SNL Financial Exclusive Article

By Chris Vanderpool

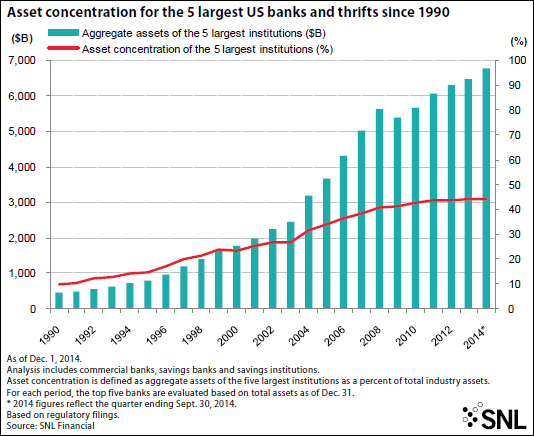

Five companies owned more than 44% of the U.S. banking industry's total assets at Sept. 30 - a dramatic increase from decades past.

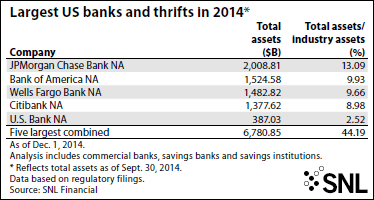

For the purposes of this analysis, SNL defined the banking industry as commercial banks, savings banks and savings institutions. JPMorgan Chase Bank NA, Bank of America NA, Wells Fargo Bank NA, Citibank NA and U.S. Bank NA together held $6.781 trillion in total assets at the end of the third quarter, compared to the $8.565 trillion held by the entire rest of the banking industry. JPMorgan Chase Bank NA, the main commercial bank subsidiary of JPMorgan Chase & Co., owned more than 13% of the entire industry's assets.

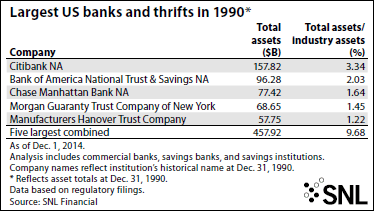

The concentration of assets among the banking industry's biggest players has climbed steadily since the 1990s, although the pace of that growth has slowed slightly in recent years. In 1990, for example, the five largest U.S. banks had just $457.92 billion in assets, or 9.68% of the industry's total assets. Only once - from 1999 to 2000 - did the top five banks' share of the industry's assets shrink year over year.

The concentration of assets among the banking industry's biggest players has climbed steadily since the 1990s, although the pace of that growth has slowed slightly in recent years. In 1990, for example, the five largest U.S. banks had just $457.92 billion in assets, or 9.68% of the industry's total assets. Only once - from 1999 to 2000 - did the top five banks' share of the industry's assets shrink year over year.

The industry has seen continued consolidation in 2014. Through mid-November SNL counted more than 250 deal announcements in the banking sector with an aggregate disclosed deal value of more than $17 billion. Some analysts have pointed to BB&T Corp.'s recently announced plan to buy Lititz, Pa.-based Susquehanna Bancshares Inc. as evidence that big regional banks may now be more willing to engage in deals.

However, it remains to be seen whether the top five banks will pursue any further growth through M&A, particularly now that the Federal Reserve has finalized its rule establishing concentration limits for the industry. Effective Jan. 1, 2015, the rule prohibits a financial company - including insured depositories, bank holding companies, and savings and loan holding companies - from combining with another company if the ratio of the resulting company's liabilities exceeds 10% of the aggregate consolidated liabilities of all financial companies.

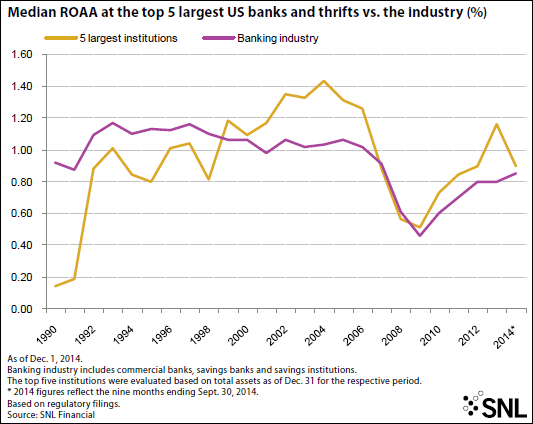

Between 1999 and 2006, the return on average assets among the top five banks outpaced the rest of the industry, with median ROAA peaking in 2004 at 1.43% compared to the industry median of 1.03%. Since then, however, returns on assets at the biggest banks have tracked closer to the industry as a whole. Median ROAA for the nine months ended Sept. 30 for the largest five banks was 0.90%, just above the industry median of 0.85%.