Readers were introduced to the YMBC (You Must Be Crazy) High Yield Portfolio at the beginning of the year: (https://seekingalpha.com/instablog/379412-darren-mccammon/2860573-a-high-yield-portfolio-using-ubs-2x-etns).

Later, a risk analysis of the portfolio was published: (seekingalpha.com/instablog/379412-darren...).

This is the 3rd quarter update.

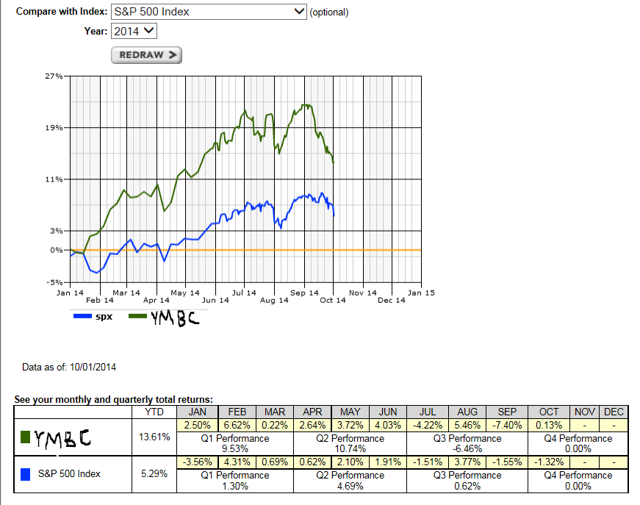

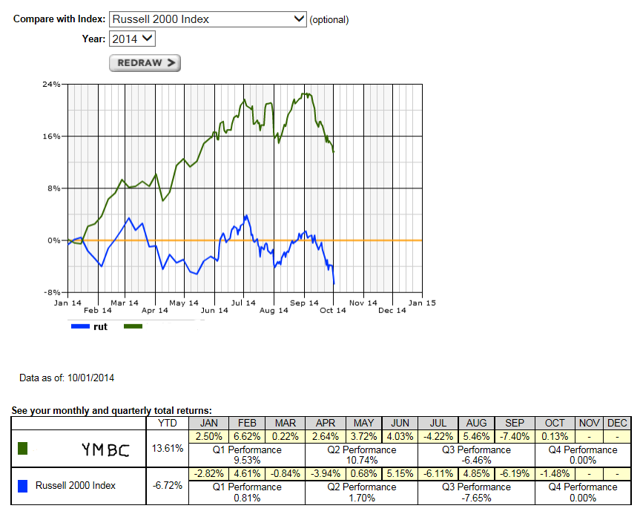

The YMBC (You Must Be Crazy) Portfolio was -6.5% in Q3 vs. the S&P 500 at +0.6%. It also saw significantly more volatility than the S&P (see graph). However, I think this was probably not due to the 2x leverage or a lack of diversification in YMBC, but rather a lack of diversification in the S&P 500. The fact is the S&P 500 is dominated by domestic large cap stocks. These are exactly the type of stocks which performed the best in Q3. If instead we compare YMBC to the Russell 2000

we see much more similar up a down movements. YMBC was -6.5% vs. -7.7% for the Russell 2000 in Q3. Year to date YMBC has outperformed the Russell +13.6% vs. -6.7% and the S&P 500 +13.6% vs. +5.3%. As YMBC contains a wider variety of capitalizations, the Russell may be a more accurate benchmark; but I'll probably stick with the S&P 500 since this is what most people consider "the market".

During the quarter two transactions took place. The first was the normal re-investment of dividends. Per policy, all dividends were re-invested into the worst performing component of the portfolio, BDCL. The second transaction was a sell of all CEFL shares.

My excuse for selling CEFL was that PHK and PTY, two bond funds in CEFL which trade at significant premiums to NAV, had just lost there star manager, Bill Gross. CEFs in my opinion, shouldn't trade at premiums even if there manager is the "King of Bonds". When the star manager leaves, well, it is past time to get out. In my opinion, considering it's 42% premium, anyone still long PHK at this point needs there head examined. Additionally, considering that discount to NAV is supposed to be one of CEFLs prime criteria, I really don't understand how PHK and PTY were included in the ETN in the first place. I would love an explanation by someone in the know more detailed than the obvious, "it had high yield". Regardless, UBS needs to re-examine it's criteria for inclusion and I need to be a little more careful with my assumptions. So, I sold CEFL for a logical reason; but I must admit, I also welcomed an excuse to raise some cash.

BDCL is the current component with the poorest record YTD; if it was earlier in the year BDCL is where the cash would go. However, it is near end of year and an RMD (required minimum distribution) needs to be funded. Also, we are getting to the point where there may be a fair amount of tax loss selling occurring with BDCs, so I'll wait until the new year to make the buy. (Or maybe UBS will have thrown PHK out of CEFL by then; or maybe PHK will have come down to reality; or maybe that new LMLP, it looks kind of interesting; or....well you get the point. No guarantee's. I'll make the decision when I do.)

The portfolio as of September 30th:

- 20% MORL

- 0% CEFL

- 19% DVHL

- 13% SDYL

- 13% BDCL

- 17% EFF

- 18% Cash

Expected Annual Income: 11.3%

Your comments, including criticism, are welcome.