Today I used Barchart to sort the NASDAQ 100 Stock Index to find the stocks with the highest technical buy signals, then used the Flipchart feature to review the charts.

Today's list includes Verisk Analytics (VRSK), Sirius XM Radio (SIRI), O'Reilly Automotive (ORLY), Fiserv (FISV) and Dollar Tree (DLTR):

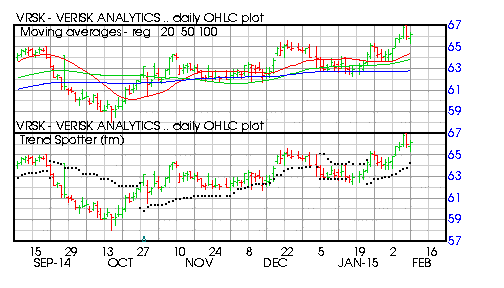

Barchart technical indicators:

- 96% Barchart technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 8 new highs and up 4.74% in the last month

- Relative Strength Index 63.74%

- Barchart computes a technical support level at 64.88

- Recently traded at 66.12 with a 50 day moving average of 63.4

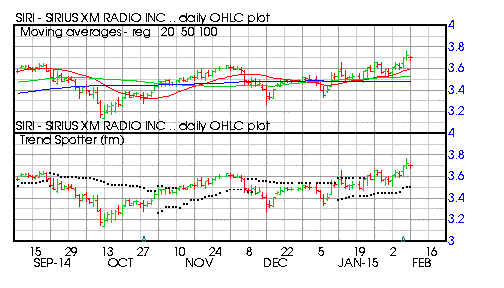

Barchart technical indicators:

- 100% Barchart technical buy signals

- Trend Spotter buy signal

- Above its 2, 50 and 10 day moving averages

- 8 new highs and up 5.10% in the last month

- Relative Strength Index 62.03%

- Barchart computes a technical support level at 3.62

- Recently traded at 3.70 with a 50 day moving average of 3.53

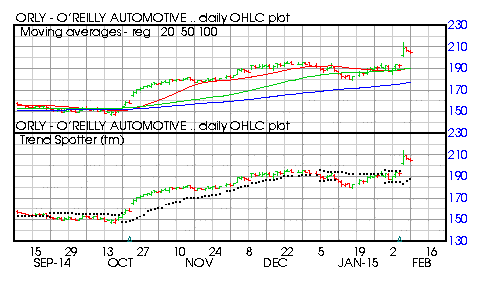

Barchart technical indicators:

- 96% Barchart technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 6 new highs and up 8.91% in the last month

- Relative Strength Index 66.23

- Barchart computes a technical support level at 202.85

- Recently traded at 204.54 with a 50 day moving average of 190.46

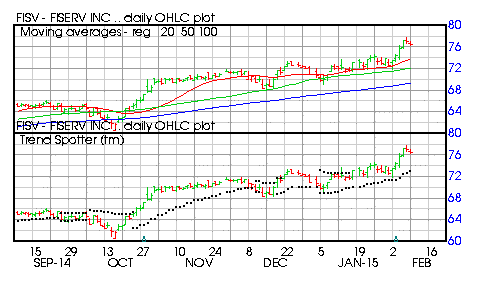

Fiserv (FISV)

Barchart technical indicators:

- 96% Barchart technical buy signals'

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 7 new highs and up 5.99% in he last month

- Relative Strength Index 64.80%

- Barchart computes a technical support level at 76.07

- Recently traded at 76.39 with a 50 day moving average of 72.10

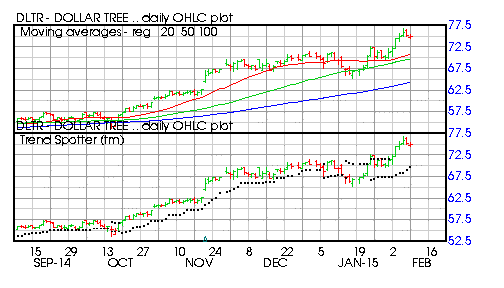

Barchart technical indicators:

- 96% Bachart technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 7 new highs and up 7.85% in the last month

- Relative Strength Index 65.55%

- Barchart computes a technical support level at 73.82