With the market in general per se, being a little "rough" if one will these past few weeks, I figured that it might be a sort of ideal time to look back on the performance of some water index related stocks.

_____

_____

The water stocks used here are none other than PIO, FIW, and CGW. Though one might presume that these stocks might have similar returns per se, it seems that there is a slight amount of alpha or systematic yield per se, based on approach to forming said portfolio of water stocks per se, that can pay dividends or at least yield in this case(at least in the medium-long term). In so far as these indices in general are concerned, it seems that they tend to be "industrials" heavy, and they tend to have an emphasis on water investments on either side of the Atlantic per se, in general.

_____

The Guggenheim ETF, CGW, is an interesting sort of fund. It's holding-weighting strategy per se, produces an interesting sort of holdings distribution pattern. It heaviest holdings per se, comprise around 5-7% of its portfolio, and this sort of trails off in a sort of wedge like manner into a sort of long tail of around 1% of portfolio holdings-positions. It may also be worthy of note that it has 52 different holdings in its portfolio based on the S&P Global Water Index. As one last note per se, this portfolio has a price to book of roughly 2.4.

CGW website; guggenheiminvestments.com/products/etf/cgw

_____

The First Trust water index investment, FIW, is another interesting water investment if one will. It has 36 or 37 holdings(counting holdings in cash/cash-proxies), and is based on the ISE Water Index. The fund its self, seems to select its holdings based on market-capitalization in general, so perhaps that may be a somewhat interesting approach. This fund's price to book is around 2.25, perhaps placing it in between the other two funds per se.

FIW website; www.ftportfolios.com/Retail/Etf/EtfSummary.aspx

_____

Not to leave our third entry per se out in the cold, PIO is also an interesting investment. It has that similar price to book value of around ~2.15. It also has a sort of heavy top position weighting in some cases with some positions holding upward of 7% to 8% of the total portfolio's assets per se. It also seems more geared towards large and mid-cap growth stocks per se, and is quite US-centric, with about 40% of its holdings representing US-water-related-investments. In so far as # of holdings and base index are concerned, PIO seems to be based on the Nasdaq water index, as opposed to that from the S&P, and has a total # of holdings value of 36 or 37, depending on if one counts cash etc.

PIO's Website; www.invesco.com/portal/site/us/investors/etfs/product-detail

_____

Just before we get to the tables and graphs, for the current dividend yield for these guys per se, we have the following;

(from Google Finance, similar source for the data used in the other data-displays further below)

CGW; 1.49

FIW; .69

PIO; 1.94

_____

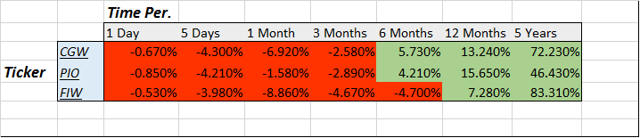

According to data from Google finance concerning the price changes of these guys, we have the following for a more long term picture for these water-index-investments in general;

Price change over time;

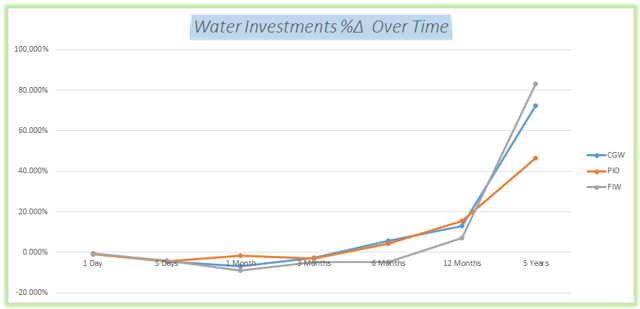

and a chart to see this from another angle if one will;

_____

Hence in the data, one may see that FIW in particular is sort of interesting, is has the lowest 1 day losses for today, and the highest 5 years gains overall, just barely edging out CGW for the top spot there. In the interim it seems as though CGW and PIO break even into positive values per se a little earlier, but it seems as though CGW continues that positive streak over time per se, a little more than the other stock that breaks even at roughly the same time per se. FIW seems to pull out the median price to book value per se, at the moment, with the highest long-term gains, but just barely over CGW. Whether this makes it better or not is perhaps a sort of qualitative sort of individual preference call perhaps, for surely it seems a touch more volatile per se, or dynamic if one will.

_____

Either way, hopefully if one had water stocks or water investments on one's mind this hopefully helped partially quench that thirst per se. In addition to these sort of investments, there are also sort of interesting water mutual funds if that is more to one's liking per se. One notable water-mutual fund perhaps being CFWAX for example, which is managed by ye olde Calvert Investments, down here in Maryland, which seems to have other interesting sort of sustainable-investment related products on offer aswell.

Calvert Water Fund website;

www.calvert.com/fundProfile.html

______

However one goes about adding a little water-stock action to one's portfolio is seems as though in the relatively short-term they look rather similar even if based on somewhat different underlying indices per se, so perhaps just as one may prefer Aquafina or whatnot to Poland Springs, perhaps water investments are somewhat similar, or perhaps some quality of them may be a better fit with one's specific portfolio per se, in regards to the beta/alpha melange of one's own individual investments. Either way hopefully this helped others perhaps get their feet wet aswell per se, in regards to these "liquid investments" if one will. Thanks again for reading, and I hope everybody's investments are doing great.