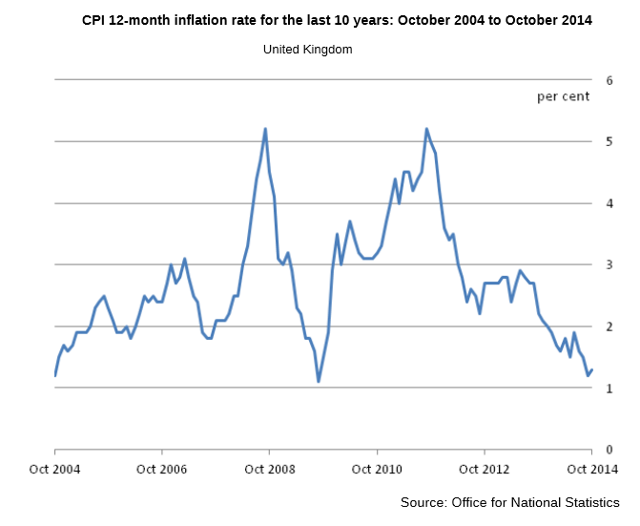

The British pound traded lower against the US dollar recently, as the FX market was not keen buying the British pound. The recent releases in the UK were not as expected by the FX market. There was an important release in the UK today as well, as the Core Consumer Price Index was released by the National Statistics. The market was expecting the UK CPI to increase by 1.3% in the year to October 2014, up from 1.2% in September. The outcome was in line with the expectation, as the UK's CPI increased by 1.3%. When we consider the monthly change, then the UK CPI grew by 0.1%, which was a bit more than the last time.

However, there was a disappointing part as well, as the core consumer price index was expected to increase by 1.6% in the year to October 2014, up from 1.5% in September. However, the outcome was a touch lower, as the core CPI managed to register an increase of 1.5%. When we speak of important sectors, then the UK transport prices decreased by 1.1% between September and October this year and the UK recreation/culture prices jumped by 0.4% between September and October 2014.

UK PPI

There were some other minor releases as well. The UK Producer Price Index was also released by the National Statistics around the same time. The market was expecting the UK PPI output to decrease by 0.2% in October 2014 in non-seasonally adjusted terms. However, the outcome was a bit disappointing as it declined more than the forecast and came in at -0.5%. Moreover, the UK Retail Price Index remained flat at 0% whereas the market was expecting it to be around 0.1%. When we consider the yearly change then the UK Retail Price Index increased by 2.3%. Overall, the outcome was mixed and cannot be considered on the positive side. The reaction from the British pound buyers was neutral as the GBPUSD pair consolidated for most of the time.

Technically, the GBPUSD is trading in the negative territory as it fell towards the 1.5600 support area recently. It looks like that the pair is forming a support around the mentioned level, but that can only be confirmed when we see some bullish signs on the higher timeframes. On the upside, the 1.5720-40 is a major swing area for the pair, which might continue to act as a hurdle in the near term.