IF THE WORLD IS COMING TO AN END, SHOUDN'T GOLD AND GOLD STOCKS BE SOARING? Not necessarily. Not when the US Dollar is rising. In fact, Dollar strength has crushed stocks and commodities, and commodity stocks. Seems like the only thing that the FED-manufactured Bull Market can't stand is a rising dollar.

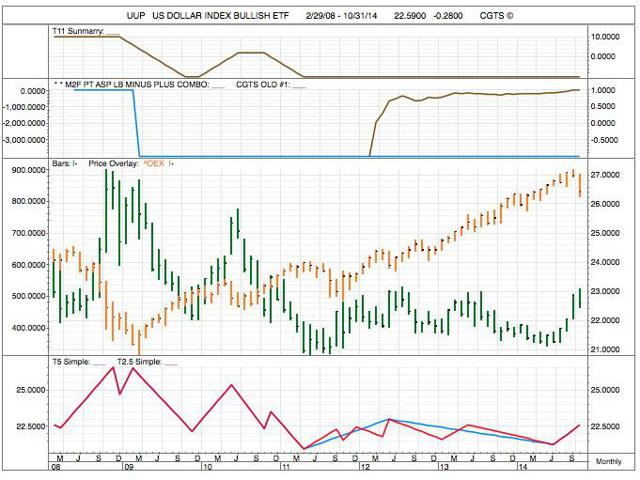

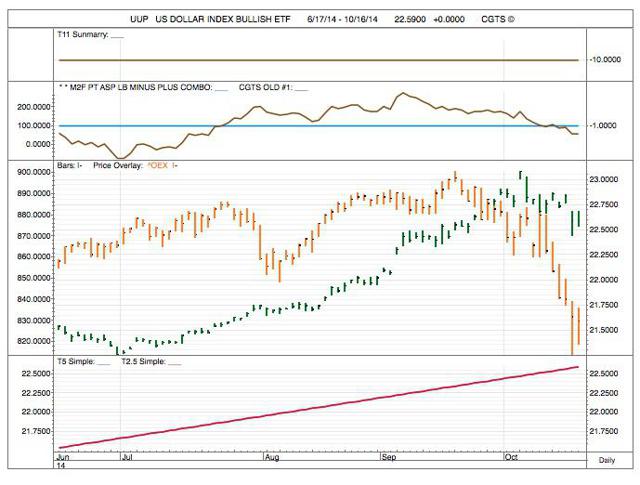

The chart below compares the ^OEX (S&P 100 Index) and UUP, US Dollar Bull ETF on a monthly basis. Note how week the UUP (US Dollar) has been, since 2009, after which the FED began its 'kill the Dollar' policy. The current US Dollar rally is actually not much ($23 vs. $27 in 2009), but note on the daily chart the recent reaction of too much Dollar strength to the OEX and other stock indexes.

Note below the weekly reaction of OIL (Oil ETF) to recent UUP strength.

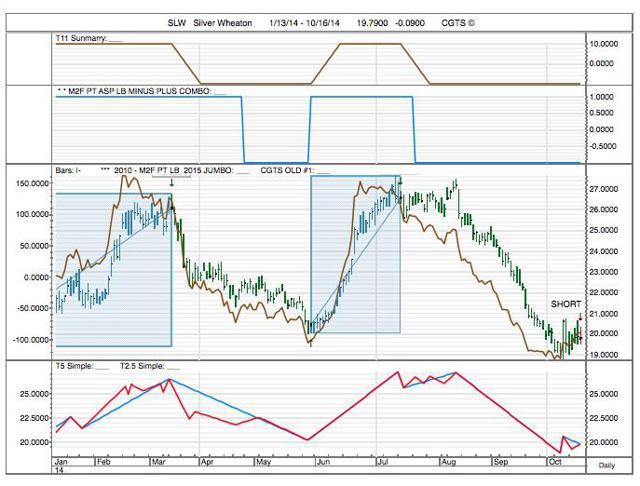

We received two shortsell signals this evening, both precious metals stocks, one gold, NEM, Newmont Mining, and one silver, SLW, Silver Wheaton.

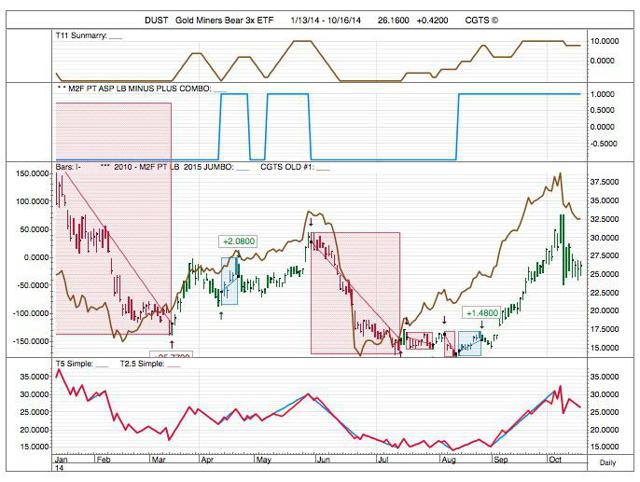

DUST, the Short Gold Stocks ETF, has been hesitating after a strong climb. Our feeling is this will become a buy-signal in a day or two. The CGTS Old #1 indicator, brown line, third pane down, is currently attempting to reverse its decline of the last few days, for another assault on the heights.

Best of luck trading.

Michael J. Clark, CGTS

Eugene, Oregon