Today I used Barchart to sort the S&P 600 Small Cap Index stocks for the best technical buy signals, then used the Flipchart feature to find the charts I liked.

Today's list includes Universal Forest Products (UFPI), Texas Roadhouse (TXRH), Resources Connections (RECN), Neogen (NEOG) andMonolithic Power Systems (MPWR):

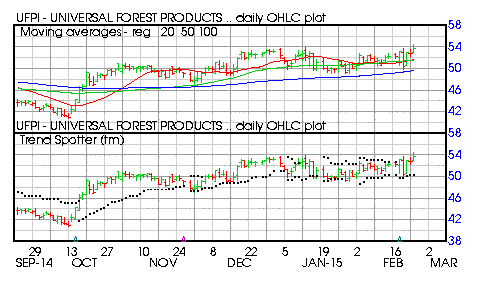

Universal Forest Products (UFPI)

Barchart technical indicators:

- 100% Barchart technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 7 new highs and up 8.71% in the last month

- Relative Strength Index 51.63%

- Barchart computes a technical support level at 51.63

- Recently traded at 54.14 with a 50 day moving average of 51.56

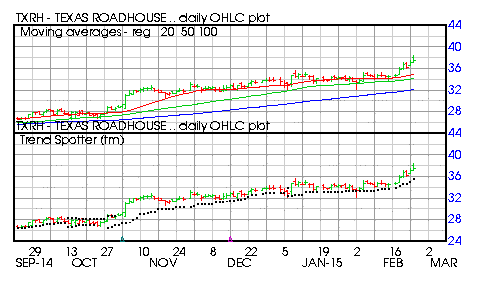

Barchart technical indicators:

- 100% Barchart technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 8 new highs and up 9.98% in the last month

- Relative Strength Index 71.38%

- Barchart computes a technical support level at 36.00

- Recently traded at 37.57 with 50 day moving average of 34.15

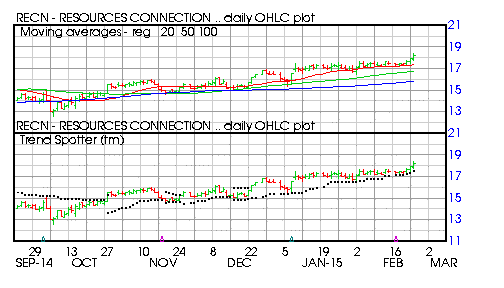

Resources Connections (RECN)

Barchart technical indicators:

- 100% Barchart technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 8 new highs and up 5.57% in the last month

- Relative Strength Index 68.83%

- Barchart computes a technical support level at 17.34

- Recently traded at 18.15 with a 50 day moving average of 48.18

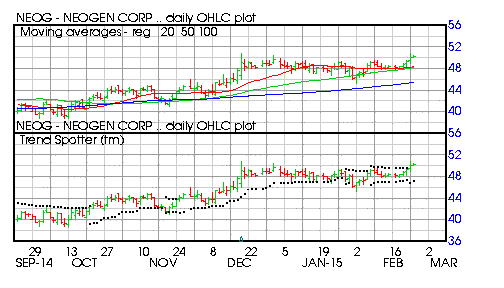

Barchart technical indicators:

- 100% Barchart technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 4 new highs and up 4.00% in the last month

- Relative Strength Index 64.13%

- Barchart computes a technical support level at 48.16

- Recently traded at 50.18 with a 50 day moving average of 48.18

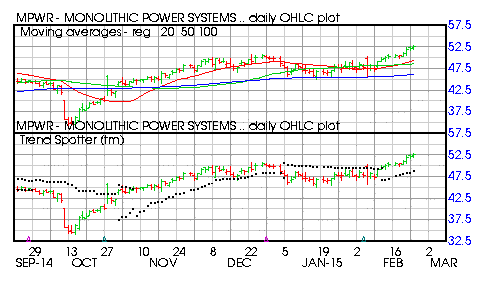

Monolithic Power Systems (MPWR)

Barchart technical indicators:

- 100% Barchart technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 10 new highs and up 9.38% in the last month

- Relative Strength Index 70.81%

- Barchart computes a technical support level at 51.25

- Recently traded at 52.52 with a 50 day moving average of 48.58