GROWTHACES.COM Trading Positions

EUR/USD: short at 1.2480, target 1.2330, stop-loss 1.2550

GBP/USD: short at 1.5760, target 1.5580, stop-loss 1.5820

USD/JPY: long at 117.50, target 119.80, stop-loss 118.00

USD/CHF: long at 0.9600, target 0.9760, stop-loss 0.9580

EUR/CHF: long at 1.2025, target 1.2095, stop-loss 1.1995

EUR/GBP: short at 0.7990, target 0.7840, stop-loss 0.7980

GROWTHACES.COM Pending Orders

USD/CAD: buy at 1.1280, target 1.1450, stop-loss 1.1220

AUD/USD: sell at 0.8570, target 0.8315, stop-loss 0.8630

NZD/USD: sell at 0.7950, target 0.7760, stop-loss 0.8020

We encourage you to visit our website http://growthaces.com and subscribe to our newsletter to receive trading positions summary for major pairs and crosses.

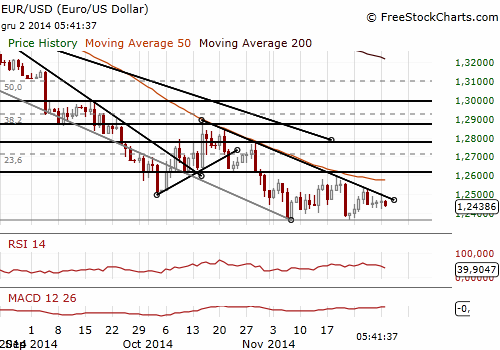

EUR/USD: Hawkish Dudley, Hawkish Fischer, Time For Yellen

(stay short, the target is 1.2330)

- New York Fed President William Dudley (a permanent vote on Fed monetary policy) said the central bank will unleash more aggressive rate rises if financial markets do not tighten as expected, and vice versa. He flagged short- and long-term interest rates, equities, credit spread and availability, and the dollar as areas the Fed will watch. Dudley repeated it seems reasonable to expect liftoff from near-zero rates around mid-2015.

- In the opinion of Dudley the recent drop in energy prices is positive for the U.S. economy because much of the extra money will be spent by Americans. He said that the global price drop will also spur more monetary easing by other central banks, spurring global growth. He expects U.S. inflation to rise toward a 2% target next year despite recent softening.

- Federal Reserve Vice Chairman Stanley Fischer said recent drop in oil prices would be a temporary drag on inflation. In his opinion the USA may be on the verge of a long-awaited jump in wages.

- Comments from Dudley and Fischer were rather hawkish. Today, traders are waiting for Janet Yellen's speech (13:30 GMT).

- The U.S. ISM Manufacturing PMI for November was almost unchanged, down to 58.7 from October's 59.0. The reading was better than expectations, with the median estimate of 57.8. The new orders index climbed to 66.0 from 65.8. That was the second-highest level since August 2009.

- The EUR/USD is getting lower. The EUR bears are supported by weaker Euro zone PMI data, stronger-than-expected U.S. ISM reading and hawkish comments from the Fed officials. Janet Yellen is in the spotlight today and we have also very important ECB meeting ahead of us (Thursday), at which Mario Draghi is likely to drop a hint of further stimulus. In our opinion the short-term outlook for the EUR/USD is bearish and we stay short with the target at 1.2330.

Significant technical analysis' levels:

Resistance: 1.2507 (high Dec 1), 1.2520 (30-dma), 1.2532 (high Nov 26)

Support: 1.2402 (low Nov 25), 1.2358 (low Nov 7), 1.2342 (low Aug 21, 2012)

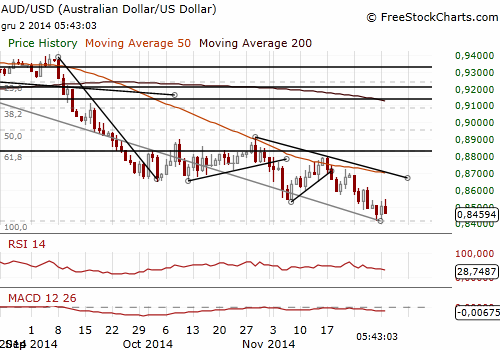

AUD/USD: Short-Lived Recovery After RBA Decision

(sell at 0.8570)

- The Reserve Bank of Australia kept interest rates unchanged on Tuesday. The cash rate has been at 2.5% since August last year. The RBA repeated the currency was overvalued given the ongoing slide in prices for many of the country's commodity exports. The bank stuck to its steady outlook for interest rates, disappointing speculators who had looked for a hint of a future cut given recent steep falls in resource prices .

- The RBA Governor Glenn Stevens said: "Overall, the Bank still expects growth to be a little below trend for the next several quarters."

- Approvals to build new homes surged 11.4% mom in October vs. the median forecast of 5.0% mom, completely reversing a big fall in September. The GDP report is due on Wednesday (0:30 GMT).

- The AUD gained a little ground after the decision of the RBA, but the recovery was short-lived. The rate edged up to 0.8542, but settled back at levels it traded prior to the decision soon. The AUD did not get any boot from yesterday's gain in commodity and precious metal prices.

- We lowered our sell order to 0.8570. If filled the target is 0.8315.

Significant technical analysis' levels:

Resistance: 0.8545 (high Nov 28), 0.8564 (10-dma), 0.8619 (high Nov 25)

Support: 0.8417 (low Dec 1), 0.8315 (low Jul 1, 2010), 0.8269 (low Jun 10, 2010)

GrowthAces.com is an independent macroeconomic research consultancy for traders. We offer you daily forex analysis with forex trading signals. The service covers forex forecasts and signals for following currencies: EUR, USD, GBP, JPY, CAD, CHF, AUD, NZD as well as emerging markets. Our subscribers should expect to receive: forex trading strategies, latest price changes, support and resistance levels, buy and sell forex signals and early heads-up about the potential fx trading opportunities. GrowthAces.com offers also daily macroeconomic fundamental analysis that enables you to see fundamental changes on forex market. We provide in-depth analysis of economic indicators resulting from knowledge, experience, advanced statistics and cutting-edge quantitative tools.

We encourage you to subscribe to our daily forex newsletter on http://growthaces.com to get daily analysis for forex traders. We intend that our consultancy should help you make better decisions. At GrowthAces.com we give our best to you - always greatest quality, usefulness and profitability.