Silver Wheaton, SLW, is the largest silver and gold streaming company in the world. SLW has a very good business model in that it finances mines and then receives gold and silver at a fixed cost for the life of the mine. SLW is receiving silver for around $5/ounce and gold for around $400/ounce. Currently silver is trading for around $19.50/ounce and gold $1300/ounce.

There are differently held opinions on whether or not precious metals should be held in a portfolio. I believe that precious metals being a finite resource like oil have value and have a place in a diversified portfolio. Especially now as they are cheap. Not to mention the world wide economic stimulus currently underway and potential future inflationary pressures among other things. Here are links to two articles that give an overview of silver and gold http://geology.com/articles/uses-of-silver/ and http://geology.com/minerals/gold/uses-of-gold.shtml as well as some nice images to put amounts of gold into perspective http://demonocracy.info/infographics/world/gold/gold.html

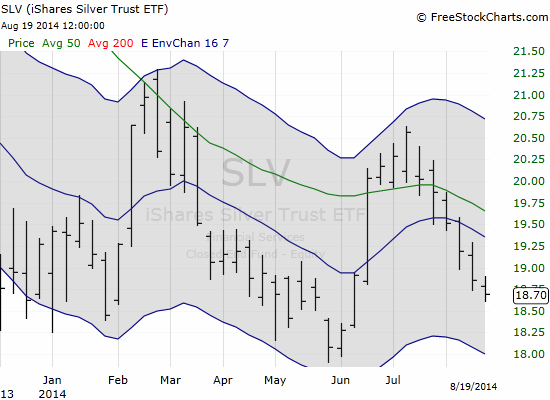

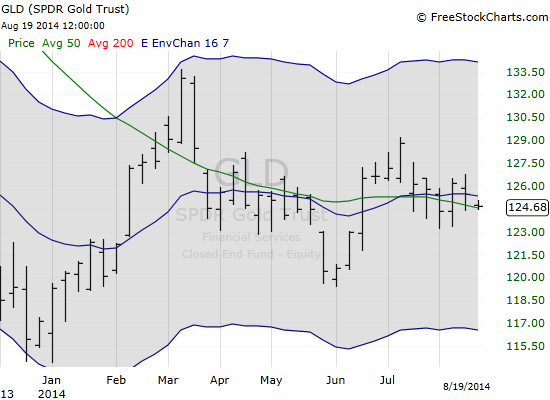

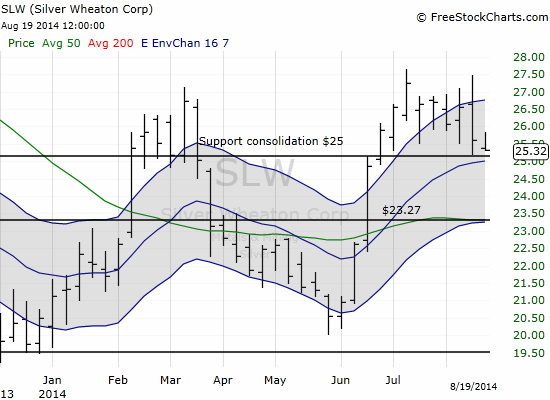

SLW tracks the price of silver and gold here are charts for 2014 of silver SLV, gold GLD and Silver Wheaton so that you can observe the correlation. You can see the closer correlation of SLW to silver rather than gold.

For a larger perspective silver and gold hit highs in the beginning of 2011 and have been in a downtrend since. 2014 has been up and sideways for the year in the price of gold and silver.

SLW is an advantageous way of owning gold and silver in your portfolio. Owning large amounts of the physical bullion and having to deal with storage etc or owning silver and gold through an ETF like the SLV or GLD and having to pay an annual expense ratio both have their disadvantages. SLW gives you a way to own silver and gold and pays a dividend.

SLW has pulled back after their latest earnings report because they missed on EPS, revenue and reduced the dividend. Short term these factors have sent SLW lower, with any increase in the price of gold and silver SLW will be a rocket ship. I have started nibbling just above $25/share via stock as well as March 2015 23,24,25 strike PUT options yielding 6,7 and 8% premiums. I may be early but there is support at $25. I am nibbling seeing a pullback lower could very well be in the cards.

Financial and technical keys: Financial VIA Charles Schwab and Charts Via freestockcharts.com

PE 28.81

FPE 27.61

ROE 9.36**

Dividend % 1.11

Payout Ratio 37.51

Current Ratio 7.48

Debt To Equity %28.51

Rock solid financial data. SLW's ROE will go significantly higher if gold and silver head higher.