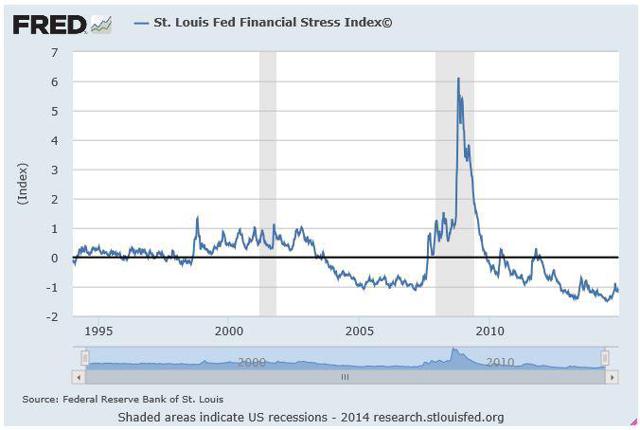

We've seen some fairly alarmist articles, loaded with emotional words, prophesying dire consequences from the oil crash, with contagion extending throughout the economy. Let's take a look at the St. Louis Financial Stress Index:

So far, financial stress remains at well below average levels. Bear in mind, it is presented in standard deviations, so that a level of -1.075 shows that stress is well below average, which would be 0.0. Just eyeballing the stress levels at the onset of the last two recessions, it would need to be in the +1 area before real trouble starts to develop.

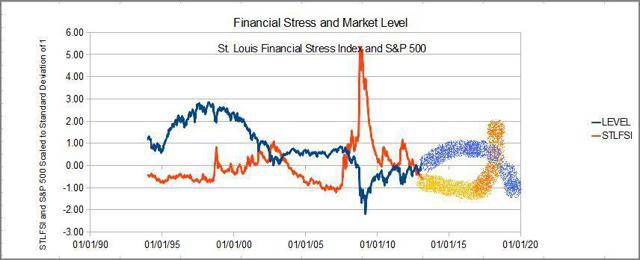

Next Question - Market Level

I did the work a while ago, and won't update it. However, you get the general idea. The lower stress, the higher the market. The market level is estimated by using a ratio of S&P 500 to GDP, assuming it is normally distributed, and scaling it in standard deviations, for comparability to the STLFSI.

As you can see, it includes a broad brush projection, that stress would go down, and the market up, in the same general proportion, which is what has happened. Of course it ends badly, in due course, but that's still a way down the road.

Before panicking at any point over the next six months, it would be a good idea to check the STLFSI, which is updated weekly. Here's the link.