The popular BNN show Bermans Call, put on events across Canada earlier this month, here is the presentation they gave audiences.

WATCH A VIDEO OF THE PRESENTATION HERE

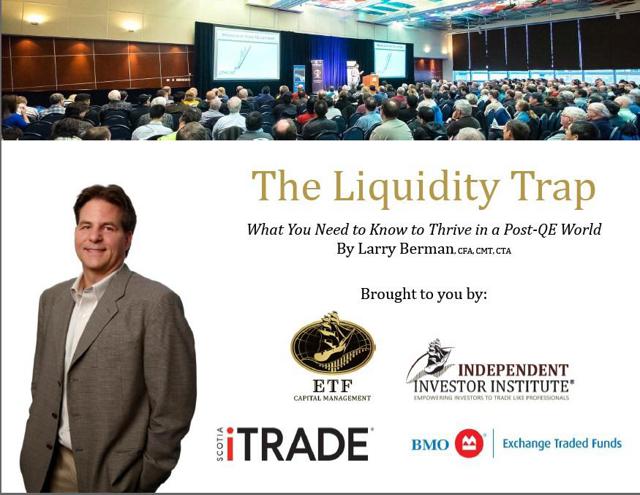

The takeaway from the USA was its Debt Relative To its Income.

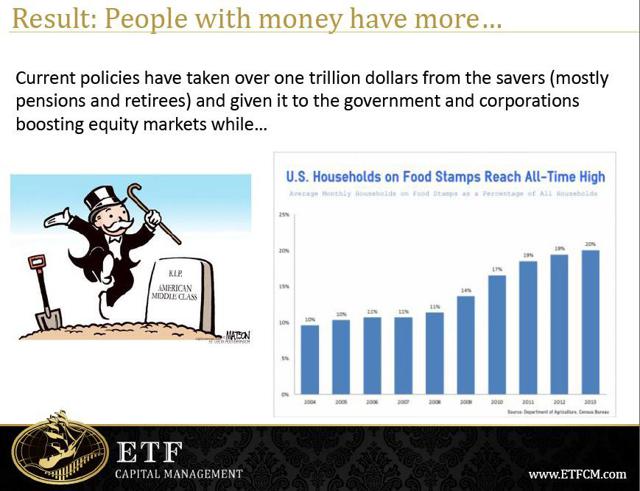

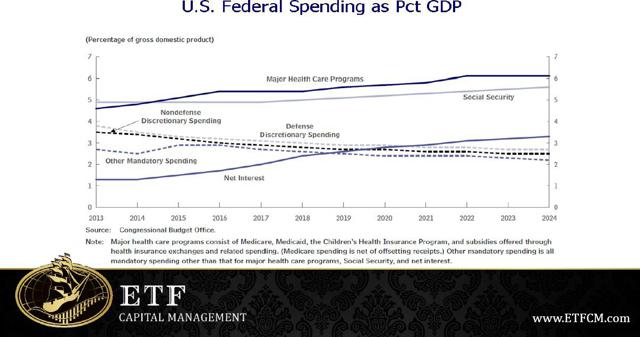

The have entitlement programs that account $2.34 trillion.

The annual interest USA $17 trillion federal debt = $260 billion.

Together this represents 92% of federal revenues, thus, USA is borrowing virtually all of money needed to run and protect country.

This can't going to continue much longer, Time to educate yourself.

Become a Berman's Call SCHOLAR

• How different assets respond in certain market environments;

•To evaluate risk adjusted returns;

•How to diversify your portfolio and adjust sensitivity to market;

•To keep the yield in your portfolio above 4%;

•Hedging to profit from foreign currency exposure;

•How to find relative value;

•To minimize your emotions;

•To learn from your worst trades;

•To sleep at night no matter what markets do;

•To become a more confident investor

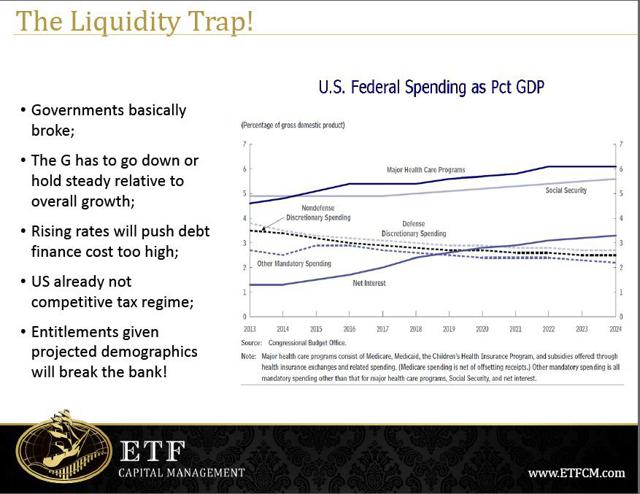

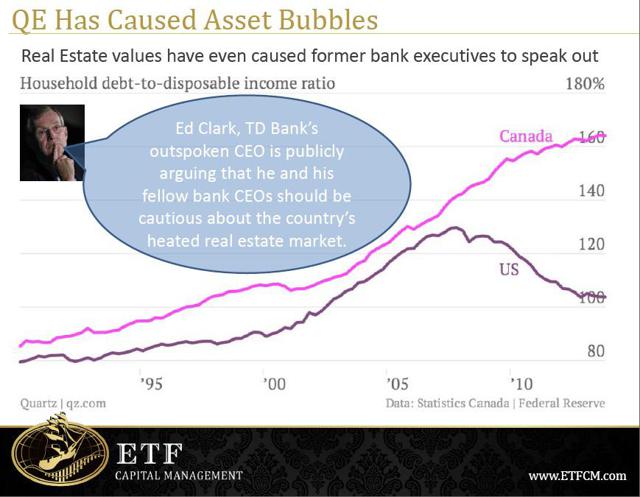

We are going into a 0% growth era.

…and Earnings drive the markets

•Margins for US corporations have never been better in history;

•Companies have refinanced at generational low interest rates;

•Have laid off most excess capacity from workforce;

•Obamacare often cited by CEOs as they shift to part-time workers;

•Low interest rates have forced investors into equities for dividends;

•Huge corporate cash positions used to buy back shares driving EPS;

•Dividends are rising, but not at a high rate. World Index about 2.1%;

•Expectations for earnings growth is 11% for 2015 and 2016.

Fed Mandate: Stimulate Growth and Employment

You need Dividends...