An Iron Condor has a non-directional bias. Some time it seems like traders use it as a trade on time-value to collect option premium, this is not really the case. In Iron Condor is a non-directional bias play on volatility. This is an advanced options strategy that can sometime be difficult to execute so it may not be optimal for all traders.

Anyway, so when executing this type of trade we bet on implied volatility going down.

E.g lets say that we are considering selling some Apple Inc (AAPL) October 14 $105 calls with an IV of 22.65%. This implied vol means that the market expects Apple to move in either direction 22.65% under normal circumstances, which means 68.2% (one standard deviation) of the time. This is the Implied Volatility we want to go down, not the VXAPL, which is the Apple Inc. Volatility Index. Which is vega weighted so it does not always give clear data on the out-of-the-money options.

A delta neutral trade

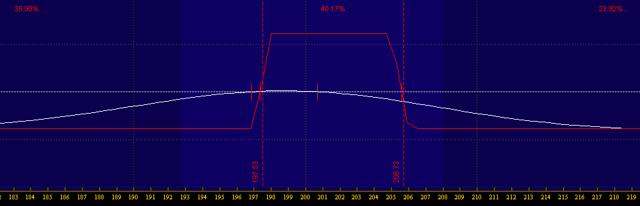

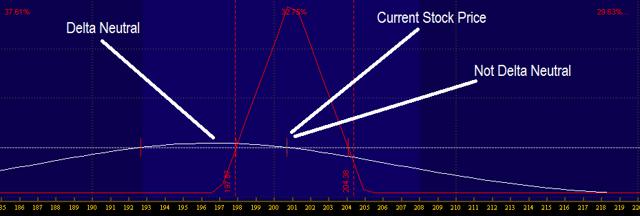

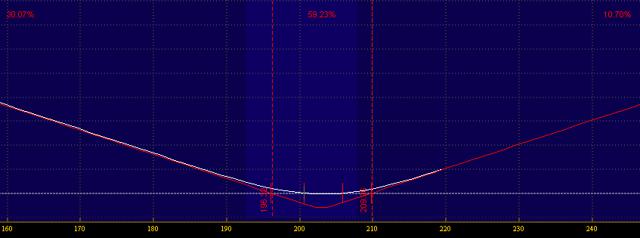

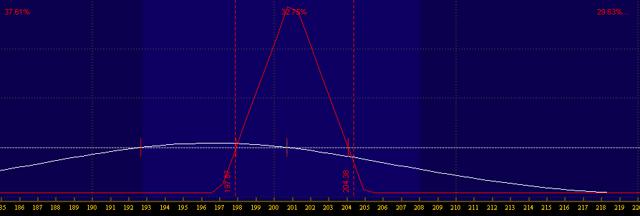

A delta neutral trade is a trade where we do not gain anything or lose anything if the underlying moves in either direction. Just because we are creating a delta neutral position does not mean that the delta always will be neutral. Depending on the inputs in the preferred option pricing models the delta may change. In the below risk charts the white line represents the risk graph "right now" and the red line represents the risk graph at expiration.

Data: Thinkorswim (Risk Graph of an Iron Condor)

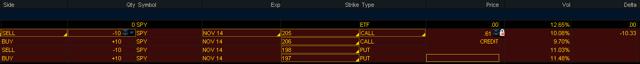

Data: Thinkorswim (Iron Condor setup)

As we can see on the "setup" chart the position actually isn't exactly delta neutral at the moment. The current delta is -10.33, this means that the current position will lose $10.33 if the underlying

If we for some reason want the position to be delta neutral when we execute the order (in this case) we could simply add 10 (=10 deltas) SPDR S&P 500 ETF's (SPY) to the position.

Below is a more clear example of a strategy that is supposed to be delta neutral but is not, at it's current stage. In this case we can see how the position is delta neutral at $196.5, and the delta is -74.32 at the current price. If we want to be delta neutral right now and use the same strikes, we could buy 74 positions in the underlying asset. In this case that would be 74 SPDR S&P 500 ETF's (SPY). Simply because the delta currently is -74.

As stated earlier, Iron-Condors are not theta plays. There are better ways to profit on theta then to use this strategy, that's why investors and traders should see this as a volatility trade and not the purpose of profiting from time. When executing this strategy there are better to look at a longer time frame, such as 70 days and try to be out of the position before the last 30 days to expiration, for the simple reason that theta increases closer to expiration.

Basic guidelines for Iron-Condors

- Try to have a wider spread between the wings.

- Set up Iron Condor that has 5-15 delta strikes

- At least 50 days to expiration, not less!

- Exit the trade when you have 30 days to expiration

- If open interest is low it may be a good idea to have a wider spread between the wings

- And the most important, set up your own profit/loss guidelines before entering the trade and follow them, because I don't think there is a good way to adjust this strategy

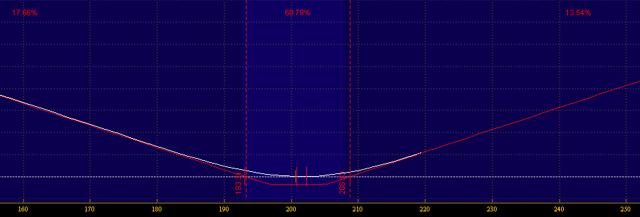

Options are probably the most flexible instrument on the market and I will know show graphs of some other delta neutral positions

Strangle

Straddle

Butterfly