Despite beating analysts' consensus in its latest quarter earnings release on November 04, The Priceline Group Inc. (PCLN) stock declined 8.4% on that trading day (PCLN reported before the market open). The drop in PCLN's stock came after the company's fourth-quarter outlook fell short of Wall Street estimates. Priceline Group said that the economic uncertainty, especially in Europe, is weighing on its outlook. In addition, the strengthening dollar can result in overseas sales translating back to fewer dollars in revenue. Since reporting, PCLN's stock has recovered 3.5%, however, it is still down 2.3% year-to-date. That compared to the S&P 500 index which is up 12.1%, and the Nasdaq Composite Index that has risen 14.2% year-to-date. That in contrast to 2013, when PCLN's stock had gained 87.4% while the S&P 500 index had increased 29.6%, and the Nasdaq Composite Index had risen 38.3%. Yet, in my opinion, PCLN's stock is a smart long-term investment. PCLN has recorded an annual sales growth of 29.2%, and an astounding annual EPS growth of 57.4% in the last five years. Moreover, it is expected to achieve a substantial annual EPS growth of 19.74% in the next five years. In addition, the company has shown considerable earnings per share surprise in its last four quarters, and its valuation metrics have significantly improved over the trailing 12 months.

International Operations Prospects

Europe is the company's largest market accounting for more than 80% of gross bookings, revenues and operating profits for the international operations. International bookings were $12.08 billion in the latest quarter; 87.4% of total gross bookings. Moreover, international bookings have shown much higher year-over-year growth rates than domestic bookings; 31.6% vs. 9.9% in the last quarter, as shown in the chart below.

Data: Priceline third-quarter report

The company's fourth-quarter outlook is for a much lower bookings growth due to the strengthening dollar and economic uncertainty, especially in Europe.

The Priceline Group said it was targeting the following for 4th quarter 2014:

• Year-over-year increase in total gross travel bookings of approximately 8% - 15% (an increase of approximately 13% - 20% on a local currency basis).

• Year-over-year increase in international gross travel bookings of approximately 10% - 17% (an increase of approximately 16% - 23% on a local currency basis).

The U.S. Dollar to Euro exchange rate is the main factor in the company's bookings growth prospects, the chart below shows Dollar to Euro since 2011. Although the Euro might continue to decline, it seems that it is approaching a resistance line at about 1.212 dollars to Euro.

Chart: TradeStation Group, Inc.

According to European Commission Autumn forecast 2014; a slow recovery with very low inflation is expected. The European Commission's autumn forecast projects weak economic growth for the rest of this year in both the EU and the euro area. In the course of 2015, a gradual strengthening of economic activity is expected and growth is projected to rise further in 2016. All EU countries are set to register positive growth in 2015 and 2016. This is also when the lagged impact of already implemented reforms should be felt more strongly.

In any case, Europe in the last five years has been flat with signs of hope now of improving economic conditions. According to Priceline, if a European comes to New York, they come with a fixed budget so the beautiful thing is they can go from say a 3.5 star hotel to a 3-star hotel and still spend the same amount so they are still moving but in travel.

In my view, despite the slow recovery of Europe, and the weak euro, The Priceline Group stock is still very attractive, and few slower quarters do not change the long-term strong growth prospects of the company. European love to travel and travel is growing twice the rate of GDP. Online travel within the travel is also increasing, and Priceline Group the world's leading provider of online travel & related services, is gaining market share.

The Company

The Priceline Group is the world's leading provider of online travel & related services, provided to consumers and local partners in over 200 countries through six primary brands: Booking.com, priceline.com, agoda.com, KAYAK, rentalcars.com, and OpenTable. The company was founded in 1997 and is headquartered in Norwalk, Connecticut.

Valuation Metrics

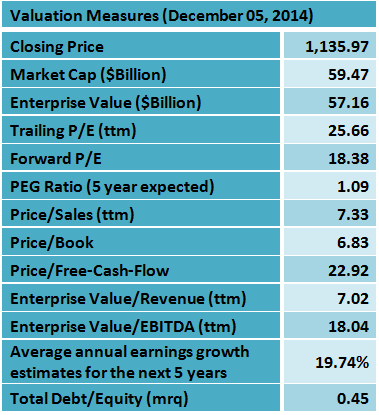

The table below presents the valuation metrics of The Priceline Group; the data were taken from Yahoo Finance and finviz.com.

The Priceline Group's valuation metrics are good; the forward P/E ratio is at 18.38, and the average annual earnings growth estimates for the next five years is very high at 19.74%. The price-to-free-cash-flow is at 22.92, and the PEG ratio is pretty low at 1.09. The PEG Ratio - price/earnings to growth ratio is a widely used indicator of a stock's potential value. It is favored by many investors over the P/E ratio because it also accounts for growth. A lower PEG means that the stock is more undervalued.

Latest Quarter Results

On November 04, The Priceline Group reported its third-quarter 2014 financial results, which beat EPS expectations by $1.05 (4.97%) and beat Street's consensus on revenues.

The Group's gross profit for the third-quarter was $2.6 billion, a 32% increase from the prior year. International operations contributed gross profit in the third-quarter of $2.3 billion, a 33% increase versus a year ago. The Priceline Group had GAAP net income applicable to common shareholders for the third-quarter of $1.1 billion, or $20.03 per diluted share, which compares to $833 million or $15.72 per diluted share, in the same period a year ago.

In the report, Darren Huston, President and CEO of The Priceline Group, said:

The Priceline Group finished the summer travel season with market leading growth and strong operating performance. Globally, our accommodation business booked 95 million room nights in the third quarter, up 27% over the same period last year. Booking.com continues to extend its lead as the world's largest brand for booking accommodations, with over 540,000 hotels and other accommodations on the platform, up 52% over last year. Our rental car business grew rental car days by 18% over last year, an acceleration from 14% in the second quarter, led by improving results at both rentalcars.com and priceline.com.

Competitors and Group Comparison

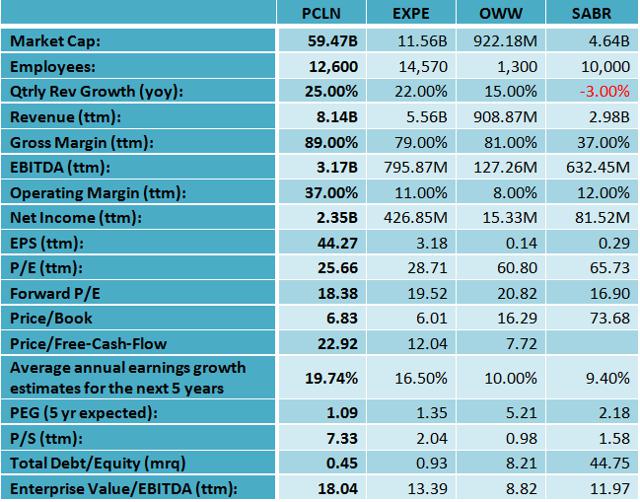

A comparison of key fundamental data between The Priceline Group and its main competitors is shown in the table below.

The Priceline Group has the highest gross margin, the highest operating margin, the lowest debt-to-equity ratio and the lowest PEG ratio among the stocks in the group. However, it also has the highest EV/EBITDA ratio.

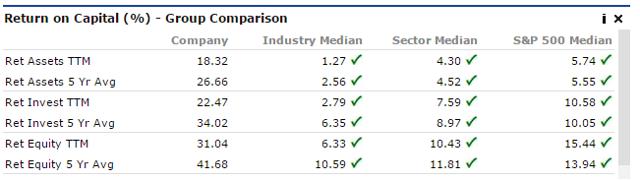

PCLN's Growth Rates, Margins and Return on Capital parameters have been much better than its industry median, its sector median and the S&P 500 median, as shown in the tables below.

Source: Portfolio123

Technical Analysis

The charts below give some technical analysis information.

Chart: finviz.com

The PCLN stock price is 1.25% below its 20-day simple moving average, 0.17% above its 50-day simple moving average and 5.91% below its 200-day simple moving average. That indicates a long-term downtrend.

Chart: TradeStation Group, Inc.

The weekly MACD histogram, a particularly valuable indicator by technicians, is negative at -2.85 and ascending, which is a bullish signal (a rising MACD histogram and crossing the zero line from below is considered an extremely bullish signal). The RSI oscillator is at 46.56 which does not indicate oversold or overbought conditions.

Analyst Opinion

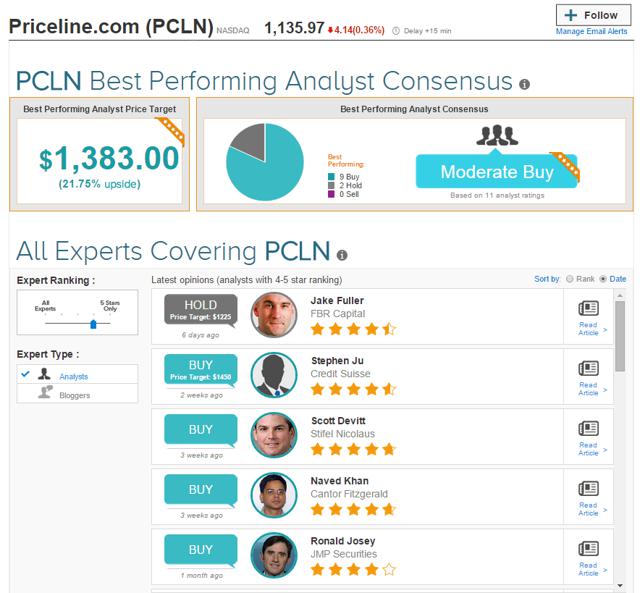

Many analysts are covering the stock, and most of them recommend it. Among the twent-six analysts, seven rate it as a Strong Buy, sixteen analysts rate it as a Buy, and only three analysts rate it as a Hold.

TipRanks is a website that ranks experts (analysts and bloggers) according to their performance. According to TipRanks, among the analysts covering PCLN stock there are eleven analysts who have the four or five star rating, nine of them recommends the stock, and two rate it as a Hold.

Source: TipRanks

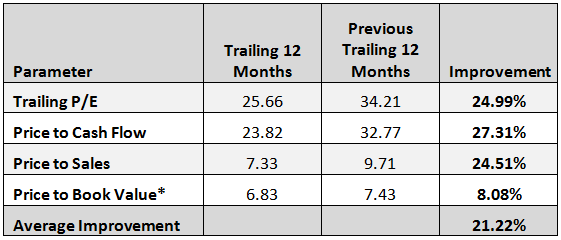

Have PCLN's valuation metrics improved?

In order to give an answer to this question, I compared PCLN's latest trailing 12 months' values of four relevant parameters to their previous trailing 12 months' values. However, in the case of price-to-book-value, I compared last quarter value to its previous quarter value. The results are shown in the table below; the data were taken from Portfolio123.

* last quarter value and previous quarter value.

All trailing 12 months values of the valuation metrics have improved since the previous trailing 12 months, and the average improvement was at 21.22%.

In my opinion, these results suggest that according to its valuation metrics PCLN's stock is more attractive now than a year ago.

Major Developments

In its latest earnings report, the company issued soft fourth quarter guidance. Priceline said it expects adjusted earnings of $9.40 to $1.10 per share in the fourth quarter. It is forecasting revenue growth of 11 to 18 percent from last year, which suggests a total of up to $1.82 billion. Analysts had expected earnings of $10.97 per share and $1.91 billion in revenue. Priceline's Chief Executive Officer Darren Huston noted that the company is operating in a "mixed macro-economic backdrop, particularly in Europe."

I see strong growth prospects for the company, despite weakening economic conditions in Europe and the deterioration in the Euro exchange rate over the last couple of months. Europe is the company's most important market accounting to more than 80% of gross bookings, revenues and operating profits for the international operations. In my view, The Priceline Group will continue to benefit from the growth in global travel. The Priceline Group is the largest player now in online travel, and according to the company, travel is growing twice the rate of GDP. Online travel within the travel is also increasing. In addition, according to Priceline it is gaining market share.

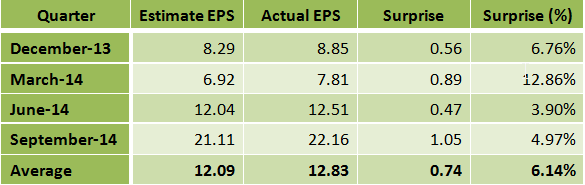

The Priceline Group has shown earnings per share surprise in each one of the last four quarters, as shown in the table below.

Data: Yahoo Finance - Analyst Estimates

In my opinion, the fact that the company has succeeded to beat analyst expectations quarter after quarter by a considerable margin, demonstrates the strength of its business. Hence, there is a good chance that The Priceline Group will continue to surprise by reporting better than estimate results also in the future.

After outperforming the market in 2013 by a considerable margin, PCLN's stock has significantly underperformed the market year-to-date. Since the beginning of the year, PCLN's stock has declined 2.3%, while the S&P 500 index has increased 12.1%, and the Nasdaq Composite Index has risen 14.2%. That in contrast to 2013, when PCLN's stock had gained 87.4% while the S&P 500 index had increased 29.6%, and the Nasdaq Composite Index had risen 38.3%. Nevertheless, considering its good valuation metrics and strong earnings growth prospects, in my opinion, PCLN's stock still has room to move up.

Conclusion

As the world's leading provider of online travel & related services, The Priceline Group will continue to benefit from the growth in global travel, which is increasing twice the rate of GDP. The company has good valuation metrics and strong earnings growth prospects; its PEG ratio is low at 1.09. In addition, the company has shown considerable earnings per share surprise in its last four quarters, and its valuation metrics have significantly improved over the trailing 12 months. All these factors bring me to the conclusion that PCLN stock is a smart long-term investment.