to sort of get on the train of future "growing" companies per se, regardless of sort of more sector based themes. In a sense allowing one to invest in those companies which may potentially sort of lead their sector in regards to investments into intellectual/intangible capital if one will, without having to also invest in companies in that same sector who may not be so patent/"R&D" focused. Surely there are other ways of doing this aswell, but perhaps this represents a sort of convenient way of doing so en masse for a variety of sectors if one will.

_____________

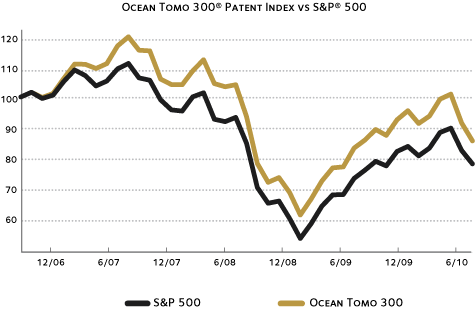

I don't mean to cite so much from the index formulator per se's website but here's an attractive representation of the performance of the index, which seems to be somewhat better if one will, than the S&P 500, historically speaking per se.

*-from webpage whose adress ends in ot300.html cited above.

*-there is another image depicting this which goes back a little further, on the webpage this is linked from, however this representation would presumably be using back-filled data, which may none-the less relate the potentially attractive nature of this index.

________________

Either way this was perhaps an interesting index, I myself was previously unaware of it, it seems interesting though, and seems to play nicely into the theme of investing in future tech-growth per se, in one way or another.

________________

Hopefully this has been perhaps interesting to others aswell, thanks again for reading, index investing or not, I hope everybody's investments are going great in this particularly sort of interesting market environment. Thanks again for reading.

_________________

source; www.wall321.com/thumbnails/detail/

20120804/ocean%20waves%20seascapes%

201680x1050%20wallpaper_www.wall321.com_68.jpg