A study by business consultant McKinsey & Co brought out the possibility that China's e-commerce market would soon outpace that of the U.S. very soon. It forecasts that the Chinese market will grow between $420 billion and $650 billion by 2020.

Another study by Forrester research estimated the e-commerce market of the U.S. will likely hit $370 billion by 2017. Though the two studies, cited by Investorplace.com, have different time frames, the difference is only about three years.

As it is, Chinese giant e-commerce site, Alibaba Group Holding (Nasdaq: BABA) - set to launch its $20 billion initial public offering (IPO) in New York in September - has bigger sales and market value than that of the two largest American e-commerce sites combined, eBay and Amazon.

The Alibaba IPO has piqued the curiosity of the market, but at the same time made smaller companies planning to publicly list next month to think twice and postpone their IPOs for fear of being crowded out by Alibaba even though the company is not known yet among many US retail investors since it basically deals with Chinese buyers.

Investment expert James Brumley noted that the excitement generated by Alibaba's forthcoming IPO "has reached a level of hype not seen since the dot-come era of the late 1990s."

It is not only Alibaba that is booming. Other Chinese e-commerce sites are also benefitting from the Internet shopping craze sweeping across the Asian giant.

JD.com (JD), called the Amazon of China, logged an impressive 64 per cent boost in revenue for Q2 2014 compared to the same quarter in 2013. For that period, it had a 38 million customer base.

Dangdang (DANG), another Chinese firm, reported a 31 per cent hike in revenue, while Cheetah Mobile (CMCM) logged an astounding 139 per cent growth in the last quarter, with revenue hitting $61.3 million. Cheetah likewise reported that the number of its active users have reached 284 million.

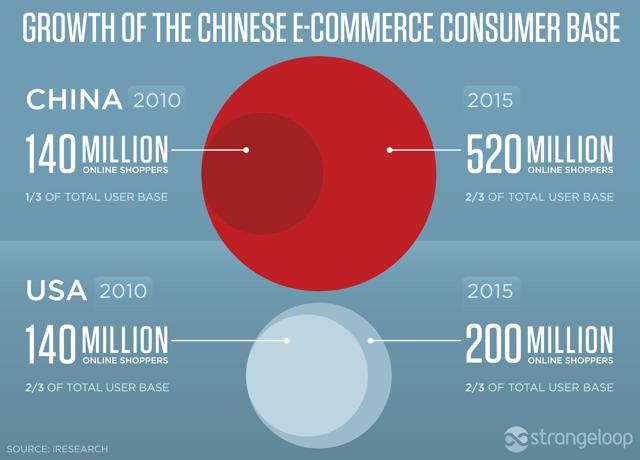

With China's population now at 1.35 billion, only about 50 per cent of Chinese are Internet users, while the US enjoys 87 per cent Internet usage rate among adults. The implication of those numbers is that China's e-commerce market has a lot of room for growth, which explains why the investing public is anticipating the public launch of Alibaba in September.

But public expectation should not be the sole basis when buying stocks. Experts recommend that people should acquire investor education before considering joining the stock market.

One good source of investor education is Red Bank, New Jersey-based investment education company InvestView (OTCQB: INVU).

InvestView, Inc. provides and delivers a comprehensive online program of investor education: proprietary investor search tools and trading indicators, weekly newsletters as well as access to live weekly Trading Rooms. It delivers subscription-based financial education courses through InvestView's web site. InvestView also allows new retail investors to use the portal's subscriber information on a 2-week trial period for $9.95.

The company does it through its online education, analysis and application platform that provides analysis, tools, education solutions and an application. InvestView's web-based tools were designed to simplify stock research and improve the investor's research efficiency. One such tool is the Market Point, which is made up of five sections, namely: Charts, Stock Watch, Market, Calendar and Campus.

InvestView offers five training courses that provide an incredible education in the stock market. The five InvestView courses build upon each other. Beginners should take them in the suggested sequence, while more seasoned traders may jump right into the more advanced topics that they are craving to better understand and give them the edge as a successful trader. Each course is offered via live webinar and as a recorded on-demand videos that is immediately posted at the end of each webinar. For more information, please visit their web site.