Summary

- Yahoo! sold 140m shares in Alibaba, only to see them jump 38% immediately.

- Although Yahoo! raised $9.5 billion, pre-tax, it left $3 billion on the table.

- In contrast Softbank didn't sell a single share in Alibaba.

- Now the tail is wagging the dog, with investments in Alibaba & Yahoo! Japan worth more than Yahoo! itself.

- If only a clever accountant could find a way to break Yahoo! up. It would be good for everyone. Almost!

An excellent deal?

Alibaba jumped 38% on its first day of trading. And the lucky buyers of the $25 billion in stock saw the value jump by a sweet $9.5 billion on the day.

In fact, it wasn't just a paper profit for the institutional investors that got allocated the shares by the underwriters. Over 270 million shares traded (out of the 368 million shares sold). So over 70% of them locked in their profit.

With institutional investors making $9.5 billion, who lost out?

Yahoo! was 38% of the shares sold in the IPO.

The company sold 140 million shares. Raising $9.5 billion, pre-tax. Only to see the value of these shares jump by $3 billion immediately.

Perhaps this explains why Yahoo! fell by over $1 billion in value on the day.

What Softbank did

In contrast, Softbank, who's the other major shareholder in Alibaba, didn't sell a share. Softbank, who's Yahoo!'s Japanese partner, is now the second-largest company in Japan. Yahoo!'s not the second-largest company in the US.

I'm not a shareholder in Yahoo!. But if I was, I'd be fuming. Selling some of its most valuable asset for $3 billion less than the market thinks it's worth isn't a great signal of management's ability.

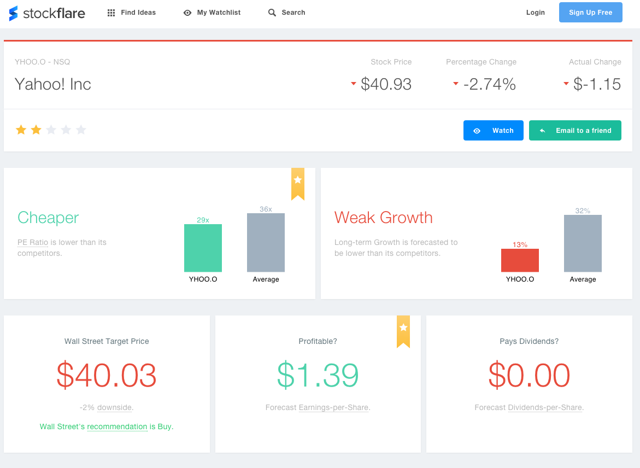

Even if I rated management, the outlook for the core business is poor at 13% growth versus the competitors at 32%.

So for now, I have to pass on Yahoo!.

So what next?

The tail now wags the dog. The stakes in Yahoo! Japan and Alibaba are worth more than Yahoo! itself (though that's pre-tax). And there's a lot of cash on the books too.

If only a clever accountant could work out how to sell the company to Softbank (so it got control of Yahoo! Japan and Alibaba), and then spin out the core business to shareholders in a new entity, everyone would be happy:

- Softbank creates value

- Management creates value for shareholders

- Yahoo!'s core business remains an independent US owned company

Well everyone except Uncle Sam's tax collectors. And even they would get some large crumbs!