Is the Grinch stealing investors' Christmas?

December 15, 2014 in In My Opinion byJerry Wagner

It was 1957. My Mom settled down with my brothers, sister, and me and began to read. It was a book by one of my favorites, Dr. Seuss. Unless you have spent the time since then living in a van down by the river, you've either read the book (or had it read to you), seen the TV cartoon account (1966) or Jim Carrey in Ron Howard's motion picture version (2000) of How the Grinch Stole Christmas! Even the song has been a hit!

In the story, the Grinch, an evil villain, lives on a mountain top high above the village of Whoville. The tiny Whos that inhabit the town are a happy lot, and that greatly disturbs the crusty old Grinch. Together with his faithful but confused dog, Max, Mr. Grinch sets out on Christmas Eve to steal Christmas from the Whos below.

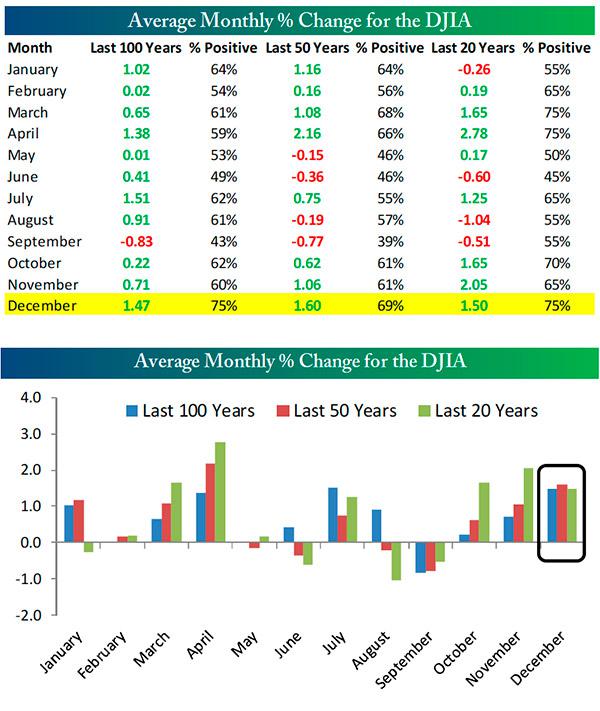

As I watched the stock and commodity markets fall last week, I could not help but think of Mr. Grinch. December is the time of the Santa Claus rally in stocks. Christmas time is almost always a period of rising stock market prices. Over the last 100 years, December registers the most consistently positive returns (75%) of any month.

Source: Bespoke Investment Group

Last week, though, I saw an Internet post by an investor that said, "I was thinking of taking advantage of the Santa Claus rally to put a few dollars to work this year, but after the decline this week I'm not so sure."

Truth is, though, as I pointed out last week, December almost always sees a decline that precedes the year-end rally. Over 100 years of Dow history suggests a bottom on December 11th on average. More recent data point to December 15th as the bottom of the mid-December slump.

Whichever, the true "Santa Clause rally" actually occurs at month's end (the last five days of the month plus the first two days of the year end is the official definition). The period is almost 80% positive and usually delivers about half of December's monthly gains. And small-cap stocks (this year's laggard) tend to benefit even more than the Dow stocks.

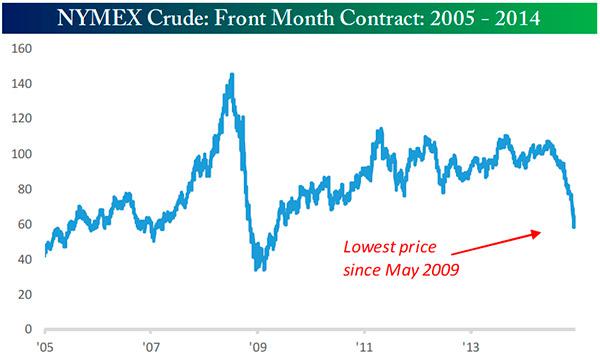

But enough of market history - isn't this time different? Oil prices have gone back underground, slipping about 50% since their high point a number of months ago.

Source: Bespoke Investment Group

There is no doubt that oil's precipitous fall has been noticed by investors. In the past, however, falling oil prices have been good for the economy as more dollars are made available to consumers.

The conflict this year is that with the US now being the top oil producing nation, the impact on the fast-growing oil producing companies in this country and our GDP growth rate may offset the advantage to consumers. Some even believe that this is an attempt by the OPEC nations to drive many of our fledgling producers out of business.

While it is difficult to know which scenario will prevail, we do know that uncertainty is bad for the markets. However, odds do favor that the fall in prices will soon end or at least consolidate for a time. After all, we have now seen the third worst decline in oil prices since the eighties.

I looked back in history to see how stocks (the S&P 500) have done after the ten worst oil price declines since 1983. The results were not conclusive. While stocks rose for the week-, month-, quarter-, and six-month periods after the top five declines ended, they declined for all periods for the top ten averages. The number of positive outcomes was right around 50% in both studies.

With such a mixed bag of results, I think the stock market before year end will resume the post-October rally where it left off. Realize that even for most of the oil price decline, the stock market has been rocketing higher. A new all-time high in the S&P 500 was registered just a week ago last Friday!

Yet to borrow a phrase from early in the stock market boom of the eighties, "This is one of the most hated bull markets in history!" Investors just don't believe in it, have passed up the opportunity to benefit from it, and remain woefully underinvested in equities. Given the number of actively managed strategies available to investors to gain their stock market exposure while having an exit plan in the event of a crash, this is hard to understand. I sympathize with poor confused Max.

Last week's economic reports provided ample evidence that the economy is on the right track on many fronts. Giant leaps higher that defied expectations were registered across the board in the period. For example, such gains were recorded in the NFIB Small Business Optimism Index, and the Retail Sales report, while the University of Michigan Confidence Index soared to its highest level since 2007. In all, twelve of fourteen economic reports beat the average expert prediction last week.

At the same time, interest rates slid lower propelled by buying from foreign investors seeking refuge from their economic weakness and the rising Dollar. When I reviewed my credit card reports from my Australia and New Zealand trip last month, I found a better than 10% advantage in Dollar purchasing power. When I recently crossed our border to our northern neighbor, Canada, I found a 15% advantage!

I know the Grinches out there will point not only to the oil disruption, but also to the widely expected Federal Reserve actions to raise interest rates as reasons to be fearful of stocks. The counter to the latter is that 1) inflation readings, even ex-oil, keep declining, giving the Fed few reasons to be in a hurry to raise rates, 2) it will take a greater increase in interest rates than what is contemplated to slow this economy down, and 3) higher interest rates will cause the Dollar to decline, putting even more pressure on our economic friends who are already facing lower sales and production.

Each week brings another commentator coming forward to agree with my opinion since this talk of higher rates began. They argue that rates are likely to stay low longer and that Fed action is likely to be delayed longer than most think. But time will tell. Even if we are wrong, rates are so low presently that I don't think a moderate increase will have a significant impact on stock prices or the secular bull market that we are now in.

Contact our Internal Sales Representatives at (800) 347-3539 ext. 2 for a free book on secular bull markets (Aim Higher! Dow 85,000). It explores the unique history of Secular Bull Markets and what that can mean for your portfolio.

Yes, we will have a 20% correction - probably in the next twelve months, but a recession or return to the 50%-plus declines that twice punctuated stocks in the Secular Bear Market of the first decade of this century do not seem to be in the immediate future.

If you fast (?) forward 25 years after my mom's first reading of How the Grinch Stole Christmas, you'd find me as Christmas neared sitting on the side of the bed with two small boys curled up, fascinated by the tale Dad was spinning for them.

The illustrations were great, the Grinch was fearsome, and, yes, all the signs of Christmas were vacuumed into his massive bag and carted away. But best of all, when morning came, the inhabitants of Whoville were seen crowded into the town square, undisturbed and celebrating the true meaning of Christmas.

The Grinch's heart was softened. All the commercial parts of Christmas were returned. And the last sighting of the Grinch was of him joining in the celebration, having learned the true value of Christmas.

I don't think the Grinch will steal this year's Santa Claus rally, but if he does, don't be frightened. We are likely still in the early stages of a secular bull market that could have more than a decade to run before it's done. By the time it has run its course, I believe investors will be doing plenty of celebrating in their own town squares.

All the best,

Jerry

Past performance does not guarantee future results. The opportunity for profits carries with it the possibility of losses. A complete list of all of our recommendations over the last 12 months is available upon request.