Have we gone too far?

Between 1998 and 2012, the number of self-storage facilities doubled to 15,000, and there seems to be no end in sight. In some cases, people lost their homes and had to store their stuff, but this growth is a direct reflection of our insatiable appetite to own stuff.

Some historians point to the Chicago World's fair in 1893 as the launching pad for mass consumerism in America, and it took off after WWII.

1945-1949 Americans purchased:

- 20 Million Refrigerators

- 21 Million Cars

- 5.5 Million Stoves

There was tremendous demand after the Great Depression and the war to end all wars where jobs were plentiful, wages grew, and there were massive family formations… all were considered practical purchases.

These days, we call it conspicuous consumption:

- 809 Cars for every 1,000 people

- 327 Million Cell phones for a population of 317 million people

- 54% of all Households with at least three televisions

Every year around this time, there is a movement to cut back on consumerism. Some from religious groups and some from those who do not like capitalism, but the fact is we walk a delicate line… how do you handle this with your children?

Today's Session

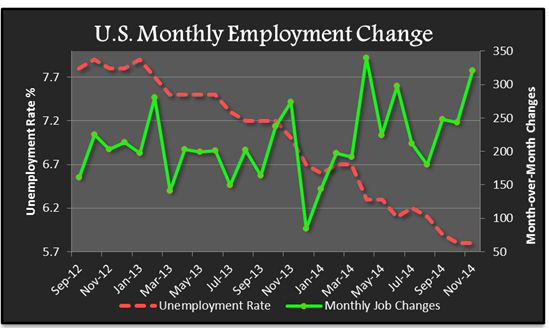

With less than a hundred points to go, the Dow may be giving us an early Christmas present of a new record high in the coming weeks. The major equities were lifted higher this morning from a positive employment report from the Bureau of Labor Statistics. Nonfarm Payrolls jumped by 32% month-over-month to add 321,000 jobs in November, from an upwardly revised reading of 243,000 jobs (from 214,000) in October. Consensus estimated 230,000 jobs would be added for the month. The unemployment rate fell slightly to 5.8% from 5.9% in October. It was also reported that the International Trade Deficit shrank to negative $43.4 billion in October from a downwardly revised negative $43.6 billion (from negative $43.0 billion) which did not have too big an impact on the market. Later today, we will be presented with October factory orders.