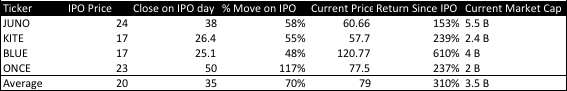

Aduro Biotech (ADRO) is a leading immunotherapy company developing first in class technology platforms designed to stimulate robust and effective immune responses against cancer. ADRO has shown strong results thus far in early stage clinical trials and clearly large pharma and biotech have caught on with the recent announcement of Novartis and prior announcement of Janssen (subsidiary of J&J). ADRO platform allows for many shots on goal and a leading cost and safety advantage over many other competitors. As you can see below, the stocks in immunotherapy have performed tremendously the day of the IPO (average move 70%) and the return since their IPOs is even more impressive. I expect ADRO's IPO to be priced in the $17-$19 range (priced 14-16, I expect it the price to be upsized) and trade into the high 20s to low 30s the first day. Fair value based on my analysis is $35-$39 based on current pipeline stages and partnerships.

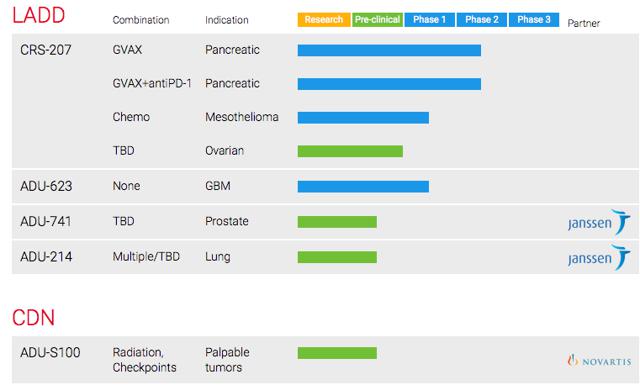

ADRO has two broad based proprietary technologies consisting of LADD & CDN platforms. LADD has more advanced indications with a solid partner in Janssen, however CDN is just as attractive as Novartis is a partner with this platform.

ADRO's proprietary technology LADD:

ADRO's approach is to engineer Listeria mononcytogens bacteria into therapeutic agents that can stimulate targeted immune responses for specific tumor antigens. Many tumor cells produce antigens, which remain on a cell's surface. A key job of the body's immune system is to detect these antigens and destroy them. Although many times the immune system can get the job done, in some cases the antigen has a complex structure in which the immune system will only partial destroy or be insufficient to restrict tumor growth.

Aduro's approach is to genetically modify Listeria to "delete" or remove two genes that are critical for the rapid onset and spreading of the bacteria. Listeria has shown to produce significant potential to express heterologous proteins in numerous cell types. After removing the two genes from Listeria to prevent spreading of the bacteria, Aduro then encodes the modified Listeria to express tumor specific antigens. Next the modified Listeria is designed to be absorbed by the patient's antigen presenting cells. The Listeria is engineered to express the tumor-associated antigen mesothelin. Mesothelin is a secreted protein which is overexpressed in some cancers such as pancreatic cancer. Many studies prior has shown that Mesothelin overexpression of mesothelin can significantly increase tumor cell proliferation and growth. ADRO has shown that silencing of mesothelin expression significantly decreased cell proliferation and promoted apoptosis in pancreatic cancer. After the Listeria is absorbed by the antigen cell, the dendritic cells immediate trigger a signal by releasing cytokines and other signaling proteins responses. Simply speaking, dendritic cells main function is to process antigen material and present it on the cell surface to the T cells of the immune system. From there, the T cells act as heat seeking missiles to attack the tumor.

(CY/GVAX) In combo with CRS-207:

The idea behind CRS-207 is to improve the effectiveness of CY/GVAX via a heterologous prime/boost mechanism. Each drug delivered has a very complimentary combination with each other. For instance, GVAX produces PDA cells which are noticed and picked up easily by dendritic cells to present them outside the cell for T-Cells to attack. Cyclophosphamide (CY) job is to maintain balance and keep the immune system from overreacting once the T-Cells notice the PDA cells on the surface of the antigen cell. In many cases for immunotherapy CRS-207's job is to target these antigen cells and express mesothelin, which is commonly overexpressed in PDA cells. In prior research, Mesothelin-specific T cells are associated with improved outcomes in PDA patients, which CRS-207 could dramatically improve overall survival in many different cancers. CRS-207 expresses and secrete tumor antigens (Mesothelin) which prime and enhance a T cell attack specifically against these tumor cells. I would note back in 2008, BioSante brought just GVAX without CY into Phase III clinical trials and was stopped after signs of a trend in number of deaths in the treatment arm. BioSante did not have CY to control a term called "cytokine storm" which occurs in many immunotherapy treatments where cytokines signal immune cells such as T-Cells to travel to infection areas. In the case of cytokine storm, too many immune cells are activated which result in immune cells attacking healthy cells and blood vessels, which could result in serious and many times life-threatening side effects. Since then, GVAX in combination with CY has shown strong safety and tolerability measures.

CRS-207 (Pancreatic Cancer) Clinical Trial:

CRS-207 is ADRO's lead drug candidate initially targeting metastatic pancreatic cancer. In ADRO's last completed randomized controlled Phase 2a clinical trial in metastatic pancreatic cancer patients, CRS-207 demonstrated statistical significance in overall survival rate when combined with GVAX Pancreas and Cyclophosphamide . The trial was designed to compare CRS-207 in combo with GVAX/CY versus GVAX/CY alone. During the interim analysis not only was the trial stopped due to meeting its primary endpoint of overall survival, but was also granted breakthrough designation by the FDA to expedite the development of CRS-207. In addition to receiving breakthrough designation, ADRO has been granted orphan drug designation for pancreatic cancer as CRS-207 will originally target the later stage second and third line treatment at which there are not many people that live past this stage

Pancreatic Cancer Phase IIa Design & Results GVAX+CY+CRS-207:

Between September 2011 and November 2012, 93 patients were enrolled and randomly assigned. The full analysis set of the trial included 61 patients in arm A and 29 patients in arm B. The per-protocol analysis set included 45 patients in arm A and 21 patients in arm B. The trial was a multicenter, randomized, phase II trial that was conducted at 10 US centers. Patients were randomly assigned at a ratio of 2:1 at each clinical site in two treatment arms. Arm A was assigned to receive two doses of Cy/GVAX and four doses of CRS-207. Arm B was assigned to receive six doses of Cy/GVAX. The primary endpoint of the study was to compare overall survival (OS) in the two arms, the secondary endpoints consisted of safety and clinical responses. On January 12, 2013, a planned interim analysis was released and at that time the data monitoring committee stopped the trial as efficacy was reached and recommended that the patients from arm B receive arm A treatment. According to ADRO's analysis: The 1-year survival probability for arm A was 24%, as compared with 12% for arm B. In patients that have received at least three doses of CY/GVAX & CRS-207, the median OS was 9.7 months in Arm A as compared with 4.6 months in Arm B. The median overall survival within all the groups including patients with < 3 doses was 6.1 months versus 3.9 in arm b (GVAX/CY only). The overall survival rate in arm A was seen in almost every subgroup with great difference from the control group. This trial was important in proving the significance of CRS-207 plays a vital role in the immunotherapy treatment of PDA cells. More information on the trial can be found here. http://jco.ascopubs.org/content/early/2015/01/09/JCO.2014.57.4244.full.pdf+html

Although there was no evidence of progression free survival CRS-207 remains highly attractive as sipuleucel-T and ipilimumab were approved based on OS benefits despite no PFS differences. In the majority of the studies, CRS-207 showed 2X the amount of months that just GVAX+CY has showed, which is substantial considering the short lifespan of patients in such late stage metastatic cancer.

Current Phase IIb Study For Pancreatic Cancer

They are currently conducting a Phase 2b trial that will enroll approximately 300 adults with previously treated metastatic pancreatic cancer. The trial will involve more than 20 sites in the United States and Canada. The design of the trial is a randomized, controlled three-arm trial to evaluate the safety, immune response and efficacy of the combination immunotherapy of GVAX Pancreas (with low-dose cyclophosphamide) and CRS-207 compared to chemotherapy or to CRS-207 alone. The primary endpoint of the trial is overall survival. They plan to complete enrollment in the 3rd quarter of 2015 and to report top line results in the 1H of 2016. Given the strong results from the phase IIa trial, I remain very optimistic. Patients in Arm A will receive two doses of GVAX and four doses of CRS-207. Patients in Arm B will receive six doses of CRS-207. Patients in Arm C will receive a physician's choice of the following single-agent chemotherapies: gemcitabine, 5-Fluorouracil, capecitabine, irinotecan or erlotinib.

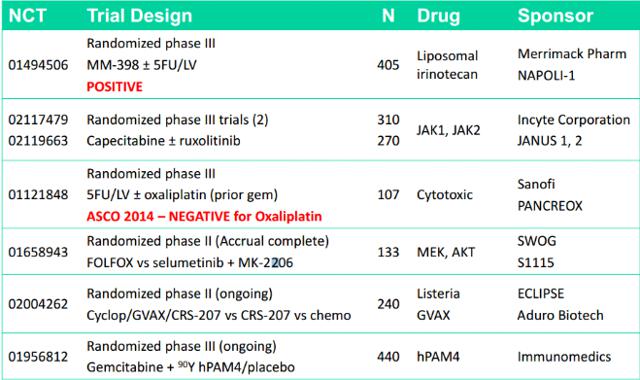

Below is a list of different companies pursing second-line and above treatment in pancreatic cancer. As you can see there is increasing competition. However, I would note that the majority of these are either chemotherapy drugs or checkpoint inhibitors.

Additional Pipeline For CRS-207:

ADRO is also evaluating CRS-207 and GVAX in combination with a checkpoint inhibitor named nivolumab, in the STELLAR trial. This is currently in Phase II randomized controlled trial in patients with metastatic pancreatic cancer. The trial is currently enrolling and is expected to enroll about 88 patients at up to five clinical trial sites. Data should read out in the 2H of 2016.

ADRO is currently conducting clinical trials of CRS-207 in combination with standard-of-care chemotherapy for treatment in the front line-setting of unresectable malignant pleural mesothelioma. In the ADRO's 1b clinical trial of the 16 patients in total, 75% had confirmed durable partial responses and 19% experienced stable disease. The estimated progression free survival rate was 7.5 months with one patient on study reporting greater than 19 months. The data was so positive the decided to open an expansion of the cohort for a total of 40 patients. They will report final top-line data in 2016.

Other Pipeline Indications in LADD Technology:

ADRO has a partnership with JNJ subsidiary Janssen. Janssen is granted world-wide development and commercialization rights for lung and prostate cancer compounds. ADRO has the potential total of $365.0 million in prostate cancer and $817M for lung cancer in upfront fees and development and commercialization milestones. The total milestone potential is well above $1B and shows the significant interest Janssen has in ADRO's candidate.

ADRO is also developing a candidate for Glioblastoma multiforme. According to ADRO's S1, "Glioblastoma multiforme is a brain cancer with an incidence of approximately 11,000 people in the United States in 2013." The engineered Listeria is designed to express specific antigens associated with Glioblastoma multiforme. ADRO is ongoing Phase 1 clinical trial.

ADRO's proprietary technology Cyclic dinucleotides (CDN):

ADRO is developing a portfolio of CDN small molecule immune modulators that target and activate the STING receptor. Once the STING receptor the Dendritic Cells present themselves on the target cell surface--much like the CRS-207 candidate except activating the STING receptor creates a response through 3 different unique pathways. This response signals the expression of a wide range of cytokines. These cytokines trigger effective T cell immune responses. It is believed that the molecules ADRO has developed are much more potent than current immune modulators out there as ADRO's modulators focus on 3 distinct pathways of signaling.

If the idea sounds intriguing, you're not the only one. Novartis on 3/30/2015 announced a major multiyear alliance with Aduro Biotech that will focus on the discovery and development of next generation cancer immunotherapies targeting the STING receptor.

According to the press release: "Under the terms of the agreement with Aduro, Novartis will make an upfront payment of $200 million to Aduro and will make an initial equity investment in the company for $25 million, with a commitment for another $25 million equity investment at a future date. Aduro will lead commercialization activities and book sales in the US, with Novartis leading commercialization and recognizing sales in the rest of the world. The companies will share in profits in the US, Japan and major European countries. Novartis will pay Aduro a royalty for sales in the rest of the world." http://www.novartis.com/newsroom/media-releases/en/2015/1907119.shtml

It is estimated that the deal is worth about $750M with the potential of $500 million to be paid if development milestones are met. This is a pretty substantial deal for ADRO considering none of their CDN candidates are past preclinical. However this shows the promise of how powerful ADRO's technology is

Pricing & Market Opportunity:

Bristol-Myers Squibb prices Ipilimumab at about $30,000 per injection. This comes to a cost of $120,000 for a normal course of therapy, this number is based on the approved dosing regimen of 3 mg/kg every 3 weeks for four doses. Analysts have pegged peak sales at ~$1.5B in the U.S. alone by 2018 and $1B international. BMS started selling Iplimumab in 2011 with total sales of $360M and current total sales of ~$1.4B to date.

In ADRO's 10k they stated that in 2012, the estimated cases of pancreatic cancer according to Globocan was 43,000 in the United States and 338,000 worldwide. Most patients are diagnosed after the age of 45, and 94% of patients die within five years from diagnosis. There are currently no approved treatments for second and third-line patients. In addition, only 5%-10% of patients live beyond 5 years, as to why it is consider the "silent killer". Regarding mesothelioma, in the United States is approximately 3,000 cases per year. This is considered an orphan indication. In the rest of the world there is over 10,000 cases per year.

Regarding market exclusivity, ADRO anticipates market exclusivity for each of their biological product candidates for 12 years in the United States and 10 years in Europe and significant durations in other markets.

Management:

Stephen Isaccs prior to Audro, Stephen founded Cerus Corporation. He served as CEO & President from 1991 to 2004. He raised over $650M, negotiated a $200M partnership with Baxter International, took Cerus public and developed two marketed products.

Prior Patent Issues Should Not Be A Problem:

In 2009, ADRO's predecessor Anza challenged Advaxis's patent regarding composition of matter and method of preparation of Listeria to express tumor antigens in different cancers in Europe. The European Patent Office sided with Advaxis. Although the decision was negative, the patent surrounding Listeria-based vaccines for treating certain cancers will expire in 2017, this is before any commercialization of any of ADRO's products. The patent expiration will allow ADRO to advance their lead drug CRS-207 and any other drug candidates including ADU-214 and ADU-741 that is being developed with Janssen Pharmaceuticals.

Analysis & Valuation:

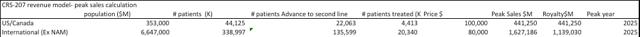

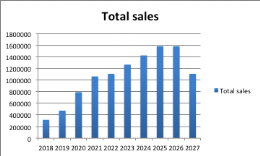

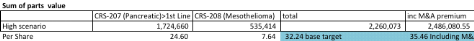

My analysis for CRS-207 > first line pancreatic cancer is highlighted below:

For my analysis, I assume the number of total cases per year in the US is roughly 35,000. I estimate about half of these patients advance to a second line therapy. I estimate that approximately they penetrate 20% of the market leaving them with ~4,413 patients per year treated as the peak year. ADRO received orphan designation for CRS-207 so I assume they charge ~$100,000 for a course of therapy which is $20,000 cheaper than BMS sells Ipilimumab. I believe they will reach peak U.S. sales of $441M. In addition, I estimate peak sales net of royalties international to be $1.6B. I would note that Ipilimumab targets a larger patient population as it is approved as a first line therapy and charge $120,000 per therapy.

Below I have showed my analysis for CRS-207 for pancreatic cancer. In the analysis, I apply a 35% probability of success given still the early stage of CRS-207 in pancreatic cancer. In addition, I discount sales by 10% coming to an NPV of ~$1.7B. This gets me on a per share basis a fair value price of ~$35 per share.

The only other indication I gave ADRO credit for in my valuation is Mesothlioma. Within the model I discounted sales at a 20% probability of success given the early stages of the trial. I get on a per share basis about $7 per share at current levels assuming a 2019 launch.

In summary, I believe fair value is around $35. I would note that I did not include current cash which includes a $200M upfront Novartis payment, current cash hand and cash received from the IPO. Also, I did not include over $1.5B in potential milestone payments from Janssen, Novartis and any other partners they sign. In addition, I did not include any other indications in the valuation.

Risk:

- Clinical Risk--Difficult to recruit considering 5-10% only live after 5+years

- Secondary Offerings; won't see much revenue until maybe 2018

- Sector rotational risk

- Many competitors in clinical trials for > 1st line treatment

- ADXS has a Listeria vector to drive immune responses. The technologies are different but there may be patent crossovers at some point that could be a risk. However, the patent expires in 2017 before ADRO expects to receive approval.

Investment Thesis:

In conclusion, ADRO is the first company to demonstrate overall survival improvements using immunotherapy in PDA cells. ADRO has the potential to be a first mover in the knock down of Mesothelin using gene therapy. The gene therapy space has been hot as leaders in the space continue to show great results. There currently is no treatment for 2nd line and beyond treatment in pancreatic cancer and although early, ADRO shows promising results with controlled safety. I would expect the leads (Merrill & Leerink) to price this deal in the $17-$19 range. This IPO could pop given the demand for gene therapy names. I would expect if the demand for this deal is strong (as I fully expect) and they price it right we could see high twenties to low thirties that same day.