By Hina Nawaz and Robb Soukup

SNL Financial Feature

Credit quality metrics continued to improve during the second quarter across the banking industry and will likely show further improvement as banks begin reporting third-quarter earnings.

But even as many banks have moved past the last credit crisis, industry observers say that many smaller institutions are still struggling with legacy problems, while some of their competitors are aggressively lending on terms that may lead to problems down the line.

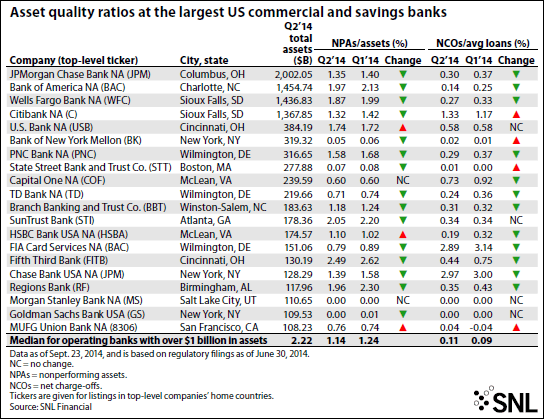

Indeed, the largest institutions in the industry have for the most part seen continued declines in levels of problem assets and net charge-offs as a percentage of average loans, according to SNL data. Bank of America NA, the main subsidiary of Bank of America Corp., saw nonperforming assets fall by 16 basis points as a percentage of total assets during the second quarter, and Wells Fargo Bank NA saw a 12-basis-point decline in the same metric compared to the linked quarter. Both banks also reported declines in net charge-offs as a percentage of average loans.

Some major regional institutions also continued to work down their problem asset levels. SunTrust Banks Inc., for example, saw NPAs fall 15 basis points, to 2.05% of total assets.

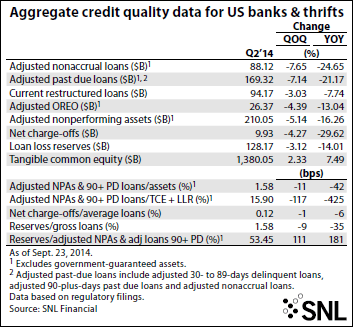

Industrywide, adjusted nonperforming assets fell 5.14% from the linked quarter and were down by 16.26% on a year-over-year basis. Adjusted nonaccrual loans and adjusted past-due loans declined, as did adjusted OREO and current restructured loans on both a quarter-over-quarter and year-over-year basis.

Net charge-offs were down 4.27% on an aggregate basis from the previous quarter and fell nearly 30% from the second quarter of 2013, according to data collected by SNL.

Still, David Ruffin, a founder and managing member with Credit Risk Management LLC, says the aggregate numbers and improvements at the largest banks are masking some remaining problems at smaller institutions. He said that a number of key credit metrics that his firm analyzes, including NPAs, have not fallen industrywide the way they have at larger companies. "The other side of the coin is disproportionately more difficult for community banks," Ruffin said.

Some of those smaller institutions still face "significant structural impediments, and many of those small banks are unable to work off that dead weight because they can't take the capital hit," Ruffin told SNL.

Loan loss reserves also fell on an aggregate basis, and as a percentage of gross loans, during the quarter. Reserves were 1.58% of gross loans on an aggregate basis, down 9 basis points from the first quarter and down 35 basis points year over year.

Those metrics have probably fallen as far as they can, according to Ruffin. "The short-term answer is that they've pretty well bottomed out … you're just not going to have many regulators allowing reserves to fall" much lower, Ruffin said.

BankUnited Inc. Chairman, President and CEO John Kanas argued at a recent RBC Capital Markets investor conference that, in fact, the biggest risk to the industry is "the next credit cycle - it always is."

He admitted during his presentation that he did not know what the catalyst would be for the next credit cycle. He also pointed to loose underwriting standards as a worrisome trend happening across the industry and said that bankers need to be vigilant despite the improvements in the economy and credit numbers across the board.

"I don't know where it is, or when it is, but credit can't stay this good forever - there will be a change," Kanas said.