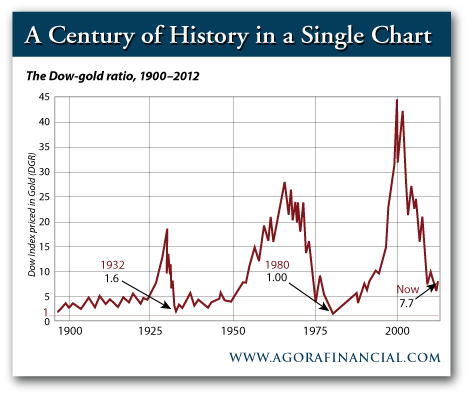

When I first began to realize the economic structure of the 36-year cycle of economic movement in American history I came upon a chart of the Dow-Gold Ratio -- and I was shocked to see this ratio matched almost perfectly my own cyclic structure:

1911-1929, Day-Cycle Growth or Inflation Season

1929-1947, Night-Cycle Rest or Deflation Season

1947-1965, Day-Cycle Growth or Inflation Season

1965-1983, Night-Cycle Rest or Deflation Season

1983-2001, Day-Cycle Growth or Inflation Season

2001-2019, Night-Cycle Rest or Deflation Season

Note: I use the word 'inflation' as a synonym for growth -- not in the technical way 'inflation' is viewed in economics today, as a way of attempting to measure toxic growth in a system.

Let's look at the historical Dow-Gold Ratio chart covering the 20th Century and notice how close this chart complies with my own stated cycles.

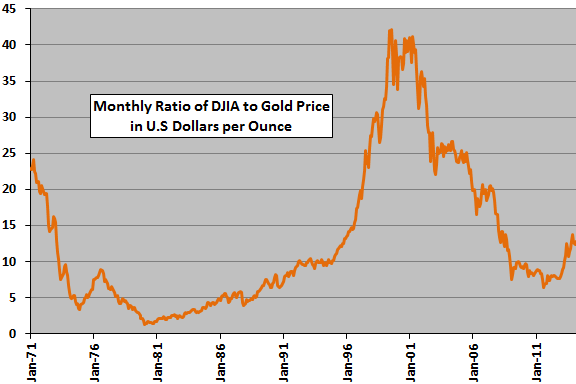

Let's look at the latest cycle, as it is more current, showing the aberration of what I call a bounce -- the FED's massive re-inflation of stocks -- which I will claim is only a bounce, with the likelihood of a combination of higher gold prices and lower Dow prices.

This chart suggests that the price of gold peaked in 2011 -- and that my historical reckoning is flawed -- and my expected true peak in gold prices, or bottom in stock (DJIA) prices, of 2019. Note in this same chart, however, a suggest peak in gold prices in 1975, 6 years before the actual peak. There was quite a difference in gold prices over those 6 years. $170 gold in 1975; $580 gold in 1981. A gain of 240% in 6 years.

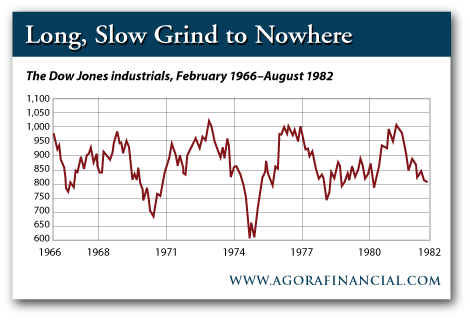

Historically, appreciation in the Dow Jones Industrial Index does follow my cycles. Day-Cycle exhibit massive stock appreciation. Night-Cycles are periods of rest, mostly sideways movement. In the very interesting article on the Dow-Gold Ratio, written by Addison Wiggin for Agora Financial, and then published on Daily Reckoning, a chart is included showing the sideways movement of the Night-Cycle rest-period for 1965-1983.

dailyreckoning.com/reading-the-dow-v-gol.../

This is actually what the Night-Cycle Dow for 2001-2019 should look like. A sideways consolidation. There is evolution and 'progress' during the Day-Cycles; and there is consolidation during the Night-Cycles. Only the FED, today, found a way to steal money from the future to try to make evolution, growth, progress happen all the time, uncomfortable with the program Nature has written, of Days for active progress, and Nights for Rest.

Let's look at the Dow during the three Day-Cycles this century to see what progress really looks like:

During the three Day-Cycles during the twentieth Century, buying the Dow Jones Industrial Average would have given approximately these returns:

Day Cycles

| Column1 | Points | Average Gain | Annual Average Gain |

| 1911-1929 | 268 | 424% | 24% |

| 1947-1965 | 678.7 | 386% | 22% |

| 1983-2001 | 9559.52 | 915% | 51% |

| TOTALS | 3502.0733 | 1725% | 97% |

During the two Night-Cycles (that have been completed) during the Twentieth Century, buying the Dow Jones Industrial Average would have given approximately these returns:

Night Cycles

| Column1 | Points | Average Gain | Annual Average |

| 1929-1947 | -155.99 | -47% | -3% |

| 1965-1983 | 190.71 | 22% | 1% |

| 2001-2019 | TBD | TBD | TBD |

| TOTALS | -25% | -2% | -2% |

Either central bank intervention during this Night-Cycle has worked and will become the model for other Night-Cycles as they come around again after every 18 years of growth or inflation -- or this intervention has only delayed the inevitable reckoning, and the world must still expect another crisis before 2019, with higher gold prices and lower stock prices.

At the moment, with the US Dollar strength, a real rally in gold seems unlikely. But things change dramatically, especially in a massively manipulated market.

How is the fold market 'massively manipulated'? Paul Roberts and David Kranzler explain this manipulation thus:

www.paulcraigroberts.org/2014/01/17/hows.../

The deregulation of the financial system during the Clinton and George W. Bush regimes had the predictable result: financial concentration and reckless behavior. A handful of banks grew so large that financial authorities declared them "too big to fail." Removed from market discipline, the banks became wards of the government requiring massive creation of new money by the Federal Reserve in order to support through the policy of Quantitative Easing the prices of financial instruments on the banks' balance sheets and in order to finance at low interest rates trillion dollar federal budget deficits associated with the long recession caused by the financial crisis.

The Fed's policy of monetizing one trillion dollars of bonds annually put pressure on the US dollar, the value of which declined in terms of gold. When gold hit $1,900 per ounce in 2011, the Federal Reserve realized that $2,000 per ounce could have a psychological impact that would spread into the dollar's exchange rate with other currencies, resulting in a run on the dollar as both foreign and domestic holders sold dollars to avoid the fall in value. Once this realization hit, the manipulation of the gold price moved beyond central bank leasing of gold to bullion dealers in order to create an artificial market supply to absorb demand that otherwise would have pushed gold prices higher. The manipulation consists of the Fed using bullion banks as its agents to sell naked gold shorts in the New York Comex futures market. Short selling drives down the gold price, triggers stop-loss orders and margin calls, and scares participants out of the gold trusts. The bullion banks purchase the deserted shares and present them to the trusts for redemption in bullion. The bullion can then be sold in the London physical gold market, where the sales both ratify the lower price that short-selling achieved on the Comex floor and provide a supply of bullion to meet Asian demands for physical gold as opposed to paper claims on gold.

I am not a gold bug. I 'believe in' the logic of my cycle-history and this cycle-history proclaims: "Buy Stocks and the Dollar during Day-Cycles; and short Gold. Buy Gold during Night-Cycles; and short Stocks and the Dollar."

I am predicting that Gold will rise and the Dow will fall by 2019. In assuming that the Dow will return to its average (a 1% annual loss for each of those 18 years of the Night-Cycle), the Dow, if it, in fact, does return to its average, would fall back to about 8787.

I am clearly making a major assumption. IF the central bankers have successfully 'fixed the game' then the old cycles may become distorted or perverted. If the central bank 'devil dance' has effectively CHANGED NATURE, then there is no reason we cannot continue to have growth, evolution, wealth, happiness, health for everyone everywhere forever -- death and darkness will have been eliminated from the equation of Life. Of course dualistic philosophy's claim that Life and Death inevitably are partners -- and my own understanding of life corresponds more closely with the dualistic philosophy than with the 'rejected non-growth principle' supported by the central banks -- their principle looks more to me like a subterfuge for steal as much as you can before they catch on.

Every 36 years we have a banking crisis in which banks are found guilty of stealing the world blind. It would be surprising if, this time, it proved to be a change in the paradigm of Nature, rather than just another Grand Theft Auto(matic) performed by greedy bankers who can't ever get enough.

Michael J. Clark, CGTS

Eugene, Oregon

cgts@mindspring.com