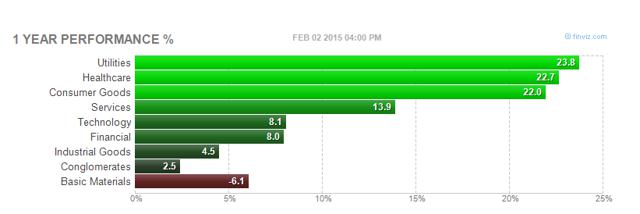

The healthcare sector has performed very well in the last few years. Only the utilities sector has achieved a higher return of 23.8% in the last year, compared to 22.7% for the healthcare sector.

Source: finviz.com

Among 56 S&P 500 healthcare companies, 54 have achieved a positive return (included dividends) in the last 52 weeks. Furthermore, 35 companies have had a higher than 25% return in that period, and 7 companies have had a higher than 50% return.

The table below shows the top twenty S&P 500 healthcare companies, according to their 52 weeks return.

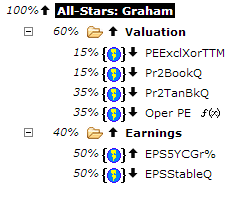

A Ranking system sorts stocks from best to worst based on a set of weighted factors. Portfolio123 has a powerful ranking system which allows the user to create complex formulas according to many different criteria. They also have highly useful several groups of pre-built ranking systems; I used one of them the "All-Stars: Graham" in this article. The ranking system is based on investing principles of the well-known investor Ben Graham.

The ranking system is quite complex, and it is taking into account many factors like; trailing P/E ratio, price to book value, and EPS growth, as shown in the Portfolio123's chart below.

Back-testing over sixteen years has proved that this ranking system is very useful.

After running the "All-Stars: Graham" ranking system on all the S&P 500 healthcare stocks on February 03, I discovered the twenty best healthcare stocks, which are shown in the chart below. In this article, I will focus on the top-ranked healthcare stock Cigna Corp. (CI).

Cigna is a global health service company, it has in excess of 35,000 colleagues around the world. The company is positioned with infrastructure in 30 different countries around the world serving a local population as well as the globally mobile population. Cigna is one of the largest U.S. employee benefits organizations, provides health care products and services and group life, accident and disability insurance.

Cigna has recorded an impressive growth in revenue, earnings and EPS over the last four years. In fact, it achieved an equal 15% compound annual growth rate in revenue, earnings and EPS, exceeding the company's strategic targets. Moreover, from 2009 through its 2014 outlook Cigna has outperformed the marketplace and its peers. In fact, its most recent 2014 outlook implies an underlying 7% to 10% EPS growth rate in a very challenging environment. In my view, what is more encouraging is the declaration by David Cordani, Cigna President and CEO, in a conference call on January 13, that the company remains on track to its long-term commitment of sustained on average 10% to 13% EPS growth.

According to the company, it has continued to deliver industry-leading medical cost trend as well as strong margins that have created a free cash flow proposition that is quite attractive from a shareholder value proposition standpoint. Most recently in 2014 it used a meaningful amount of that capital, about $1.4 billion, to buy back a little over 16 million shares of our stock. Moreover, it expects to step out of 2014 as it enters 2015 with some good momentum again.

One of Cigna's fastest growing segments is the Select Segment, which serves employers with 50 to 250 employees that have historically only had traditional insurance programs available to them but not really health engagement based programs. Cigna is a market leader in that segment. In addition, Cigna has a disciplined process to expand itself further globally with new market in Turkey and in India. Within the United States it has a disciplined process to expand Medicare Advantage into new markets.

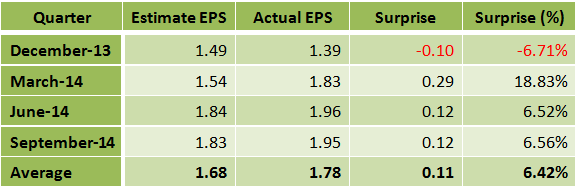

Cigna will report its fourth-quarter 2014 financial results on February 05. According to eighteen analysts' average estimate, the company is expected to post a profit of $1.67 a share, a 20.1% rise from its actual earnings for the same quarter a year ago. The highest estimate is for a profit of $1.77 a share while the lowest is for a profit of $1.54 a share. Over the last 30 days, there have been three up revisions and two down revisions.

In previous quarters, Cigna has shown significant earnings per share surprise in its last three-quarters as shown in the table below.

Data: Yahoo Finance - Analyst Estimates

Valuation

CI's stock has significantly outperformed the market in the last few years. Since the beginning of 2014 the stock is up 23.3% while the S&P 500 index has increased 9.3%, and the Nasdaq Composite Index has risen 12.0%. Moreover, since the beginning of 2012, CI's stock has gained an astounding 156.9%, while the S&P 500 index has increased 60.7%, and the Nasdaq Composite Index has risen 79.5%. Nevertheless, considering its good valuation metrics and strong earnings growth prospects, the stock, in my opinion, still has a room to move up.

Chart: TradeStation Group, Inc.

CI's valuation metrics are very good, the forward P/E is low at 13.19, and the price to sales ratio is extremely low at 0.83. Moreover, its Enterprise Value/EBITDA ratio is low at 10.26, and its PEG ratio is also low at 1.28.

Summary

Cigna has recorded an impressive growth over the last four years; it achieved an equal 15% compound annual growth rate in revenue, earnings and EPS, exceeding its peers and its strategic targets. The company remains on track to its long-term commitment of sustained on average 10% to 13% EPS growth. Cigna has good valuation metrics and strong earnings growth prospects; its price to sales ratio is extremely low at 0.83. All these factors bring me to the conclusion that CI stock is a smart long-term investment.